Daily Market Comment – Euro flatlines but stocks lifted by vaccine and stimulus progress

- EU strikes compromise deal on a virus recovery fund but euro pares gains

- Positive vaccine headlines drive Nasdaq to record close as key earnings loom

- Win-win situation for gold as it climbs to 9-year highs

- Focus turns to talks on US fiscal package and Brexit; dollar sags but pound upbeat

Europe gets its fiscal bazooka; euro pauses for breath

Europe gets its fiscal bazooka; euro pauses for breathEuropean Union leaders ended a marathon summit on Tuesday with a classic fudge as a compromise deal that significantly waters down the original plan of a €750 billion rescue package finally got the backing of the ‘frugal’ nations. Under the agreement, €360 bln will be disbursed as loans, but only €390 bln will be allocated as grants, down from the initial proposal of €500 bln.

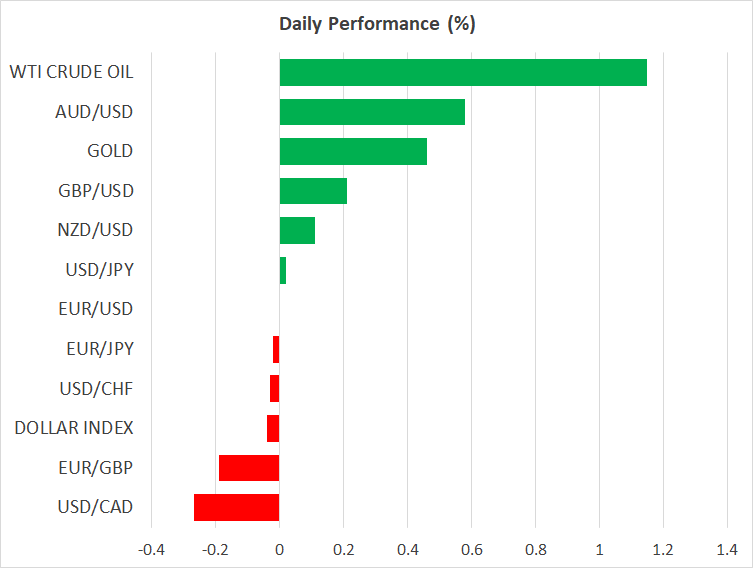

After hitting fresh 4-month highs earlier today, the euro became the victim of ‘buy the rumour, sell the fact’, falling on the announcement, but has since picked up some momentum again to trade nearer $1.1450.

European stocks cheered the much-anticipated fiscal boost for the euro area economy, which has been devastated by the Covid-19 pandemic. Germany’s DAX index soared to the highest since late February, pulling the Euro Stoxx 50 index to a 4½-month peak.

Vaccine and stimulus hopes re-energize NasdaqGlobal shares were also riding high on Tuesday, lifted by the stimulus news not just in Europe but elsewhere too. The Australian government has extended its wage subsidy scheme until March 2021, while in the United States, White House officials are in talks with the Democrats to reach an agreement on a new virus support package.

Adding to the positive sentiment were encouraging headlines for two separate coronavirus vaccines being tested by AstraZeneca and Pfizer. The companies’ latest trial results indicate it’s so far so good for developing a successful vaccine, though the timeline for when they can become commercially available is still unclear. Progress is also being made on a treatment for the virus, with British biotech firm, Synairgen, yesterday saying its drug can reduce severe cases from developing in patients by 79%.

All this buoyed Wall Street to fresh highs, sending the Nasdaq Composite and Nasdaq 100 to a record close as tech stocks regained their mojo, having underperformed in recent days. The S&P 500 hit a 5-month high but the Dow Jones lagged amid some caution for traditional stocks as the earnings releases pick up pace this week. Coca-Cola and United Airlines are due to report their results later today and e-mini futures were pointing to a higher open.

Virus risks and stimulus a boon for goldWith the recent bouts of risk-off proving short-lived, it seems there’s little that can get in the way of the underlying optimism in the markets, which is being fed by expectations that governments and central banks will keep the cheap liquidity flowing for as long as needed. However, the next round of fiscal stimulus in the US could prove trickier than the previous relief bills as both the Republicans and Democrats will have the November presidential election in mind when making their demands.

But time is short and with the negotiations coinciding with the earnings season, the next couple of weeks could be quite bumpy for Wall Street.

In the meantime, the only way is up for gold as the precious metal has not only been benefiting from the recent resurgence of virus cases around the world but also from the super-low government bond yields that look set to stay low even if the global economic recovery doesn’t falter.

Gold has broken above the $1,820/oz level to reach the highest in almost nine years.

Dollar hits 4-month low; pound eyes Brexit talksAn additional source of support for the gold rally has been a weakening greenback. The dollar index slid to 4-month lows earlier today, weighed down not just by a stronger euro but also from a perked-up pound.

Sterling is flirting with the $1.27 handle for the first time since mid-June on hopes that the latest round of Brexit negotiations taking place in London this week will bear some fruit. However, a deal remains far off given the significant differences on several issues and the pound could just be setting itself up for a big fall.

The Australian dollar was another star performer on Tuesday, climbing back above the $0.70 level despite the risk to Australia’s economy from the lockdown in Victoria. The aussie’s bull run was given the green light by RBA Governor Philip Lowe who has yet to express his displeasure at the exchange rate, saying it’s “hard to argue” that the currency is overvalued when speaking earlier today.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。