Daily Comment – US dollar and stock rally continues

- Euphoria in US assets, stock indices reach new highs

- Today's Fed speakers could threaten Monday’s gains

- Oil and gold in the red, bitcoin enjoys a strong boost

- Pound ignores jobs data, awaits Wednesday’s CPI

US stocks and dollar in the green

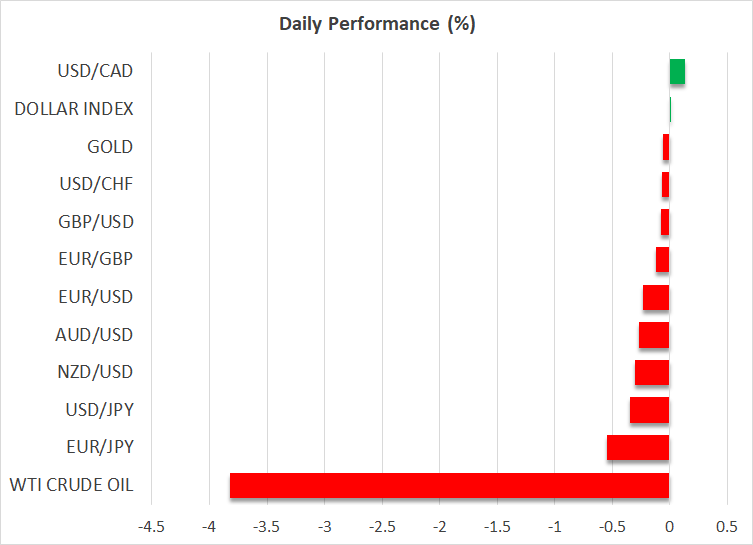

Both the US dollar and main US equity indices enjoyed another strong session yesterday. Euro/dollar traded at a 45-day low, and both the S&P 500 and the Dow Jones indices recorded new all-time highs despite the Columbus Day bank holiday keeping both the bond market closed and trading volumes below their recent averages. The release of third quarter earnings is already underway, with some big banking names on the list today and Netflix scheduled for Thursday, but the positive figures up to now do not justify the aggressive risk-on reaction.

In the meantime, the daily barrage of attacks between Israel and Iran’s proxies continues despite efforts from the US administration for a ceasefire, which could also boost Harris’ poll ratings. There were some comments from Israeli officials that Iran's nuclear and oil installations won't be targeted, but this doctrine could be quickly abandoned if Israeli losses continue to mount.

Therefore, one of the catalysts for both the dollar’s and stocks’ performance could be the latest Fedspeak. In remarks yesterday, Fed members Kashkari and Waller remained dovish even though the strong jobs market is probably forcing them to take a more relaxed approach regarding the November meeting. Interestingly, Fed board member Waller was quite frank in stating that if inflation unexpectedly rises, the Fed could pause the rate cuts.

Therefore, one of the catalysts for both the dollar’s and stocks’ performance could be the latest Fedspeak

The next CPI report will be published one week after the November 7 Fed meeting, but before that there will be an array of releases that could reveal the current inflation trend. Considering that the Fed expects a pickup in inflation in Q4, the November rate cut might appear more secure, at this stage, than the December one.

Fed members Daly, Kugler and Bostic will be on the wires today. Last week, San Francisco Fed President Daly opened the door to the possibility of no rate cut in November by stating that one or two cuts this year are likely, with Atlanta’s Bostic receiving the assist and openly talking about a November pause. A repeat of these comments from both members won’t shock the market, but it could potentially dent yesterday’s positive sentiment.

Gold and oil drop, bitcoin trying to maintain Monday’s gains

Amidst these developments, gold and oil have retreated somewhat, partly on the back of the dollar's renewed strength. Gold remains a tad below its recent all-time high while oil appears to be giving back a good chunk of its recent sizeable gains. China is partly responsible for the latter as the new support measures are again deemed as insufficient to restart the Chinese economy.

On the flip side, bitcoin rallied aggressively on Monday and tested the late September highs. It is surrendering part of its gains today, but the sentiment in the crypto space has probably changed, despite Minneapolis Fed President Kashkari repeating his aversion for bitcoin. Interestingly, presidential candidate Harris tried yesterday to appease crypto investors by announcing a ‘regulatory framework'. Harris’ plan was light on the details, but since former president Trump is an avid crypto supporter, cryptocurrencies could eventually enjoy a boost regardless of the November 5 winner.

Harris’ plan was light on the details, but since former president Trump is an avid crypto supporter, cryptocurrencies could eventually enjoy a boost regardless of the November 5 winner.

Mixed UK data, pound not impressed

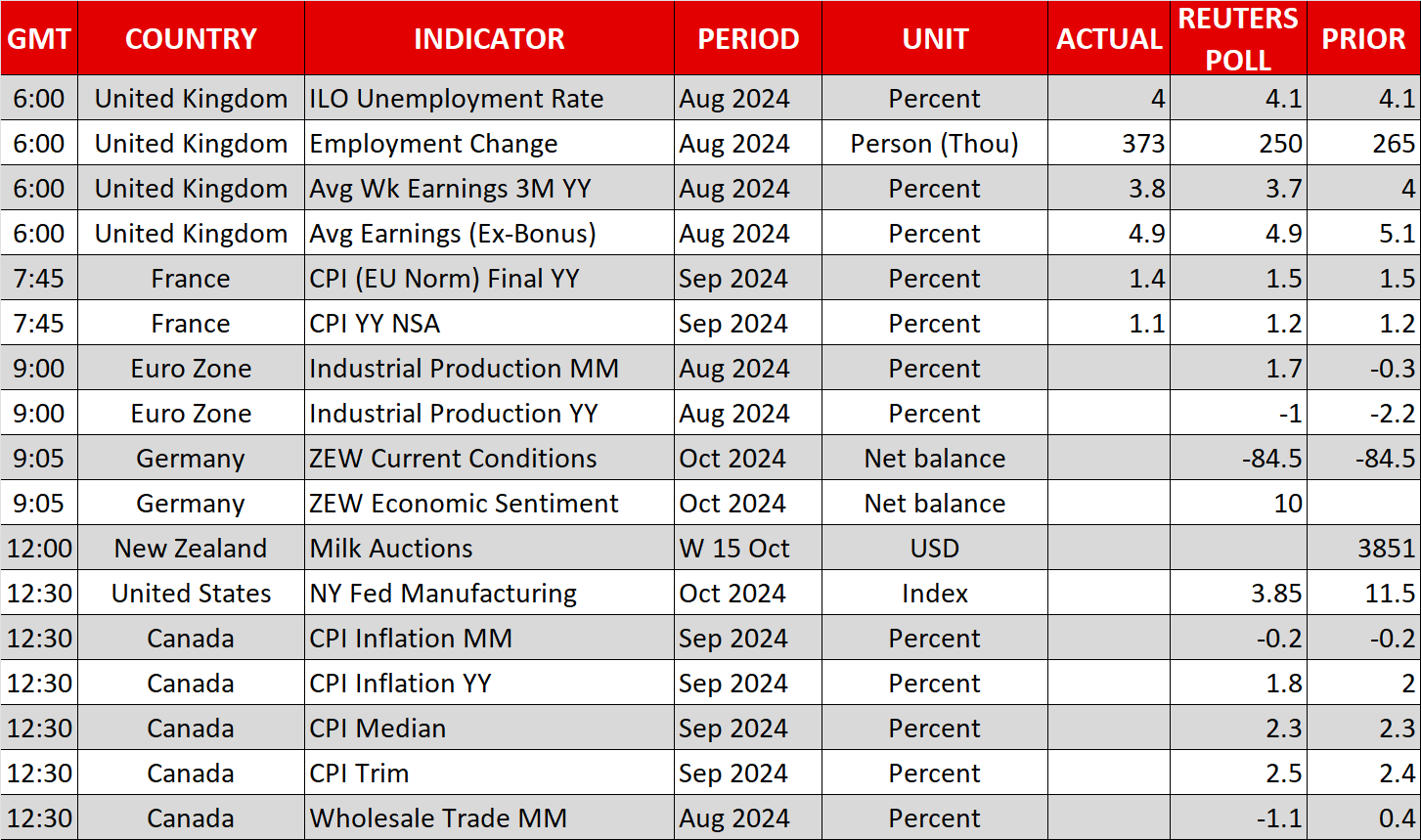

The latest UK labour market data has failed to please the pound as the unemployment rate ticked lower, but the claimant count printed above expectations and the average earnings figures edged a tad lower. Tomorrow’s CPI report remains the decisive release for the November rate cut, which is overwhelmingly priced in by the market.

Aloqador aktivlar

Eng oxirgi yangiliklar

Javobgarlikdan voz kechish: XM Group korxonalari har biri faqat ijro xizmatlarini koʻrsatadi va onlayn savdo platformamizdan foydalanish huquqini beradi, bu odamga veb-saytda yoki veb-sayt orqali mavjud boʻlgan kontentni koʻrish va/yoki undan foydalanishga ruxsat beradi hamda uni oʻzgartirishga moʻljallanmagan va uni oʻzgartirmaydi yoki kengaytirmaydi. Bunday kirish va foydalanish huquqi doimo quyidagilarga boʻysunadi: (i) Shartlar va qoidalar; (ii) Risklar haqida ogohlantirish; va (iii) Javobgarlikni toʻliq rad etish. Shuning uchun bunday kontent umumiy maʼlumot sifatida taqdim etiladi. Xususan, shuni esda tutingki, bizning onlayn savdo platformamiz mazmuni moliyaviy bozorlarda biror bitimni amalga oshirishga oid maslahat yoki taklif emas. Har qanday moliyaviy bozorda savdo qilish sizning kapitalingiz uchun jiddiy risk darajasini oʻz ichiga oladi.

Onlayn savdo platformamizda chop etilgan barcha materiallar faqat taʼlim/axborot maqsadlari uchun moʻljallangan va unda moliyaviy, investitsiya soligʻi yoki savdo maslahatlari va tavsiyalar; yoki bizning savdo narxlarimizning qaydlari; yoki har qanday moliyaviy vositalar bilan bitim tuzish maslahati yoki taklifi; yoki sizga kerak boʻlmagan moliyaviy reklama aksiyalari hisoblanmaydi

Har qanday uchinchi tomon kontenti, shuningdek XM tomonidan tayyorlangan kontent, masalan: fikrlar, yangiliklar, tadqiqotlar, tahlillar, narxlar va boshqa maʼlumotlar yoki bu veb-saytda joylashgan uchinchi tomon saytlariga havolalar umumiy bozor sharhi sifatida "boricha" taqdim etiladi va investitsiya maslahatini tashkil etmaydi. Har qanday kontent investitsiya tadqiqoti sifatida talqin qilinsa, siz bunday kontentni investitsiya tadqiqotlarining mustaqilligini ragʻbatlantirish uchun moʻljallangan qonun talablariga muvofiq moʻljallanmagan va tayyorlanmaganligini eʼtiborga olishingiz va qabul qilishingiz kerak, shuning uchun unga tegishli qonunlar va qoidalarga muvofiq marketing kommunikatsiyasi sifatida qaraladi. Mustaqil boʻlmagan investitsiya tadqiqoti va yuqoridagi maʼlumotlarga oid risk haqida ogohlantirishimizni oʻqib chiqqaningizga va tushunganingizga ishonch hosil qiling, unga bu yerdan kirish mumkin.