Daily Comment – US dollar and stock rally continues

- Euphoria in US assets, stock indices reach new highs

- Today's Fed speakers could threaten Monday’s gains

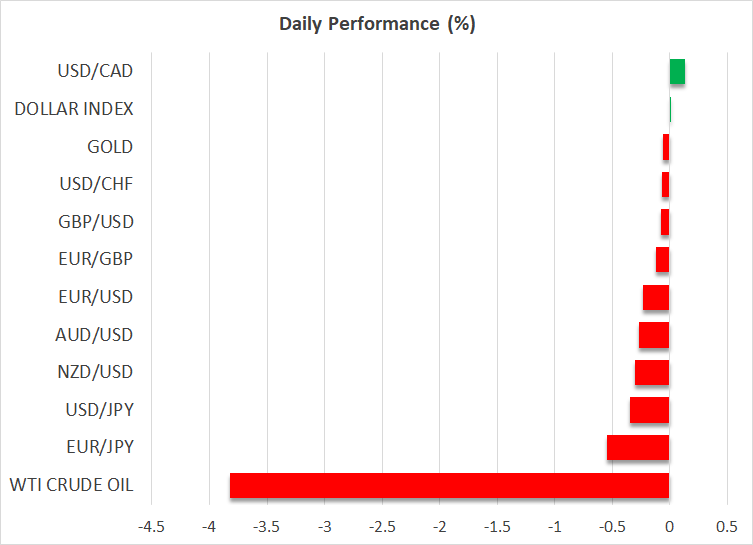

- Oil and gold in the red, bitcoin enjoys a strong boost

- Pound ignores jobs data, awaits Wednesday’s CPI

US stocks and dollar in the green

Both the US dollar and main US equity indices enjoyed another strong session yesterday. Euro/dollar traded at a 45-day low, and both the S&P 500 and the Dow Jones indices recorded new all-time highs despite the Columbus Day bank holiday keeping both the bond market closed and trading volumes below their recent averages. The release of third quarter earnings is already underway, with some big banking names on the list today and Netflix scheduled for Thursday, but the positive figures up to now do not justify the aggressive risk-on reaction.

In the meantime, the daily barrage of attacks between Israel and Iran’s proxies continues despite efforts from the US administration for a ceasefire, which could also boost Harris’ poll ratings. There were some comments from Israeli officials that Iran's nuclear and oil installations won't be targeted, but this doctrine could be quickly abandoned if Israeli losses continue to mount.

Therefore, one of the catalysts for both the dollar’s and stocks’ performance could be the latest Fedspeak. In remarks yesterday, Fed members Kashkari and Waller remained dovish even though the strong jobs market is probably forcing them to take a more relaxed approach regarding the November meeting. Interestingly, Fed board member Waller was quite frank in stating that if inflation unexpectedly rises, the Fed could pause the rate cuts.

Therefore, one of the catalysts for both the dollar’s and stocks’ performance could be the latest Fedspeak

The next CPI report will be published one week after the November 7 Fed meeting, but before that there will be an array of releases that could reveal the current inflation trend. Considering that the Fed expects a pickup in inflation in Q4, the November rate cut might appear more secure, at this stage, than the December one.

Fed members Daly, Kugler and Bostic will be on the wires today. Last week, San Francisco Fed President Daly opened the door to the possibility of no rate cut in November by stating that one or two cuts this year are likely, with Atlanta’s Bostic receiving the assist and openly talking about a November pause. A repeat of these comments from both members won’t shock the market, but it could potentially dent yesterday’s positive sentiment.

Gold and oil drop, bitcoin trying to maintain Monday’s gains

Amidst these developments, gold and oil have retreated somewhat, partly on the back of the dollar's renewed strength. Gold remains a tad below its recent all-time high while oil appears to be giving back a good chunk of its recent sizeable gains. China is partly responsible for the latter as the new support measures are again deemed as insufficient to restart the Chinese economy.

On the flip side, bitcoin rallied aggressively on Monday and tested the late September highs. It is surrendering part of its gains today, but the sentiment in the crypto space has probably changed, despite Minneapolis Fed President Kashkari repeating his aversion for bitcoin. Interestingly, presidential candidate Harris tried yesterday to appease crypto investors by announcing a ‘regulatory framework'. Harris’ plan was light on the details, but since former president Trump is an avid crypto supporter, cryptocurrencies could eventually enjoy a boost regardless of the November 5 winner.

Harris’ plan was light on the details, but since former president Trump is an avid crypto supporter, cryptocurrencies could eventually enjoy a boost regardless of the November 5 winner.

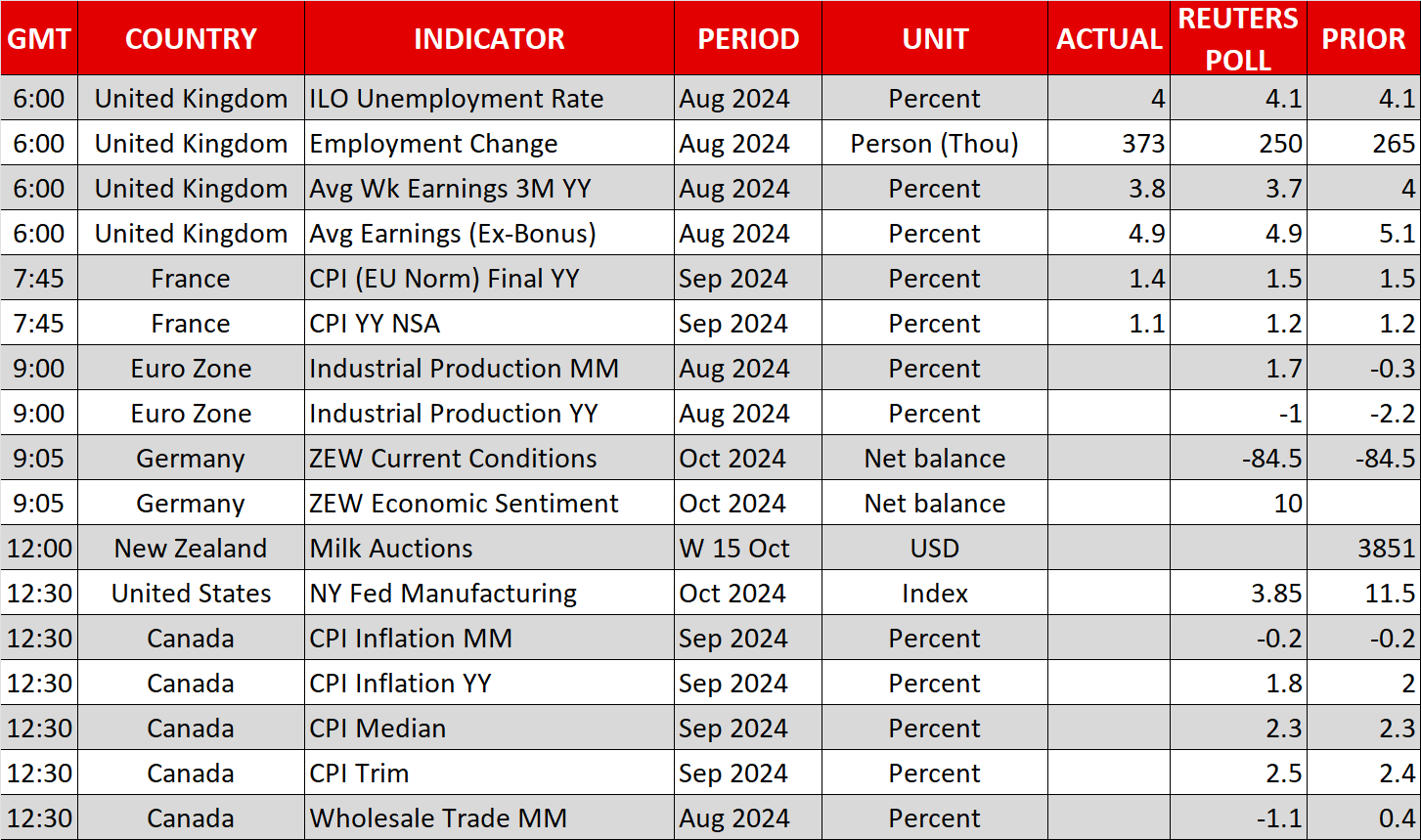

Mixed UK data, pound not impressed

The latest UK labour market data has failed to please the pound as the unemployment rate ticked lower, but the claimant count printed above expectations and the average earnings figures edged a tad lower. Tomorrow’s CPI report remains the decisive release for the November rate cut, which is overwhelmingly priced in by the market.

관련 자산

최신 뉴스

면책조항: XM Group 회사는 체결 전용 서비스와 온라인 거래 플랫폼에 대한 접근을 제공하여, 개인이 웹사이트에서 또는 웹사이트를 통해 이용 가능한 콘텐츠를 보거나 사용할 수 있도록 허용합니다. 이에 대해 변경하거나 확장할 의도는 없습니다. 이러한 접근 및 사용에는 다음 사항이 항상 적용됩니다: (i) 이용 약관, (ii) 위험 경고, (iii) 완전 면책조항. 따라서, 이러한 콘텐츠는 일반적인 정보에 불과합니다. 특히, 온라인 거래 플랫폼의 콘텐츠는 금융 시장에서의 거래에 대한 권유나 제안이 아닙니다. 금융 시장에서의 거래는 자본에 상당한 위험을 수반합니다.

온라인 거래 플랫폼에 공개된 모든 자료는 교육/정보 목적으로만 제공되며, 금융, 투자세 또는 거래 조언 및 권고, 거래 가격 기록, 금융 상품 또는 원치 않는 금융 프로모션의 거래 제안 또는 권유를 포함하지 않으며, 포함해서도 안됩니다.

이 웹사이트에 포함된 모든 의견, 뉴스, 리서치, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크와 같이 XM이 준비하는 콘텐츠 뿐만 아니라, 제3자 콘텐츠는 일반 시장 논평으로서 "현재" 기준으로 제공되며, 투자 조언으로 여겨지지 않습니다. 모든 콘텐츠가 투자 리서치로 해석되는 경우, 투자 리서치의 독립성을 촉진하기 위해 고안된 법적 요건에 따라 콘텐츠가 의도되지 않았으며, 준비되지 않았다는 점을 인지하고 동의해야 합니다. 따라서, 관련 법률 및 규정에 따른 마케팅 커뮤니케이션이라고 간주됩니다. 여기에서 접근할 수 있는 앞서 언급한 정보에 대한 비독립 투자 리서치 및 위험 경고 알림을 읽고, 이해하시기 바랍니다.