Daily Market Comment – Dollar succumbs to Powell’s dovish tune; stocks mixed

- Powell reiterates that rate hikes are a long way off, pressing down on yields

- Dollar skids again but upside risk from retail sales and jobless claims

- Banks kick off US earnings with a bang but only Dow Jones rises

Most dovish Fed Chair ever strikes again

Most dovish Fed Chair ever strikes againThe US dollar slid and the 10-year Treasury yield held near three-week lows as Fed Chair Jerome Powell went out of his way to dampen fears of pre-emptive action to stem rising inflation. Speaking on Wednesday to the Economic Club of Washington, Powell reiterated that the Fed would only begin winding down its asset purchases when it’s made substantial progress towards its goals. But crucially, Powell signalled that tapering would happen “well before” they start considering raising interest rates.

Treasury yields edged lower after Powell’s remarks, with the 10-yield falling towards 1.61%. Markets have finally started to take note of the Fed’s repeated assurances that creeping inflation won’t derail its current policy path even as the US consumer price index soars past 2%.

With growth accelerating amid a deluge of fiscal stimulus, a rapid vaccine rollout and falling virus cases, the Fed’s own agents are reporting stronger hiring and upward pressure on prices according to the April Beige Book.

The fast-improving economic backdrop is limiting how far Treasury yields can pull back. But the ongoing risks to the positive outlook are also supporting safe-haven bonds as the setbacks with the AstraZeneca and Johnson & Johnson vaccines have shown that there’s still plenty that can go wrong, especially if a new vaccine-resistant strain of Covid-19 emerges.

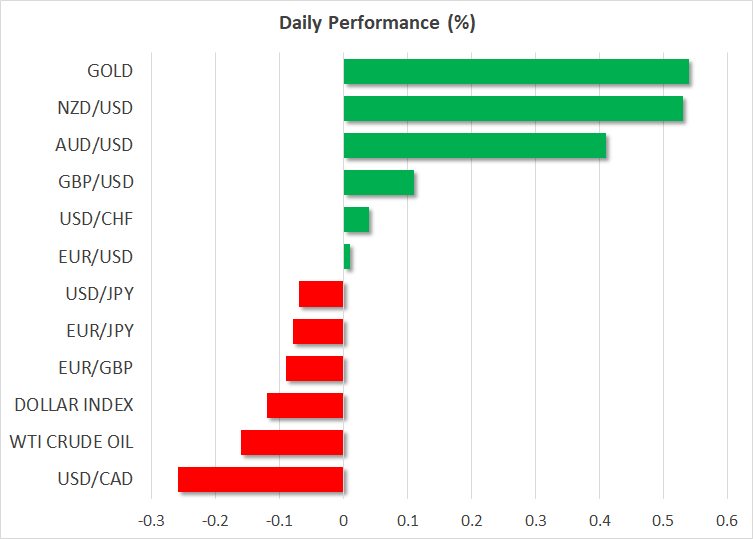

Dollar sags, aussie lifted by robust jobs dataBut for now, investors took comfort in Powell’s ultra-dovish stance, which weighed heavily on the greenback. The dollar index plumbed a fresh four-week low today, lifting its rivals. The improved risk tone further dented demand for the dollar, as well as for the yen, though some of the overnight moves had started to reverse by the European open.

The euro and pound both turned flat, easing slightly from one-month and one-week highs, respectively, against the dollar. Dovish comments by ECB President Christine Lagarde yesterday may be curbing the euro’s advances while rising political risks in the UK could be clipping the pound’s wings.

However, the Australian and New Zealand dollars extended their gains today to jump a further 0.5%, outperforming their peers. The aussie was additionally boosted by robust jobs numbers, which showed employment in Australia surpassed pre-pandemic levels in March.

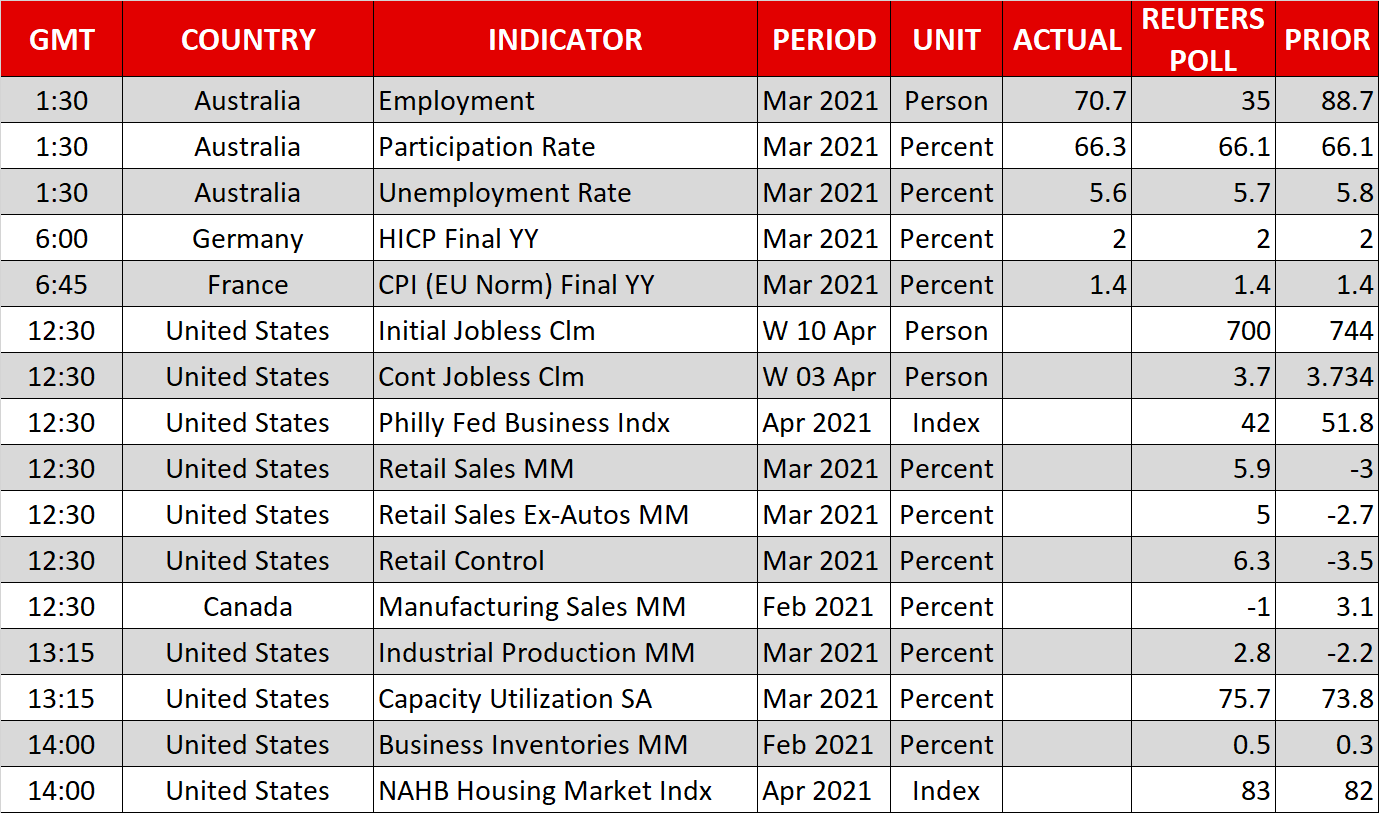

The US labour market will come in focus later today when the latest initial jobless claims figures are published. Retail sales data will also be eyed as Americans likely upped their consumption in March. Stronger-than-expected numbers might help the dollar stabilize even if they’re not able to reverse the latest declines.

Gold rose disproportionately to the weakness in the dollar and yields, indicating perhaps some safety flows from growing tensions between Moscow and Washington as the Biden administration prepares to impose yet more sanctions on Russia.

US stock futures up ahead of more key earningsIn equity markets, the S&P 500 slipped back from fresh record highs to close 0.4% lower on Wednesday. Stellar earnings from Wall Street’s big banks were unable to offset a bit of a selloff in tech stocks, which pulled the Nasdaq Composite down 1%. Only the Dow Jones was able to finish the day in positive territory, but futures were pointing to a stronger open for all three indices on Thursday.

Bank earnings will continue today with Bank of America and Citigroup reporting before the market open. Delta Air Lines will also be under the spotlight for clues on how well the airline and travel industries are weathering the pandemic storm.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。