Jackson Hole symposium to shape dollar’s path – Preview

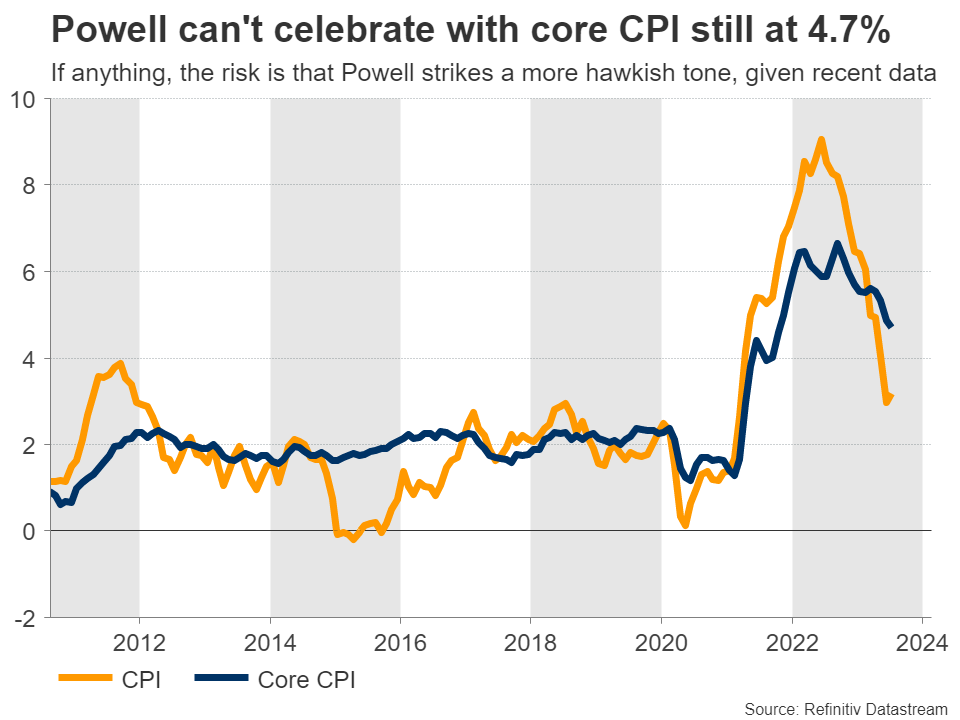

Economic growth is tracking at a 5.8% annualized pace this quarter according to the Atlanta Fed, consumers continue to spend, and the unemployment rate remains subdued near a five-decade low. Meanwhile, home prices are hitting new record highs in many parts of the country, so the cooldown in rents that the Fed has long awaited might prove elusive.In other words, the US economy is running hot and with energy prices also moving higher lately, there are credible concerns that inflation might not cool down to its 2% target anytime soon. What can Powell say? Overall, Powell is likely to keep his options open. While there has been serious progress on the inflation front, core inflation still running at 4.7% and with several signs it might remain elevated, it is probably too early for the Fed chief to take a victory lap and declare ‘mission accomplished’. He was preaching data dependence at the July FOMC meeting three weeks ago and will likely maintain that approach. However, considering the strength in the data flow lately, the risk is that he strikes a more hawkish tone this time, emphasizing the prospect of a ‘higher for longer’ regime for rates.

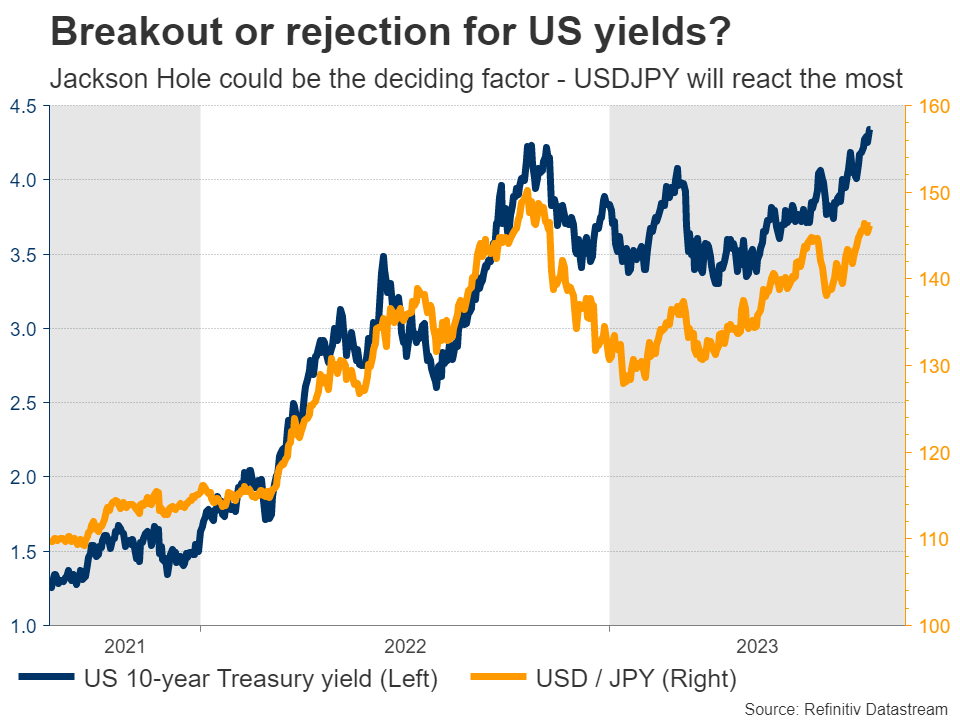

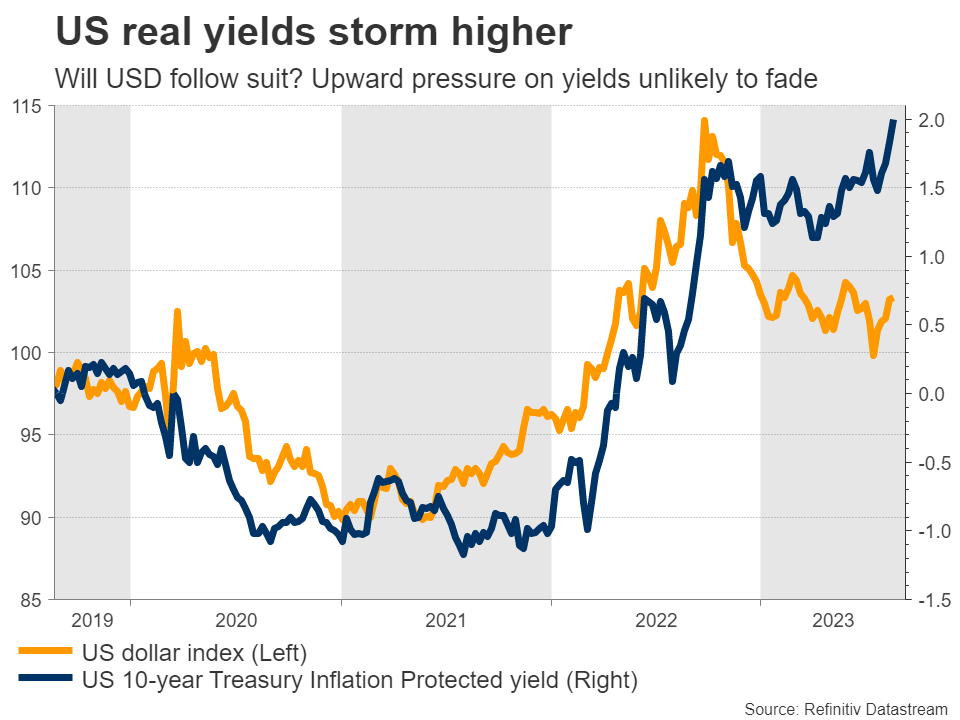

Economic growth is tracking at a 5.8% annualized pace this quarter according to the Atlanta Fed, consumers continue to spend, and the unemployment rate remains subdued near a five-decade low. Meanwhile, home prices are hitting new record highs in many parts of the country, so the cooldown in rents that the Fed has long awaited might prove elusive.In other words, the US economy is running hot and with energy prices also moving higher lately, there are credible concerns that inflation might not cool down to its 2% target anytime soon. What can Powell say? Overall, Powell is likely to keep his options open. While there has been serious progress on the inflation front, core inflation still running at 4.7% and with several signs it might remain elevated, it is probably too early for the Fed chief to take a victory lap and declare ‘mission accomplished’. He was preaching data dependence at the July FOMC meeting three weeks ago and will likely maintain that approach. However, considering the strength in the data flow lately, the risk is that he strikes a more hawkish tone this time, emphasizing the prospect of a ‘higher for longer’ regime for rates.  If Powell puts more emphasis on the prospect of keeping interest rates elevated for a longer period or on raising rates again in September, that could amplify the upward pressure on US yields, turbocharging the dollar. Dollar/yen is extremely sensitive to rate differentials, as the Bank of Japan still has not raised rates, so any spike in US yields might be reflected in this pair the most. A potential break above this year’s high at 146.60 could add momentum to the pair’s upward trend. That said, Japanese authorities will likely become more vocal about FX intervention if dollar/yen approaches the 150.00 region in a hurry, so any advances might not be linear. The big pictureAll told, the outlook for the US dollar seems promising. With real US yields hitting their highest levels since 2009 this week, the dollar is becoming an increasingly attractive investment destination. And this upward pressure on yields is unlikely to fade without a crisis. The Treasury is flooding the markets with new debt issuance, the Fed continues to unwind its own bond portfolio through quantitative tightening, and there are whispers that even China is unloading some of its Treasuries to raise reserves and defend its sinking currency.

If Powell puts more emphasis on the prospect of keeping interest rates elevated for a longer period or on raising rates again in September, that could amplify the upward pressure on US yields, turbocharging the dollar. Dollar/yen is extremely sensitive to rate differentials, as the Bank of Japan still has not raised rates, so any spike in US yields might be reflected in this pair the most. A potential break above this year’s high at 146.60 could add momentum to the pair’s upward trend. That said, Japanese authorities will likely become more vocal about FX intervention if dollar/yen approaches the 150.00 region in a hurry, so any advances might not be linear. The big pictureAll told, the outlook for the US dollar seems promising. With real US yields hitting their highest levels since 2009 this week, the dollar is becoming an increasingly attractive investment destination. And this upward pressure on yields is unlikely to fade without a crisis. The Treasury is flooding the markets with new debt issuance, the Fed continues to unwind its own bond portfolio through quantitative tightening, and there are whispers that even China is unloading some of its Treasuries to raise reserves and defend its sinking currency.  On a simpler level, the US economy is superior to its competitors at this stage from a growth perspective. China is battling a severe economic slowdown and business surveys suggest Europe is headed downhill too, perhaps towards a technical recession later this year. Over time, this economic divergence between the world’s largest economies is likely to be reflected in exchange rates, especially if US yields rise further.

On a simpler level, the US economy is superior to its competitors at this stage from a growth perspective. China is battling a severe economic slowdown and business surveys suggest Europe is headed downhill too, perhaps towards a technical recession later this year. Over time, this economic divergence between the world’s largest economies is likely to be reflected in exchange rates, especially if US yields rise further. Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.