Wall Street greets Q3 earnings season with record highs – Stock Markets

- Shares on Wall Street extend record streak as earnings get into full swing

- But trading remains choppy amid elections, geopolitical and earnings risks

Another record high

The S&P 500 notched up its 46th record close of the year on Monday, sealing a positive start to the week as the new earnings season slowly heats up. Initial forecasts for Q3 put the earnings growth rate at 4.1%, but that figure could well rise as 79% of the S&P 500 companies that have reported so far have beaten their earnings per share (EPS) estimates according to FactSet.

However, even if the projections are revised upwards over the course of the season, it’s unlikely they will be able to match the double-digit number of almost 13% for Q2. Nevertheless, investors have been optimistic as they enter this earnings season, with the positive sentiment underpinned by expectations of lower interest rates.

From recession to ‘no landing’

More specifically, it is the subsiding fears of a US recession, or the ‘no landing’ narrative, that is feeding the latest upswing on Wall Street, more than offsetting other worries that investors have cast aside for now. Namely, traders seem to be brushing off the real threat of an all-out war between Israel and Iran that would almost certainly drag Washington into the conflict.

The upcoming US presidential election also doesn’t appear to be at the forefront of investors’ minds and even the prospect of fewer rate cuts by the Fed hasn’t scared off the bulls. With the latter, this behaviour has been observed a few times already over the past year, whereby markets are not too fussed about rate cut expectations being scaled back as long as the American economy is humming along quite nicely.

Valuation concerns

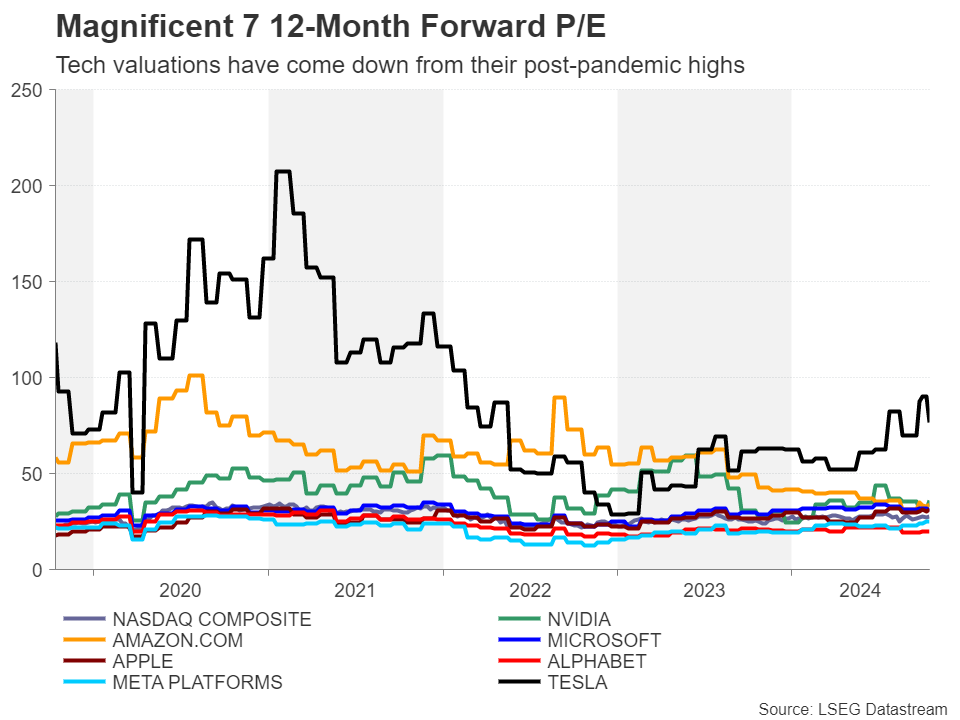

However, the mini selloff on Tuesday was a reminder that the increased volatility since the summer hasn’t completely abated. Whilst there are several risks that could upset the outlook as mentioned above, the bigger danger is that a lot of the valuations seem to be based on the most optimistic scenario rather than the base case.

This may have been the case with chipmakers, whose shares slumped on Tuesday after the Dutch semiconductor giant, ASML Holding, lowered its earnings outlook for 2025, sending the stock crashing by over 15%. There’s a risk that tech firms investing heavily in artificial intelligence (AI) could suffer the same fate if their earnings don’t live up to the high market expectations.

Netflix earnings eyed

Nvidia, which has surged by about 165% in the year-to-date, is the most immune to earnings disappointment as demand for its AI chips is very high and is likely to stay strong for the foreseeable future. Yet, its stock got caught up in this week’s turbulence due to overbought trading conditions.

Netflix also looks set to pass its earnings test when it becomes the first of the Big Tech to report on Thursday. Tesla and Amazon will follow next week.

Banks impress, mostly

Wall Street’s biggest banks have already announced their results, exceeding expectations on most counts. Citigroup, whose results were the least impressive, saw its share price dive by about 5%.

Energy stocks have also not had a good week as investors price out the possibility of an imminent Israeli attack on Iranian oil facilities, weighing on oil futures.

Don’t ignore the elections

Over the next couple of weeks, the US election is likely to become a more prominent theme as the two candidates – Donald Trump and Kamala Harris – remain almost neck and neck in most polls. But contract betting, which has just resumed after a US court ban was lifted, put the odds in favour of Trump.

Earnings will probably become the dominant driver, however, especially as rate cut expectations are unlikely to shift much before the Fed’s November meeting.

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.