Daily Market Comment – Dollar edges up, stocks slip as recovery doubts set in

- China’s GDP bounces back but signs of uneven recovery dampen sentiment

- White House’s tough line on China also a drag on risk assets

- Euro softer ahead of ECB; Stocks eye US earnings and retail sales for direction

China returns to growth but weak spending worries markets

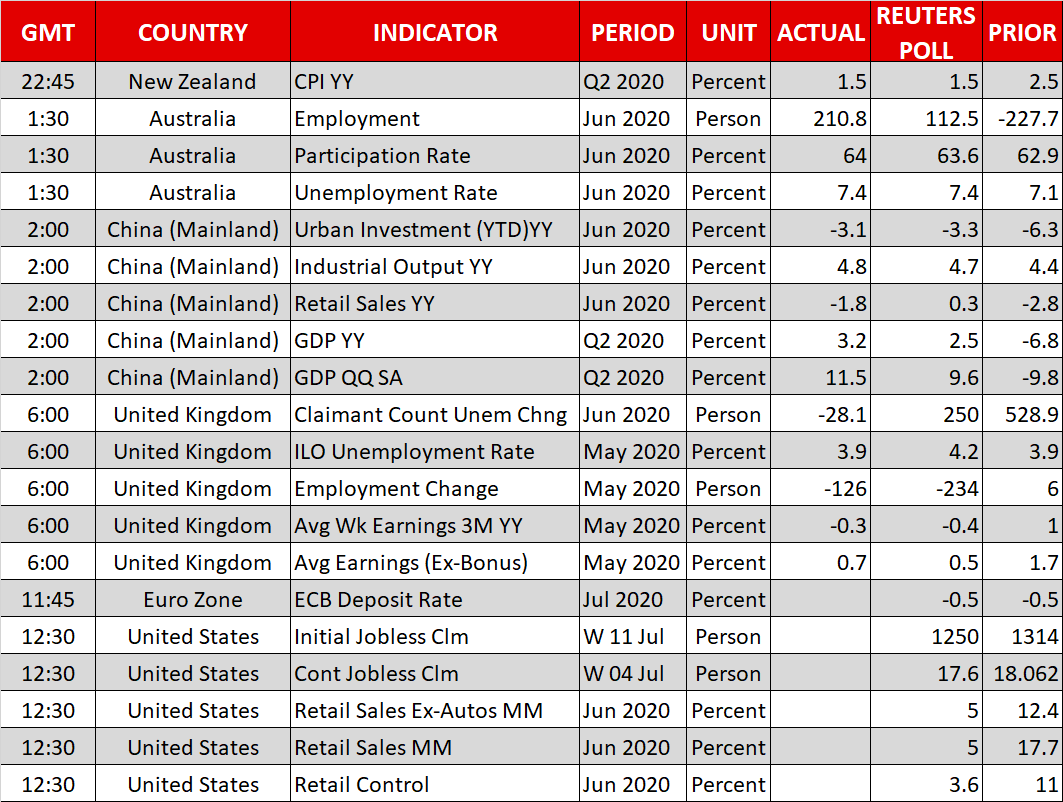

China returns to growth but weak spending worries marketsAs far as V-shaped recoveries go, China’s economic recuperation from the coronavirus couldn’t look more V-shaped. Gross domestic product (GDP) jumped by 11.5% over the quarter to June after collapsing by almost 10% in the first quarter. Year-on-year growth also returned to positive territory, with GDP rising by 3.2%, well above forecasts of 2.5%.

But rather than be reassured by the upbeat headline numbers, investors finally seem to be touching base with reality as the warning signs that the global recovery will be a bumpy one continue to grow. Up until now, the resurgence of virus infections in several countries had failed to dent hopes of a speedy and robust recovery. But the slow pickup in domestic demand in China appears to have dealt a major blow to those expectations. Retail sales in China fell on an annual basis for the fifth straight month in June, suggesting consumers are not yet feeling confident enough to revert to their pre-pandemic spending habits.

China is deemed to be in a stronger position than most nations to recover economically and combat fresh virus flare-ups so if domestic consumption is unable to bounce back quickly, that raises serious questions about future growth, especially when the rest of the world remains in crisis.

The numbers of daily virus cases in the United States continue to rise at an alarming rate, forcing more states to tighten or re-impose restrictions. Fed officials have come out in droves lately to sound caution about the pace of the US recovery and markets may finally be heeding their warnings.

Nasdaq wobbles again; S&P 500 close to erasing yearly lossesThe Nasdaq Composite had another shaky session on Wednesday but managed to end the day up 0.6%. Traditional stocks outperformed once again, helping the S&P 500 to almost wipe out its year-to-date losses. However, with more bank earnings on the way – Bank of America and Morgan Stanley will report their results before the market open – the Nasdaq might get the chance to outshine once again, especially if Netflix does not disappoint with its earnings.

In Asia, Chinese stocks were the biggest losers, plunging on a combination of factors, amid a clampdown by authorities on excessive risk taking and disappointing retail sales figures, but also from brewing tensions between Beijing and Washington.

No end in sight to US-China bickeringPresident Trump is reportedly considering whether or not to ban members of the Chinese Communist Party from travelling to the US, while his administration is growing increasingly concerned about the security risks posed by Chinese social media apps like TikTok and WeChat.

Despite the worsening tensions, however, market reaction to US-China risks remains fairly muted, with not even gold responding to the latest headlines. Positive news on possible COVID-19 vaccines appear to be keeping the bears in check for now. The precious metal was last down 0.4%, perhaps coming under pressure from a firmer US dollar.

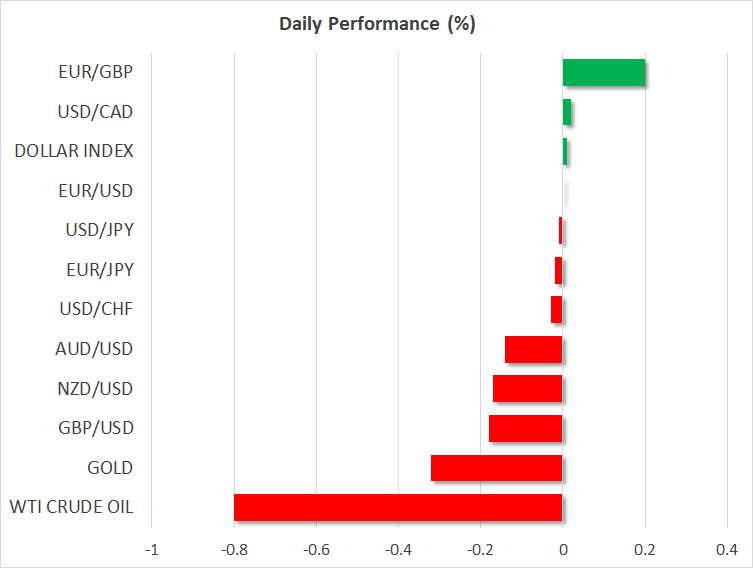

Dollar on firmer footingThe greenback was marginally higher against a basket of currencies as European trading got underway. The main focus for the dollar today will be the US retail sales numbers, which should reveal whether May’s consumer rebound extended into June.

The euro hovered around the $1.14 level as traders await the European Central Bank’s policy announcement. Although no change in policy is expected by the ECB today, markets will want clear signals from policymakers that they are committed to their pledge to do whatever it takes to protect the Eurozone economy amid doubts about the EU’s fiscal stimulus package.

The aussie was one of the worst performers on Thursday as a bigger-than-expected jump in Australian employment in June was offset by a further escalation in the virus outbreak in Victoria. The Canadian dollar, meanwhile, pared back some of yesterday’s gains when it soared after the Bank of Canada failed to provide explicit easing signals even though it struck a strongly dovish tone.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。