Will US retail sales add juice to the dollar’s rally? – Preview

US retail sales will hit the markets at 12:30 GMT Monday

Early Easter holiday likely boosted consumer spending

Another solid dataset could put more wind in the dollar’s sails

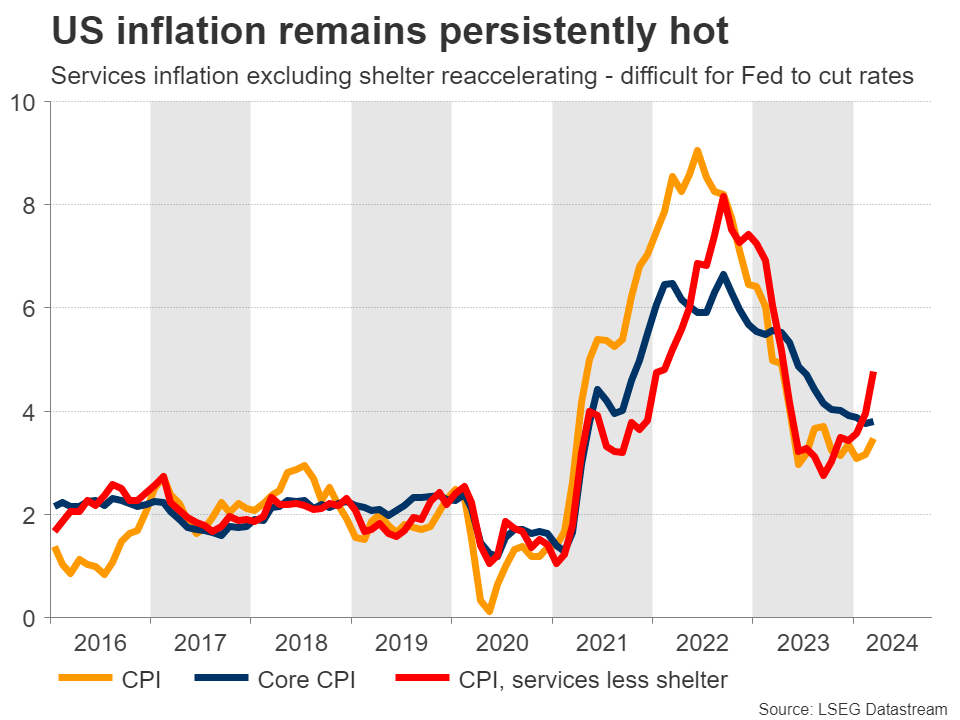

US economy outperformsBy most indications, the US economy finished the first quarter on a high note. Incoming data point to a robust labor market, which has helped bolster consumer demand and in the process, reignited inflationary pressures. The Atlanta Fed estimates real economic growth hit an annualized pace of 2.4% in the first quarter, something reaffirmed by incoming business surveys. Heavy government spending and a surge in population growth amid an influx of immigration appear to be the driving forces behind this economic resilience.

With mounting signs that growth and inflation are not cooling down, traders have continued to unwind bets of Fed rate cuts. Market pricing currently points to less than two cuts for this year, down from six just a few months ago. This sharp Fed repricing has propelled US yields higher, lending strength to the US dollar. Retail sales enjoy Easter boostTurning to the upcoming dataset, retail sales are forecast to have risen by 0.3% on a monthly basis in March, a slowdown from the 0.6% in the previous month but still a solid print overall. It seems that the early Easter holiday pulled forward some spending into March, giving an artificial boost to retail sales, at the expense of April’s print. That said, some early indicators on card spending painted a mixed picture. Bank of America data pointed to a soft month for consumption, whereas Visa’s spending momentum index continued to rise, signaling stronger demand.

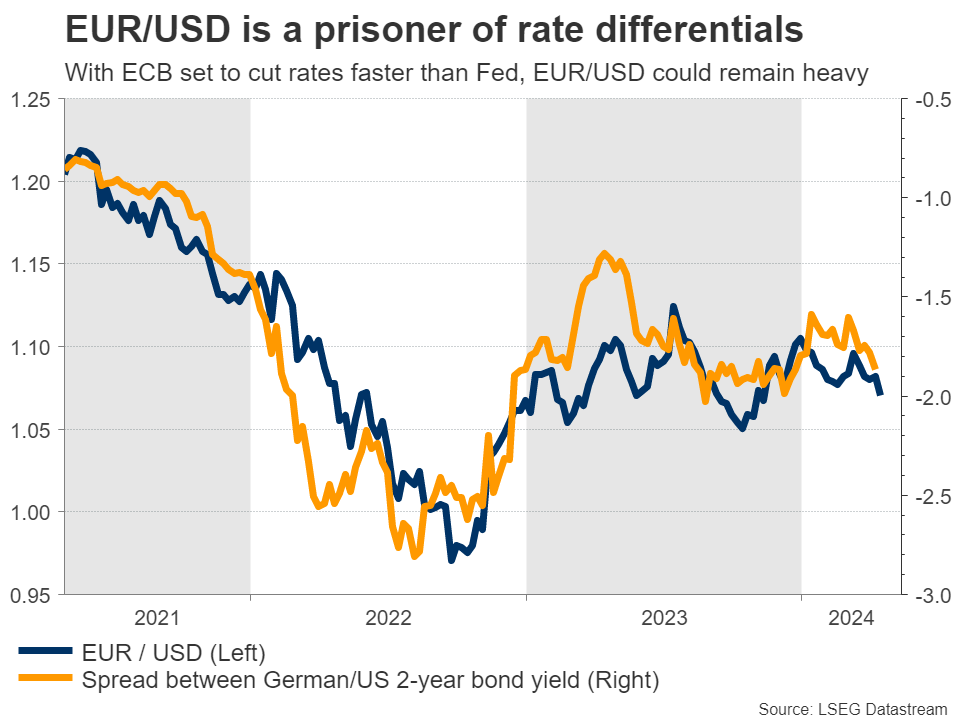

With mounting signs that growth and inflation are not cooling down, traders have continued to unwind bets of Fed rate cuts. Market pricing currently points to less than two cuts for this year, down from six just a few months ago. This sharp Fed repricing has propelled US yields higher, lending strength to the US dollar. Retail sales enjoy Easter boostTurning to the upcoming dataset, retail sales are forecast to have risen by 0.3% on a monthly basis in March, a slowdown from the 0.6% in the previous month but still a solid print overall. It seems that the early Easter holiday pulled forward some spending into March, giving an artificial boost to retail sales, at the expense of April’s print. That said, some early indicators on card spending painted a mixed picture. Bank of America data pointed to a soft month for consumption, whereas Visa’s spending momentum index continued to rise, signaling stronger demand.  Given these conflicting signals, there is some scope for surprises in this dataset. Taking a look at the euro/dollar chart, a stronger-than-expected retail sales print could push the pair even lower, with the next major cluster of support likely to be found near the 1.0515 zone. On the flipside, a disappointment could help euro/dollar correct higher. A potential move back above the 1.0700 region could open the door for further upside extensions towards the 1.0800 area. Dollar outlook remains positiveIn the big picture, the US economy seems stronger than other major regions at this stage, especially Europe. This economic divergence points to a situation where the European Central Bank might cut interest rates faster and deeper than the Fed does, which in turn could keep downside pressure on euro/dollar.

Given these conflicting signals, there is some scope for surprises in this dataset. Taking a look at the euro/dollar chart, a stronger-than-expected retail sales print could push the pair even lower, with the next major cluster of support likely to be found near the 1.0515 zone. On the flipside, a disappointment could help euro/dollar correct higher. A potential move back above the 1.0700 region could open the door for further upside extensions towards the 1.0800 area. Dollar outlook remains positiveIn the big picture, the US economy seems stronger than other major regions at this stage, especially Europe. This economic divergence points to a situation where the European Central Bank might cut interest rates faster and deeper than the Fed does, which in turn could keep downside pressure on euro/dollar.  Still, for the dollar to truly shine, it might also need some assistance from the risk sentiment channel. Given the dollar’s safe haven qualities, a period of risk aversion in the markets could go a long way in helping the reserve currency stage a more fierce rally. Indeed, with stock market valuations being stretched in an environment where US yields are rising, the risk of a correction in equities seems to be growing.

Still, for the dollar to truly shine, it might also need some assistance from the risk sentiment channel. Given the dollar’s safe haven qualities, a period of risk aversion in the markets could go a long way in helping the reserve currency stage a more fierce rally. Indeed, with stock market valuations being stretched in an environment where US yields are rising, the risk of a correction in equities seems to be growing. Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.