Disney to report higher earnings but will its shakeup plan impress? – Stock Markets

Walt Disney will unveil its fiscal Q4 earnings on Wednesday after the closing bell

Cost cutting and price hikes likely boosted earnings per share

But slowing revenue growth and downbeat guidance may weigh on the stock

Trouble at the top

Trouble at the topThe Walt Disney Company (Disney) has been undergoing a significant overhaul this year as returning CEO, Bob Iger, attempts to streamline the flagging business following several years of major acquisitions. There have been further changes at the very top of management too, with the latest being the announcement of a new chief financial officer.

Aside from the multiple challenges facing the business, the management is also battling the activist investor, Nelson Peltz, who just raised his stake in Disney and is demanding multiple seats on the board amid growing shareholder disgruntlement about the direction of the company. The latest earnings results will therefore be crucial in restoring investors’ trust in the management and the future of the company.

ESPN future under scrutiny as Disney+ strugglesEarlier in the year, the company split its ESPN sports network from the rest of the entertainment business, creating a third division, with parks, experiences and products being the other. ESPN has seen its revenue fall in recent quarters, so the move has raised speculation that Disney may be prepping to sell the unit. There is a counter argument against this, though, which is that ESPN remains a cash cow despite the recent revenue decline. Iger insists ESPN is not for sale and he is only looking for strategic partners. Apple is rumoured to be one of the companies interested in a possible stake.

The company’s popular streaming service, Disney+, hasn’t been doing so well either and continues to lose money. The streaming platform lost subscribers in each of the last three quarters after prices were raised last December. Some analysts, however, think that fiscal Q4 was a turning point, with net subscriber numbers growing slightly and this may have helped narrow the losses. The company is hoping that taking full ownership of Hulu – a sister streaming service – will bolster Disney+’s appeal by making content from Hulu available on both platforms.

Revenue boost from price hikesThe only real bright spot is likely to be the parks business where revenue has been surging. But even here the picture is not entirely positive as the record income is mostly being driven by higher prices rather than by growing visitor numbers. Still, the company is investing heavily in this segment and for the time being, the strategy appears to be paying off.

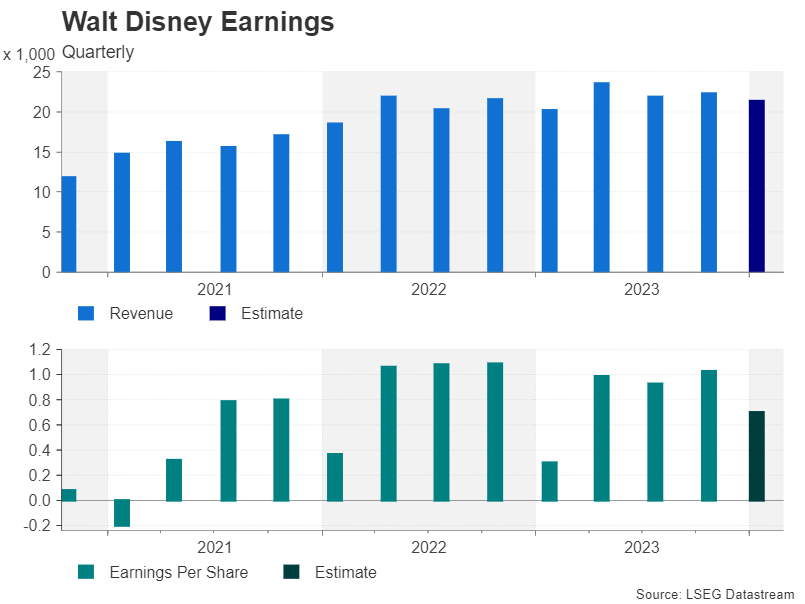

Total revenue in fiscal Q4 is expected to have reached $21.36 billion according to LSEG IBES data, up 6% from the same period a year ago but lower than the $22.33 billion reported in the prior quarter. Earnings per share (EPS), meanwhile, is anticipated at $0.70, representing a 133% jump from 12 months ago but down 32% from fiscal Q3.

All eyes on cost cutting progressWhilst there is plenty of room for disappointment as the company struggles to compete in the streaming arena and is in the midst of a major reorganisation, upside surprises are possible too as Iger implements his $5.5 billion cost-cutting drive, most of which will come from layoffs of up to 7,000 jobs.

That might go some way in explaining why analysts have maintained their ‘buy’ recommendation for the stock during this somewhat difficult period for the entertainment giant, even as the share price has fallen by about 3.3% in the year-to-date. Nevertheless, analysts are sticking to their triple digit price target. The median price target is currently $109.00 – about 30% higher than Monday’s closing price of $84.02 a share.

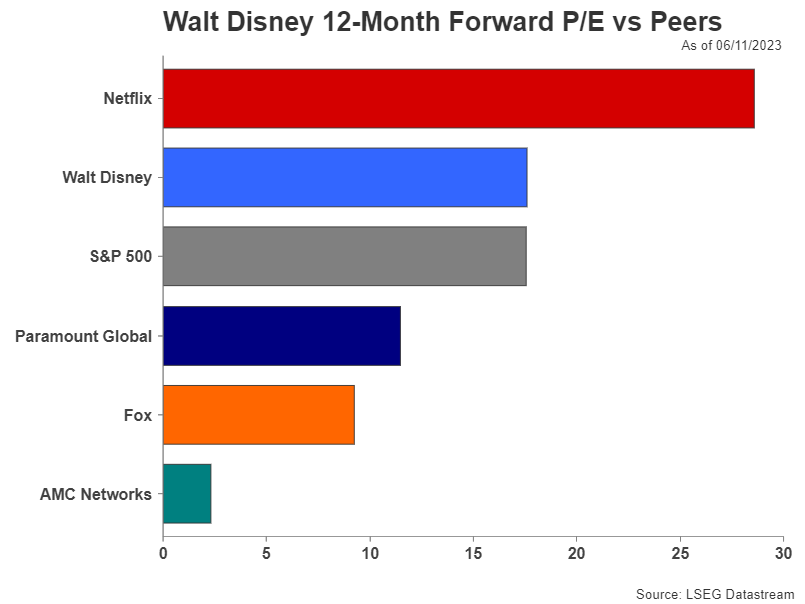

Is a rebound in the stock around the corner?On the positive side, the stock’s complete retracement of its post-pandemic rally when it hit an all-time high of $203.02 in March 2021 has made it more attractive from a valuation perspective. Disney’s forward price-to-earnings (P/E) ratio is below that of its main rival, Netflix, and equal to that of the S&P 500.

Looking ahead, the stock may have just formed a double bottom pattern and appears poised for a rebound. If the latest earnings results provide further evidence that Iger’s turnaround plan is bearing fruit, that may shore up support in the $80 region. However, in the short term, any relief rally may be capped by the 200-day moving average near the $92 level and investors will likely want to see sustained growth in streaming subscribers before taking the price back above $100.

İlgili varlıklar

En son haberler

Bildirim: XM Group şirketlerinin her biri yalnızca gerçekleştirme hizmeti ve online yatırım platformumuza erişim sağlar. Herhangi bir kişinin web sitesinde bulunan veya web sitesi üzerinden sağlanan içeriği görüntülemesine ve/veya kullanmasına izin vermek, bu hizmeti değiştirmek veya genişletmek amaçlı değildir ve bu hizmeti ne değiştirir ne de genişletir. Bu tür erişim ve kullanım her zaman şunlara tabidir: (i) Şartlar ve Koşullar; (ii) Risk Uyarıları ve (iii) Tam Bildirim. Bu nedenle bu tür içerikler yalnızca genel bilgi amacıyla sağlanır. Özellikle, online yatırım platformumuzun içeriklerinin finans piyasalarında herhangi bir işleme girmek için bir teşvik veya bir teklif olmadığını lütfen dikkate alın. Herhangi bir finans piyasasında yatırım yapmak sermayeniz için önemli düzeyde risk taşır.

Online yatırım platformumuzda yayınlanan tüm materyaller yalnızca eğitim/bilgilendirme amaçlıdır ve finansal tavsiye, yatırım vergisi veya yatırım tavsiyesi ve önerileri ya da yatırım fiyatlarımızın kaydı veya herhangi bir finansal enstrümanda işlem yapılması için bir teklif veya teşvik ya da talep edilmemiş finansal promosyonları içermez ve içerdiği şeklinde bir değerlendirme yapılmamalıdır.

Görüşler, haberler, araştırma, analizler, fiyatlar, diğer bilgiler veya bu web sitesinde bulunan üçüncü taraf sitelere verilen bağlantılar gibi her türlü üçüncü taraf içeriğin yanı sıra XM tarafından hazırlanan içerik de “olduğu gibi” esasına göre, genel piyasa yorumu olarak sağlanır ve bir yatırım tavsiyesi oluşturmaz. Herhangi bir içeriğin yatırım araştırması olarak yorumlanmasıyla ilgili olarak, içeriğin bağımsız yatırım araştırmasını desteklemek üzere tasarlanmış yasal gerekliliklere uygun hazırlanmadığını ve bu amacın güdülmediğini, aynı şekilde ilgili yasalar ve mevzuatlar kapsamında pazarlama iletişimi olarak değerlendirileceğini dikkate almalı ve kabul etmelisiniz. Buradan erişebileceğiniz Bağımsız Olmayan Yatırım Araştırması Bildirimimizi ve yukarıdaki bilgilerle ilgili Risk Uyarımızı okuduğunuzdan ve anladığınızdan emin olun.