RBA in wait-and-see mode despite drop in inflation – Preview

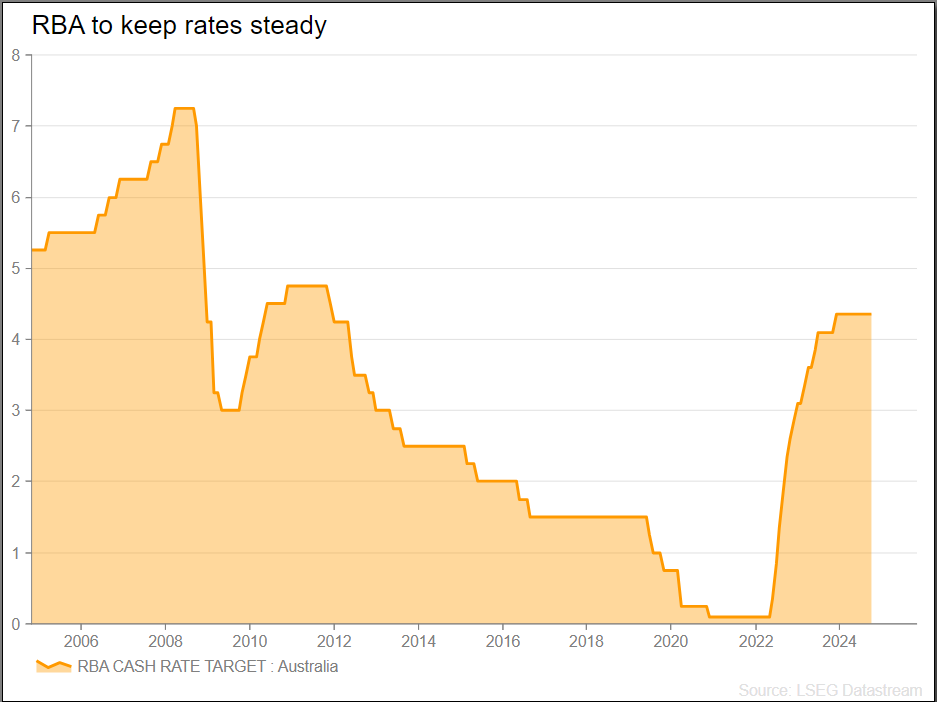

- RBA to stand pat at 4.35%

- Aussie may not be affected from this meeting

- Decision due on Tuesday at 3:30 GMT

RBA policy to remain unchanged

The upcoming Reserve Bank of Australia (RBA) policy meeting on November 5 is highly anticipated, with the bank adopting a wait-and-see approach and holding the cash rate steady while monitoring economic developments. The focus will be on ensuring that inflation continues to decline and that the economy remains on a stable growth path, with potential rate cuts anticipated in early 2025 if conditions improve.

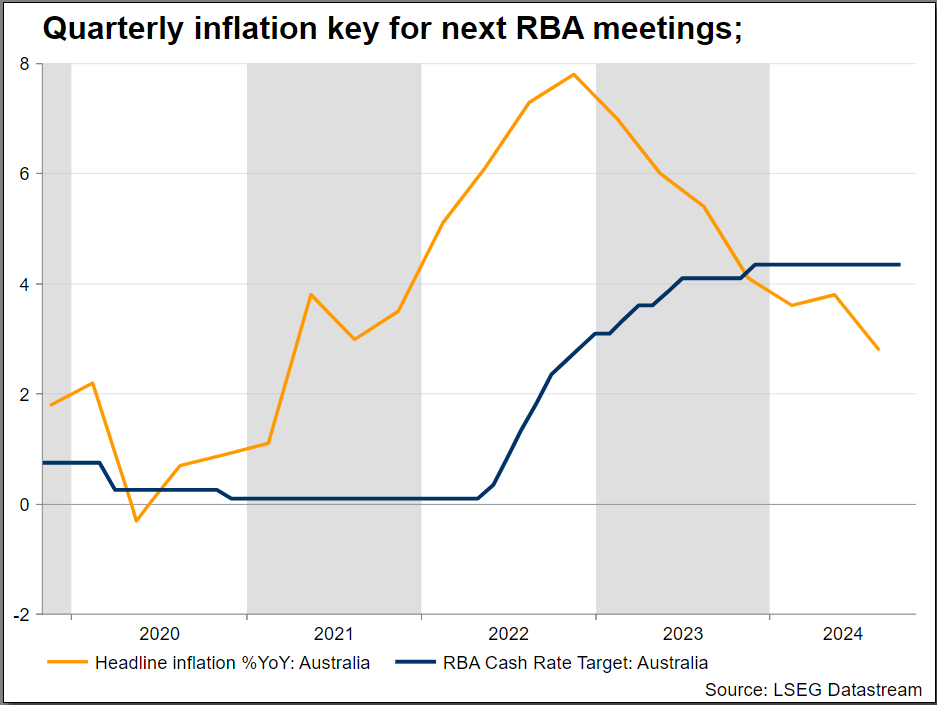

Inflation ticks down within target

Recent inflation figures show a mixed but overall encouraging pattern. In the September quarter, the headline inflation rate dropped to 2.8%, the lowest level in three and a half years. Significant drops in fuel and electricity prices, aided by government rebates, drove this decline. However, underlying inflation, measured by the trimmed mean, remains above the RBA’s target band at 3.5%. This persistent core inflation suggests that the RBA may need to maintain a cautious stance as service sector inflation, particularly in rents, insurance, and childcare, continues to exert upward pressure.

GDP and economic growth

The development of Australia's GDP has been modest. The June quarter of 2024 saw a 0.2% q/q increase in economic growth, which is consistent with the ongoing trend of gradual but consistent expansion. The weakest annual growth since the early 1990s, with the exception of the pandemic period, was 1.5% in the 2023–24 fiscal year. Although government expenditure has provided some support, this lethargic growth is a result of subdued household consumption and a decline in discretionary spending.

Various factors, including international economic conditions, domestic inflation patterns, and labor market robustness, will influence the RBA's decision. The recent decrease in headline inflation is promising; however, the RBA remains vigilant about the stickiness in underlying inflation and its possible effects on the economy. The GDP data underscore the necessity for ongoing support to foster economic growth and tackle the difficulties confronting households and companies.

Aussie stands near critical area

Investors will closely scrutinize the language and tone of the RBA's statement, even though the immediate decision to hold rates might not cause significant movement. Investors will look for clues about future monetary policy direction, which will influence the Aussie’s trajectory in the coming months.

Aussie/dollar rebounded off the 0.6535 support level, which overlaps with the medium-term uptrend line, with the next strong resistance coming from the 200-day simple moving average (SMA) near 0.6620. However, a tumble beneath the diagonal line could open the way for a test of the bearish spike of 0.6360, achieved on August 5.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。