Turkish lira falls apart, what can turn the tide?

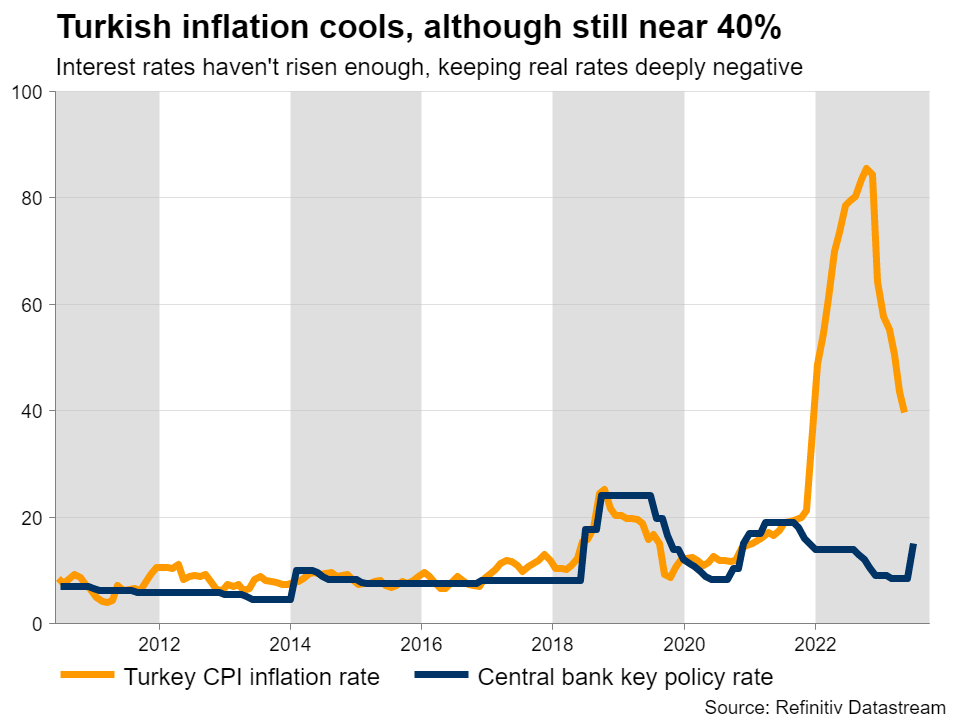

That’s only half the story, though. Another element that ravaged the lira was the central bank’s latest decision on interest rates. With a new governor coming in, there was rampant speculation about a massive increase in rates to fight runaway inflation. Some economists expected rates to be raised immediately to 25%, so when the central bank only lifted them to 15%, investors saw that as a huge disappointment. With inflation running around 40%, this move was seen as a ‘half measure’ that won’t be sufficient in cooling the economy down. Behind the downtrendTaking a step back, the lira’s downtrend is not a new phenomenon. The currency has been in decline for more than two decades, although the losses accelerated sharply after 2018 as inflation started to fire up and the nation’s deficits blew up. When inflation moves far higher but interest rates don’t follow suit, the result is that real interest rates fall deep into negative territory. That’s toxic for the lira because it discourages investors and consumers from holding it. Nobody wants to keep a currency that is constantly losing its value, if they are not compensated through high interest rates.

That’s only half the story, though. Another element that ravaged the lira was the central bank’s latest decision on interest rates. With a new governor coming in, there was rampant speculation about a massive increase in rates to fight runaway inflation. Some economists expected rates to be raised immediately to 25%, so when the central bank only lifted them to 15%, investors saw that as a huge disappointment. With inflation running around 40%, this move was seen as a ‘half measure’ that won’t be sufficient in cooling the economy down. Behind the downtrendTaking a step back, the lira’s downtrend is not a new phenomenon. The currency has been in decline for more than two decades, although the losses accelerated sharply after 2018 as inflation started to fire up and the nation’s deficits blew up. When inflation moves far higher but interest rates don’t follow suit, the result is that real interest rates fall deep into negative territory. That’s toxic for the lira because it discourages investors and consumers from holding it. Nobody wants to keep a currency that is constantly losing its value, if they are not compensated through high interest rates.  Many have attributed the central bank’s reluctance to raise rates to political pressure from President Erdogan, who has characterized high interest rates as “the mother and father of all evil”. The fact the central bank has changed its Governor four times over the last five years is a testament to this political arm-twisting, as Erdogan simply replaced any leaders that dared to raise rates much. Therefore, it can be argued the central bank has effectively lost its independence, leaving it unable to take the actions necessary to extinguish inflation. Even the new governor - who has a background as a Wall Street banker - could not break this spell. Making matters worse for the lira, Turkey runs a chronic current account deficit, which has swelled in recent years. That means the nation is a net-borrower, importing more than it exports and relying on capital flows from abroad to finance the difference. Over time, these deficits can exert massive downward pressure on a currency, especially if they keep widening.

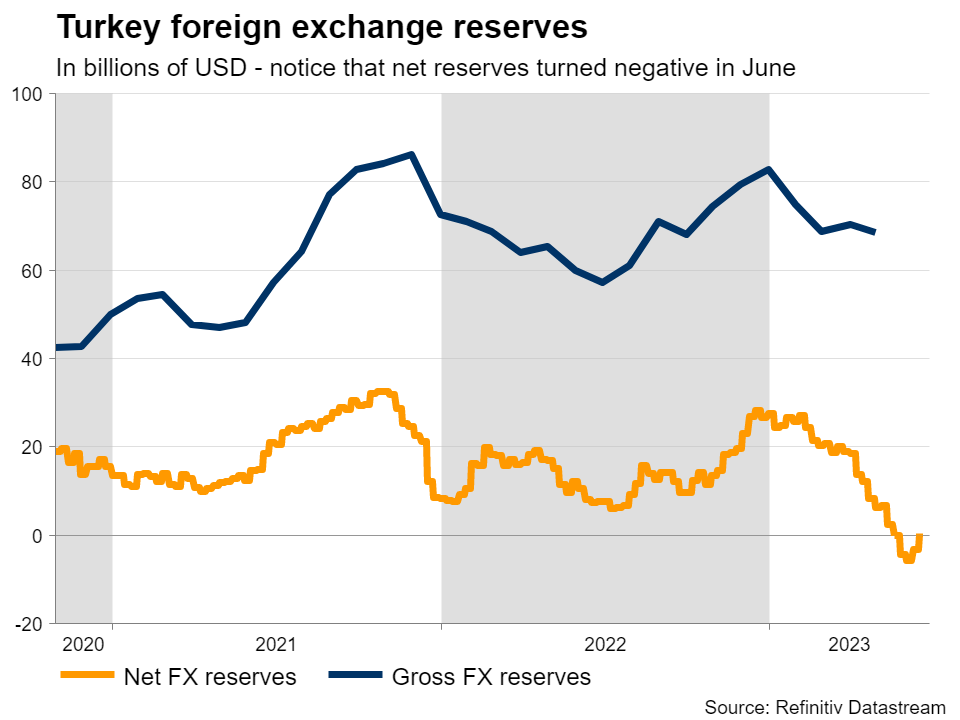

Many have attributed the central bank’s reluctance to raise rates to political pressure from President Erdogan, who has characterized high interest rates as “the mother and father of all evil”. The fact the central bank has changed its Governor four times over the last five years is a testament to this political arm-twisting, as Erdogan simply replaced any leaders that dared to raise rates much. Therefore, it can be argued the central bank has effectively lost its independence, leaving it unable to take the actions necessary to extinguish inflation. Even the new governor - who has a background as a Wall Street banker - could not break this spell. Making matters worse for the lira, Turkey runs a chronic current account deficit, which has swelled in recent years. That means the nation is a net-borrower, importing more than it exports and relying on capital flows from abroad to finance the difference. Over time, these deficits can exert massive downward pressure on a currency, especially if they keep widening.  The government has tried all sorts of unconventional tactics to stop the lira’s bleeding, such as making it more difficult to short the currency, introducing special savings accounts that compensate consumers if the lira falls sharply, and de facto confiscating foreign currencies from private banks to boost its FX reserves. These moves helped slow down the pace of depreciation for some time, alongside regular FX interventions, albeit at the cost of draining reserves. What’s next Looking ahead, there isn’t much that can turn the tides in the lira. What the currency desperately needs are higher interest rates, to slow down nominal growth and eradicate inflationary pressures, a painful process that will most likely involve a recession. Yet, President Erdogan seems determined not to let that happen. Slashing government spending could help to lower inflation, although this strategy might still be bearish for the lira initially, given its negative implications for economic growth. Plus, fiscal austerity would be a wildly unpopular move politically, making it seem even less likely.

The government has tried all sorts of unconventional tactics to stop the lira’s bleeding, such as making it more difficult to short the currency, introducing special savings accounts that compensate consumers if the lira falls sharply, and de facto confiscating foreign currencies from private banks to boost its FX reserves. These moves helped slow down the pace of depreciation for some time, alongside regular FX interventions, albeit at the cost of draining reserves. What’s next Looking ahead, there isn’t much that can turn the tides in the lira. What the currency desperately needs are higher interest rates, to slow down nominal growth and eradicate inflationary pressures, a painful process that will most likely involve a recession. Yet, President Erdogan seems determined not to let that happen. Slashing government spending could help to lower inflation, although this strategy might still be bearish for the lira initially, given its negative implications for economic growth. Plus, fiscal austerity would be a wildly unpopular move politically, making it seem even less likely.  That leaves structural reforms and regulatory changes, but admittedly, it’s highly doubtful any such policies would be powerful enough to rescue the currency. If there were easy solutions from a legislative perspective, they would have been implemented already. As such, it’s difficult to see a path towards a sustainable FX recovery, at least under the current political leadership. While a near-term correction seems plausible after such a dramatic downfall, it is unlikely to go very far, with real rates so deep in negative territory and FX reserves exhausted.

That leaves structural reforms and regulatory changes, but admittedly, it’s highly doubtful any such policies would be powerful enough to rescue the currency. If there were easy solutions from a legislative perspective, they would have been implemented already. As such, it’s difficult to see a path towards a sustainable FX recovery, at least under the current political leadership. While a near-term correction seems plausible after such a dramatic downfall, it is unlikely to go very far, with real rates so deep in negative territory and FX reserves exhausted. İlgili varlıklar

En son haberler

Bildirim: XM Group şirketlerinin her biri yalnızca gerçekleştirme hizmeti ve online yatırım platformumuza erişim sağlar. Herhangi bir kişinin web sitesinde bulunan veya web sitesi üzerinden sağlanan içeriği görüntülemesine ve/veya kullanmasına izin vermek, bu hizmeti değiştirmek veya genişletmek amaçlı değildir ve bu hizmeti ne değiştirir ne de genişletir. Bu tür erişim ve kullanım her zaman şunlara tabidir: (i) Şartlar ve Koşullar; (ii) Risk Uyarıları ve (iii) Tam Bildirim. Bu nedenle bu tür içerikler yalnızca genel bilgi amacıyla sağlanır. Özellikle, online yatırım platformumuzun içeriklerinin finans piyasalarında herhangi bir işleme girmek için bir teşvik veya bir teklif olmadığını lütfen dikkate alın. Herhangi bir finans piyasasında yatırım yapmak sermayeniz için önemli düzeyde risk taşır.

Online yatırım platformumuzda yayınlanan tüm materyaller yalnızca eğitim/bilgilendirme amaçlıdır ve finansal tavsiye, yatırım vergisi veya yatırım tavsiyesi ve önerileri ya da yatırım fiyatlarımızın kaydı veya herhangi bir finansal enstrümanda işlem yapılması için bir teklif veya teşvik ya da talep edilmemiş finansal promosyonları içermez ve içerdiği şeklinde bir değerlendirme yapılmamalıdır.

Görüşler, haberler, araştırma, analizler, fiyatlar, diğer bilgiler veya bu web sitesinde bulunan üçüncü taraf sitelere verilen bağlantılar gibi her türlü üçüncü taraf içeriğin yanı sıra XM tarafından hazırlanan içerik de “olduğu gibi” esasına göre, genel piyasa yorumu olarak sağlanır ve bir yatırım tavsiyesi oluşturmaz. Herhangi bir içeriğin yatırım araştırması olarak yorumlanmasıyla ilgili olarak, içeriğin bağımsız yatırım araştırmasını desteklemek üzere tasarlanmış yasal gerekliliklere uygun hazırlanmadığını ve bu amacın güdülmediğini, aynı şekilde ilgili yasalar ve mevzuatlar kapsamında pazarlama iletişimi olarak değerlendirileceğini dikkate almalı ve kabul etmelisiniz. Buradan erişebileceğiniz Bağımsız Olmayan Yatırım Araştırması Bildirimimizi ve yukarıdaki bilgilerle ilgili Risk Uyarımızı okuduğunuzdan ve anladığınızdan emin olun.