US airlines heading for an earnings crash; can bailouts save them? - Stock Market News

The travel industry has been the hardest hit by the global outbreak of the coronavirus, bringing the sector to a near standstill as countries around the world have shuttered their borders to protect their citizens from the deadly pandemic. Among the worst affected from the travel restrictions are passenger air carriers as most flights have ground to a halt. With airport tarmacs resembling aircraft graveyards than busy transport hubs as rows of empty planes lie idle, airline companies have been brought to the brink of collapse, with their share prices nosediving.

It was a huge relief therefore for US airline companies when Congress allocated $50 billion in assistance to the industry from the $2 trillion virus stimulus it approved in late March. What investors now want to know is, will this be enough to stave off mass-scale bankruptcies?

Not all hope is lost for airlinesJudging by Delta’s results, there may be hope yet for avoiding a complete collapse of the sector. On the face of it, Delta’s earnings are dreadful. Its revenues sank by 18% year-on-year in Q1 and its earnings per share (EPS) plunged to a loss of 51 cents, down from earnings of 96 cents a year ago but better than Refinitiv I/B/E/S estimates of a loss of 61 cents. The company expects the second quarter to be even more painful, with revenue projected to fall by as much as 90%.

However, markets saw a silver lining as Delta says it’s on track to cut expenses by 50% in Q2, which would help halve its cash burn to just $50 million a day. It is also confident it will be able to boost its liquidity from $6 billion to $10 billion. That, together with the $5.4 billion it will receive from the taxpayer in virus relief funds could be enough to keep the company afloat during the crisis. It also puts the focus on whether Delta’s rivals will be able to make similar reductions in their expenses as income dries up.

Slipping into lossesNext to come under scrutiny is Southwest Airlines’ earnings. Southwest is expected to report a 15.3% annual drop in revenue to $4.36 billion in Q1 and an EPS loss of 47 cents versus a profit of 70 cents a year ago. American Airlines is not anticipated to do any better. Its revenues are forecast to have fallen by 15.8% to $8.91 billion in Q1 and its EPS to plummet to a loss of $2.21 compared with a profit of 52 cents in Q1 last year.

Finally, United Airlines’ revenue is estimated to have declined by 13.9% to $8.26 billion. This is largely in line with the company’s preliminary report announced on Monday, which put Q1 revenue at $8 billion. Looking at the EPS, it is estimated to crash to a loss of $3.09 from earnings of $1.15 a year ago.

Like Delta, all three airlines are lined up to receive government support. Southwest is set to get $3.2 billion, American Airlines will receive $5.8 billion and United Airlines has said it expects its bailout to amount to $5 billion. Most airlines have also been busy raising funds via other sources such as from share sales and securing credit facilities.

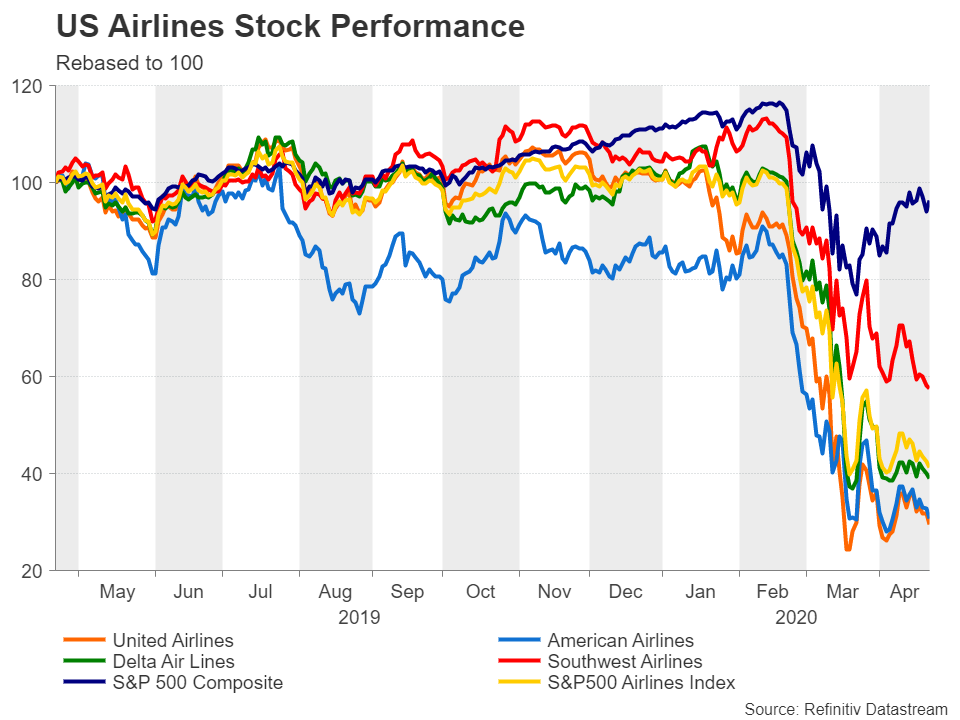

Low cash flow and high debt are concernsBut investors remain worried and this is reflected in the share prices. All the above airlines have been underperforming the S&P 500 by a wide margin since the virus fallout began in late February, with United Airlines seeing its shares fall the most. This could be down to the fact that United has quite a high debt-to-equity ratio of 1.29 versus an industry average of 0.64. Heavily indebted airlines are more at risk of going out of business from the virus turmoil as their creditors will be less keen to lend to them. Another metric investors will be looking at is free cash flow. American Airlines comes out the weakest here as it’s been struggling to retain positive cash flow since 2017.

Despite the industry’s troubles, however, analysts are not shouting ‘sell’ just yet. Delta and United stocks have a mean recommendation of ‘buy’ and Southwest and American have a ‘hold’ rating, though United was recently downgraded from ‘strong buy’ and American was demoted from ‘buy’. Their relatively low price/earnings (PE) ratios might have something to do with avoiding sharper downgrades. The PE ratios of the major airlines have been running below the average of the S&P 500 since at least 2016, and the recent stock market crash that pummelled airline stocks only amplified the comparative low ratios.

Airline stocks have stabilized, but…

Airline stocks have stabilized, but…The share prices of all four carriers have since stabilized and are off their lows, except for Southwest Airlines, which had not fallen as much to begin with. But given the uncertain economic outlook against the backdrop of the pandemic, the likelihood of further losses remains high.

Although many countries, including the United States, are gearing towards removing some of the lockdown controls, it is unclear as to when all restrictions will be lifted, especially for international travel. Without a workable vaccine on the horizon, travel curbs are likely to stay in place indefinitely, and if or when one is developed, air travel will probably be in the very last phase of easing the lockdown measures.

Will air travel ever recover?In the short term, the slump in oil prices may provide some relief to airlines, and in the US, the large domestic market may help the local air carriers to recoup a sizeable passenger base if several states go ahead with relaxing some of the lockdown rules as they intend to do.

But amidst all the uncertainty, one thing that is increasingly being questioned is whether passenger numbers can ever return to pre-crisis levels once the pandemic has ended. That prospect looks set to weigh on airline stocks for some time with the only caveat being that weaker rivals will probably not survive the impending economic downturn and a large-scale consolidation within the industry appears inevitable.免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。