Market Comment – Investors add to Fed hike bets after solid US retail sales

US retail sales rise more than expected, bolster Fed hike case

Pound slides on slowing wages, rebounds on sticky inflation

Aussie and kiwi aided by China’s GDP beat; loonie supported by higher oil prices

Wall Street ends mixed; gold extends gains on safe-haven flows

Dollar receives support, yields surge on US retail sales beat

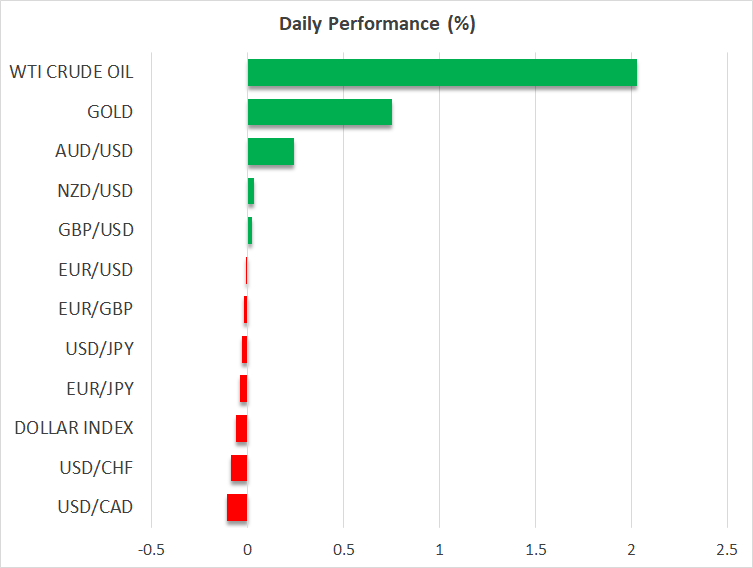

Dollar receives support, yields surge on US retail sales beatThe US dollar traded mixed against the other major currencies on Tuesday, gaining against the pound, the yen, and the kiwi, but losing ground versus the euro, the aussie and the loonie. The greenback ended the day virtually unchanged against the franc.

The dollar came under some buying interest after US retail sales for September grew more than expected, suggesting that the world’s largest economy ended the third quarter on a very strong note. Indeed, following the data, Goldman Sachs raised its GDP estimate for the quarter to a 4.0% annualized rate from 3.7%, while the Atlanta Fed GDPNow projection was revised up to 5.4% from 5.1%.

The figures had a more profound effect on Treasury yields than the dollar, with the 10-year rate climbing nearly 14 basis points as investors brought back to the table bets that the Fed may deliver one more hike before the end credits of this tightening crusade roll. According to Fed funds futures, they are now assigning around a 55% probability for another quarter-point increment by January, while they expect interest rates to end 2024 at around 4.8%, up from 4.7% seen on Monday.

Greenback traders will now probably turn their attention to speeches by several Fed policymakers, including Chair Powell on Thursday, to see whether they continue to hold the view that no more hikes are likely to be required due to the rally in Treasury yields, or whether the latest data have made them change their mind. Today, investors will have the chance to hear from New York Fed President John Williams, Philadelphia President Patrick Harker, and governors Waller, Cook and Bowman, with the latter being among the very few, if not the only, members pushing for higher rates even before last week’s higher than expected inflation numbers.

Pound recovers after CPIs; Aussie and Kiwi helped by Chinese dataThe pound was among the currencies that underperformed against the dollar, perhaps as UK jobs data for August showed that wages slowed from a record high and job vacancies dropped. The release of some labor data, including the unemployment rate, was delayed until next week.

Yesterday’s numbers may have weighed on expectations of another rate hike by the BoE, but today’s higher than expected inflation figures may have revived such bets. Although the likelihood of one last quarter-point hike being delivered in November is only 24%, the probability for that happening by March rose to almost 60%, helping the British currency to recover some of yesterday’s lost ground.

The aussie was among the gainers after the minutes from the latest RBA gathering revealed that policymakers considered raising rates, something that prompted market participants to fully price in one more hike by March, while the kiwi took a hit after New Zealand’s CPI fell to a two-year low, reducing speculation that the RBNZ will hike its cash rate further. Both currencies are on the front foot today as Chinese data showed that the world’s second largest economy accelerated more than expected in the third quarter.

The loonie also suffered a blow from Canada’s lower-than-expected inflation prints, but it quickly recovered the CPI-related losses and traded even higher, perhaps aided by the further advances in oil prices, which remained supported after a blast at a Gaza City hospital heightened fears of further escalation in the conflict between Israel and Palestine, and thereby added to concerns of oil supply disruptions.

Nasdaq slides, gold extends gains on war worriesWall Street ended mixed yesterday, with the Dow Jones and the S&P 500 closing virtually unchanged and the Nasdaq losing ground. It seems that investors’ decision to lift their implied Fed rate path following the US retail sales data weighed on the rate-sensitive Nasdaq, but that may have not been the only driver.

The tech-heavy index may have also felt the heat of the US government’s decision to announce plans to halt shipments of more advanced artificial intelligence chips to China. Nvidia opened with a large downside gap after the decision and immediately traded lower, although it recovered some ground later in the day. As for today’s earnings, Tesla and Netflix will report their results after the closing bell.

Gold continued marching north, and it is around 0.80% up today, which suggests that it remains investors’ safe haven of choice amid the Middle East conflict. Yesterday, a hospital in Gaza was hit and hundreds were killed, with Israel and Palestine blaming each other for the attack. The incident probably erased hopes of a diplomatic solution and perhaps added to fears of further escalation.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。