Market Comment – Better-than-expected US PMIs help the dollar rebound

PMIs suggest the US economy entered Q4 on solid footing

The divergence between US/Eurozone outlooks weighs on euro/dollar

Aussie rallies on stickier inflation, yen pinned near 150-per-dollar mark

Wall Street pays attention to corporate earnings

Euro/dollar slides from near key resistance on PMI data

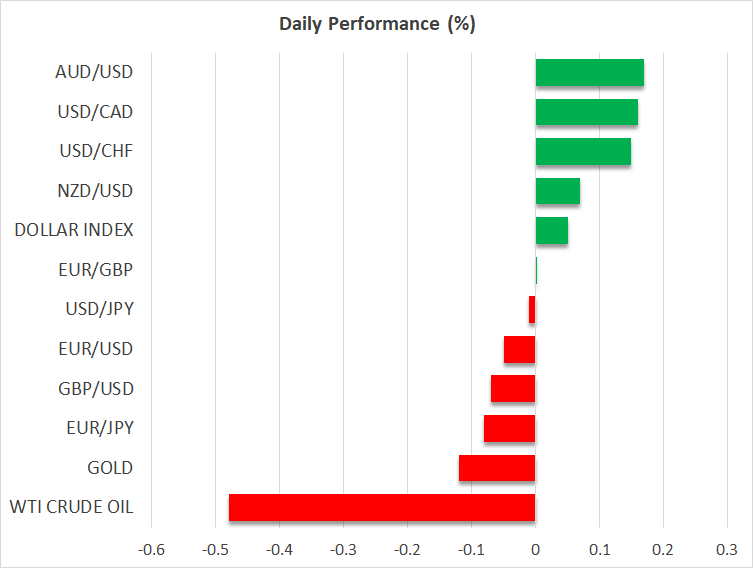

Euro/dollar slides from near key resistance on PMI dataAlthough the 10-year US Treasury yield held steady comfortably below the psychological zone of 5%, the US dollar was able to stage a comeback against most of its major counterparts as the flash US PMIs for October suggested that the world’s largest economy fared better than expected during the first month of the fourth quarter, with the manufacturing index escaping a contraction for the first time since April, and the composite index rising to 51.0 from 50.2.

This came in huge contrast to the Euro-area PMIs for the month that were released earlier in the day and painted an even uglier picture than they did in September. The divergence allowed euro/dollar bears to jump into the action from near the crossroads of the pair's 50-day moving average and the key resistance barrier of 1.0665, suggesting the latest recovery may have been just a corrective wave within the broader downtrend.

Dollar traders turn gaze to Q3 GDPThe slide may extend, and the pair could soon retest this month’s lows if Thursday’s data reveal astounding performance of the US economy in Q3. Expectations are for a solid 4.2% annualized growth rate, with the risks perhaps tilted to the upside as the Atlanta Fed GDPNow model estimates that the US economy may have grown 5.4% during that period.

The fact that Treasury yields did not track the dollar’s rebound may be an indication that investors were still reluctant to add to bets of another hike by the Fed after the better PMIs. Indeed, according to Fed funds futures, there is only a 40% chance for one final 25bps increase by January, while there are still around 80bps worth of rate reductions penciled in for next year. That said, the implied path could well be lifted, and rate cuts could be scaled back if upcoming data continues to point to a resilient US economy.

Aussie extends gains after CPIs, dollar/yen pinned near 150The aussie was among the currencies that outperformed the dollar yesterday, spiking even higher today after data showed that Australia’s inflation slowed by less than expected in Q3 and that the monthly y/y rate for September rose to 5.6% from 5.2%. This prompted investors to add to their bets of more hikes by the RBA, with the probability of another quarter-point increase at the November gathering rising to around 42%.

The yen attempted a recovery at some point yesterday, but the rebound in the dollar pinned the dollar/yen pair back near the highly monitored 150 territory, with traders biting their nails in anticipation of any signs of intervention by Japanese authorities. What could reveal whether officials are ready to act now or whether the level at which they feel comfortable intervening has shifted higher, may be a stellar US GDP print tomorrow that could force the pair to pierce through that psychological ceiling.

Wall Street ekes out gains, driven by upbeat earningsWall Street closed Tuesday in the green after upbeat forecasts from Verizon, Coca-Cola and other firms sparked optimism regarding the health of US businesses, encouraging investors to increase their risk exposure. The fact that the Fed’s implied rate path was not lifted after the better PMIs may have also helped Wall Street, which seems to be slowly shifting its attention away from the Middle East conflict.

After the closing bell, both Microsoft and Alphabet reported better-than-expected results, but the performance of their cloud services diverged. Microsoft’s Azure took off during the third quarter, but Alphabet’s cloud business saw its slowest growth in at least 11 quarters. After today’s close, it will be the turn of Meta Platforms to announce results.

In another sign that the financial world is turning its focus away from geopolitics, oil prices fell for the third straight day yesterday, perhaps as weak business surveys from the Eurozone and the UK weighed on the demand outlook.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。