Disney to report higher earnings but will its shakeup plan impress? – Stock Markets

Walt Disney will unveil its fiscal Q4 earnings on Wednesday after the closing bell

Cost cutting and price hikes likely boosted earnings per share

But slowing revenue growth and downbeat guidance may weigh on the stock

Trouble at the top

Trouble at the topThe Walt Disney Company (Disney) has been undergoing a significant overhaul this year as returning CEO, Bob Iger, attempts to streamline the flagging business following several years of major acquisitions. There have been further changes at the very top of management too, with the latest being the announcement of a new chief financial officer.

Aside from the multiple challenges facing the business, the management is also battling the activist investor, Nelson Peltz, who just raised his stake in Disney and is demanding multiple seats on the board amid growing shareholder disgruntlement about the direction of the company. The latest earnings results will therefore be crucial in restoring investors’ trust in the management and the future of the company.

ESPN future under scrutiny as Disney+ strugglesEarlier in the year, the company split its ESPN sports network from the rest of the entertainment business, creating a third division, with parks, experiences and products being the other. ESPN has seen its revenue fall in recent quarters, so the move has raised speculation that Disney may be prepping to sell the unit. There is a counter argument against this, though, which is that ESPN remains a cash cow despite the recent revenue decline. Iger insists ESPN is not for sale and he is only looking for strategic partners. Apple is rumoured to be one of the companies interested in a possible stake.

The company’s popular streaming service, Disney+, hasn’t been doing so well either and continues to lose money. The streaming platform lost subscribers in each of the last three quarters after prices were raised last December. Some analysts, however, think that fiscal Q4 was a turning point, with net subscriber numbers growing slightly and this may have helped narrow the losses. The company is hoping that taking full ownership of Hulu – a sister streaming service – will bolster Disney+’s appeal by making content from Hulu available on both platforms.

Revenue boost from price hikesThe only real bright spot is likely to be the parks business where revenue has been surging. But even here the picture is not entirely positive as the record income is mostly being driven by higher prices rather than by growing visitor numbers. Still, the company is investing heavily in this segment and for the time being, the strategy appears to be paying off.

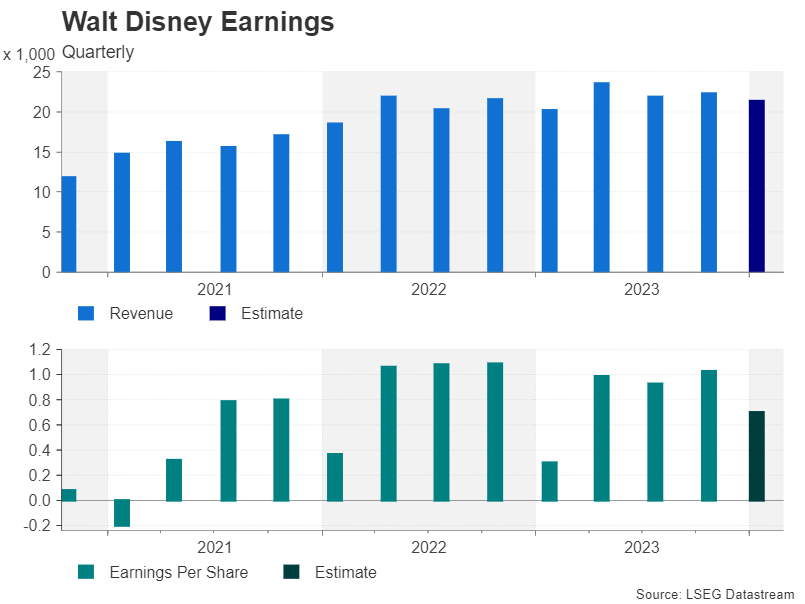

Total revenue in fiscal Q4 is expected to have reached $21.36 billion according to LSEG IBES data, up 6% from the same period a year ago but lower than the $22.33 billion reported in the prior quarter. Earnings per share (EPS), meanwhile, is anticipated at $0.70, representing a 133% jump from 12 months ago but down 32% from fiscal Q3.

All eyes on cost cutting progressWhilst there is plenty of room for disappointment as the company struggles to compete in the streaming arena and is in the midst of a major reorganisation, upside surprises are possible too as Iger implements his $5.5 billion cost-cutting drive, most of which will come from layoffs of up to 7,000 jobs.

That might go some way in explaining why analysts have maintained their ‘buy’ recommendation for the stock during this somewhat difficult period for the entertainment giant, even as the share price has fallen by about 3.3% in the year-to-date. Nevertheless, analysts are sticking to their triple digit price target. The median price target is currently $109.00 – about 30% higher than Monday’s closing price of $84.02 a share.

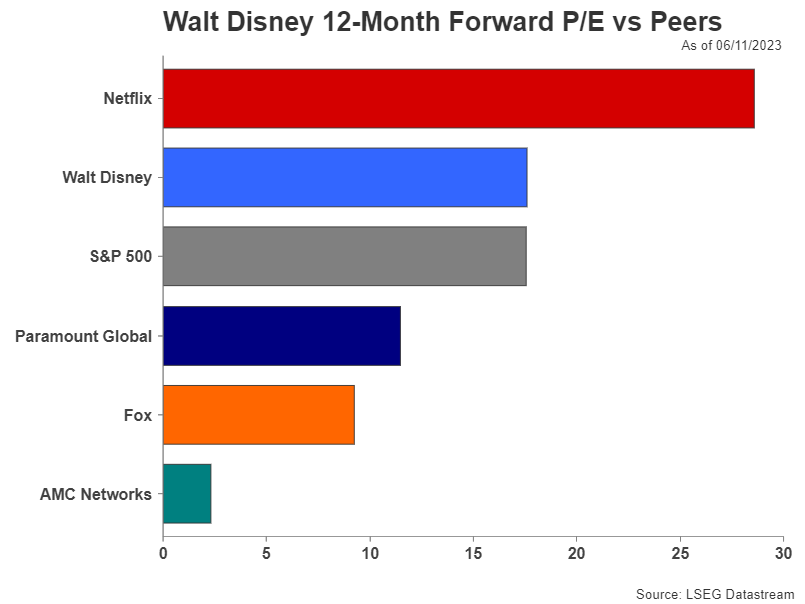

Is a rebound in the stock around the corner?On the positive side, the stock’s complete retracement of its post-pandemic rally when it hit an all-time high of $203.02 in March 2021 has made it more attractive from a valuation perspective. Disney’s forward price-to-earnings (P/E) ratio is below that of its main rival, Netflix, and equal to that of the S&P 500.

Looking ahead, the stock may have just formed a double bottom pattern and appears poised for a rebound. If the latest earnings results provide further evidence that Iger’s turnaround plan is bearing fruit, that may shore up support in the $80 region. However, in the short term, any relief rally may be capped by the 200-day moving average near the $92 level and investors will likely want to see sustained growth in streaming subscribers before taking the price back above $100.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.