Daily Comment – Will the dollar or stocks smile after the non-farm payrolls print?

- Spotlight falls on the key US labour market data

- Non-farm payrolls to rise by 140k, but could surprise to the upside

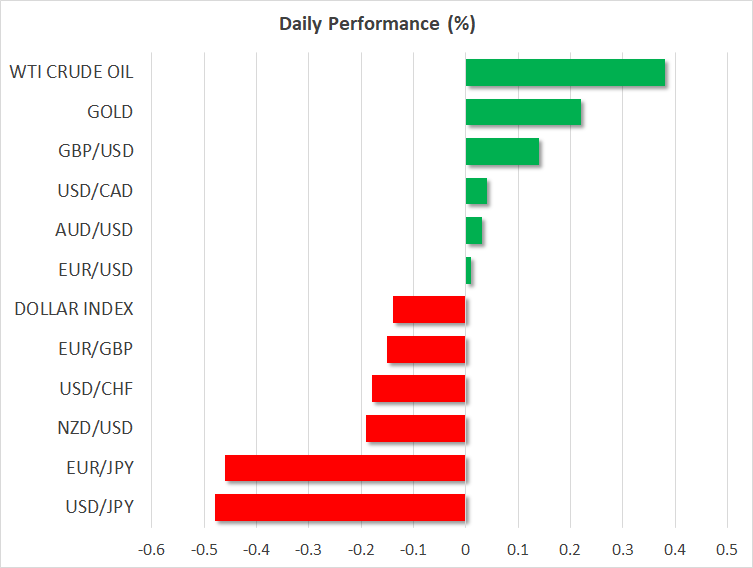

- Dollar to enjoy a strong set of data, equities prefer weaker prints

- Euro suffering continues, while both gold and oil advance

Could the US labour market data produce a surprise?

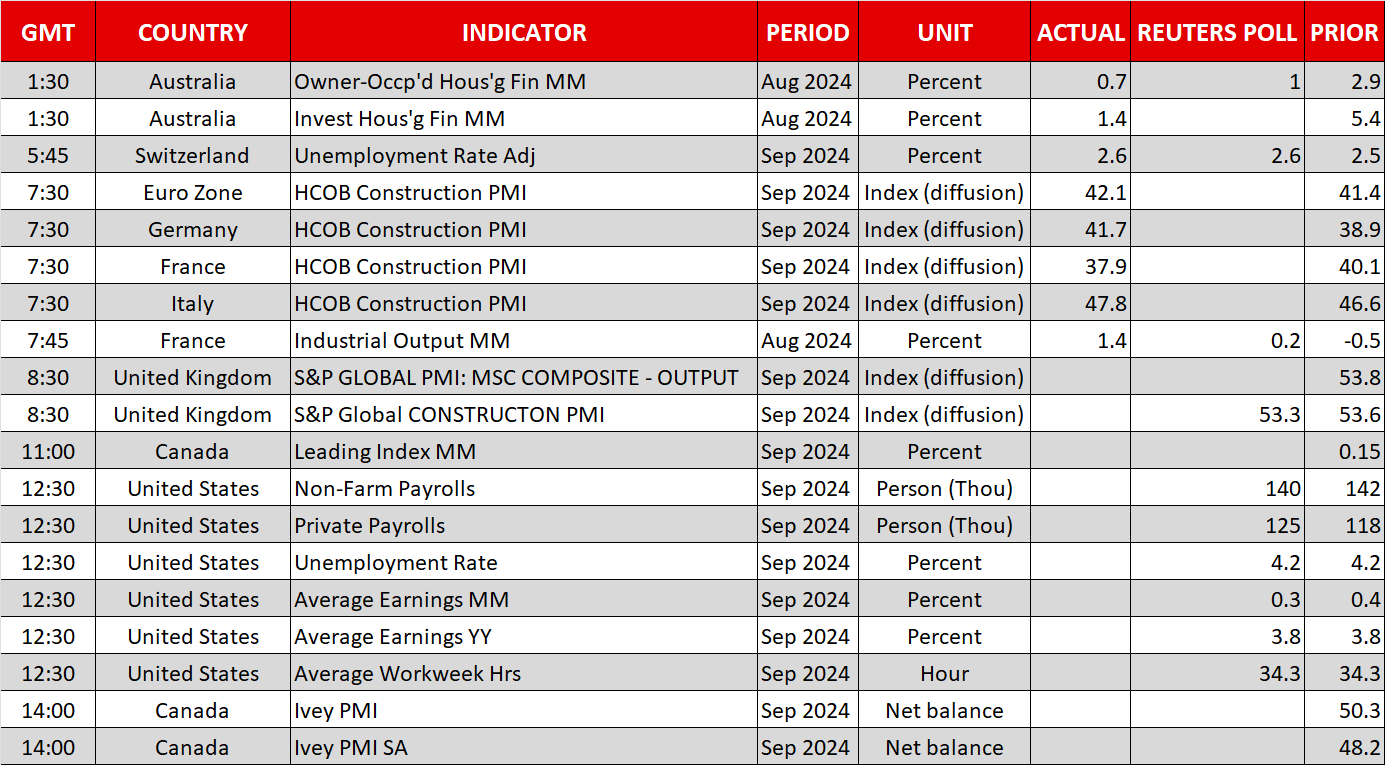

The countdown to the most crucial set of US data during October is nearly over. At 12.30 GMT the non-farm payrolls figure is expected to show a 140k increase, with forecasts ranging from 70k to 220k. Both the unemployment rate and the average hourly earnings growth will probably remain unchanged at 4.2% and 3.8%, respectively.

At 12.30 GMT the non-farm payrolls figure is expected to show an 140k increase

Up to now, data prints have been mixed, with the ISM manufacturing survey disappointing but both the weekly jobless claims and the ISM services survey raising the probability of an upside surprise today. A stronger set of prints later today, especially if the non-payrolls figure surpasses the 200k level, could force the most dovish Fed members to tone down their rhetoric for the November 7 meeting.

Such an outcome could really dent the current sizeable 35% probability for a 50bps rate move in November and further boost the US dollar. It has been a rather strong week for the greenback on the back of the reduced Fed rate cut expectations and the developments in the Middle East, with the dollar index being on course for its best week since mid-March.

Stock indices are not really sharing the dollar’s excitement, as they remain in negative territory on a weekly basis, led by the weakness seen in European stock markets. The risk-off reaction induced by Tuesday’s Iranian attack on Israel was further fueled yesterday after US president Biden’s comments that Israel has the green light to hit Iran’s oil installations.

Stock indices are not really sharing the dollar’s excitement, as they remain in negative territory on a weekly basis

Weak US data prints today, especially a sub-100k print in the non-payrolls figure and an abrupt increase in the unemployment rate, could temporarily reverse the current negative sentiment in equity markets. Interestingly, earnings announcements for the third quarter of 2024 will gradually take centre stage with the main US banking institutes publishing their results from October 11.

Euro remains on the back foot, pound tries to recover

The euro remains on the back foot, as the debate about the October ECB rate cut continues with most members appearing to be on board for such a move, despite the lack of staff projections and the fact that the meeting will take place far from the Frankfurt headquarters. There is a plethora of ECB speakers again today, but the message is unlikely to diverge much from the recent rhetoric.

The pound was the negative surprise of Thursday’s session, as Governor Bailey’s comments about a more aggressive stance in cutting rates came out of the blue and prompted a quick sell off. While the November rate cut is probably a done deal, the UK data releases point to another 25bps rate move. Maybe the BoE believes that the planned fiscal adjustment by the new government and a more dovish Fed warrant more aggressive easing.

Oil and gold are rising

With a barrage of attacks carried out by both Israel and Iran’s proxies on a daily basis, and the chances of a ceasefire remaining quite low at this stage, the current oil upleg could continue. WTI oil futures are hovering at a one-month high, quickly recovering from a 16-month low.

On the flip side, gold remains a tad below its recent all-time high, benefiting from equities’ weakness and undaunted by the dollar’s strength. The sell-off in bitcoin, and the remaining cryptocurrencies, could also support the current gold pricing as more traditional investors are not yet convinced of bitcoin’s ability to act as a safe haven asset in crisis periods.

Gold remains a tad below its recent all-time high, benefiting from the equities’ weakness and undaunted by the dollar’s strength

相關資產

最新新聞

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。