Wall Street greets Q3 earnings season with record highs – Stock Markets

- Shares on Wall Street extend record streak as earnings get into full swing

- But trading remains choppy amid elections, geopolitical and earnings risks

Another record high

The S&P 500 notched up its 46th record close of the year on Monday, sealing a positive start to the week as the new earnings season slowly heats up. Initial forecasts for Q3 put the earnings growth rate at 4.1%, but that figure could well rise as 79% of the S&P 500 companies that have reported so far have beaten their earnings per share (EPS) estimates according to FactSet.

However, even if the projections are revised upwards over the course of the season, it’s unlikely they will be able to match the double-digit number of almost 13% for Q2. Nevertheless, investors have been optimistic as they enter this earnings season, with the positive sentiment underpinned by expectations of lower interest rates.

From recession to ‘no landing’

More specifically, it is the subsiding fears of a US recession, or the ‘no landing’ narrative, that is feeding the latest upswing on Wall Street, more than offsetting other worries that investors have cast aside for now. Namely, traders seem to be brushing off the real threat of an all-out war between Israel and Iran that would almost certainly drag Washington into the conflict.

The upcoming US presidential election also doesn’t appear to be at the forefront of investors’ minds and even the prospect of fewer rate cuts by the Fed hasn’t scared off the bulls. With the latter, this behaviour has been observed a few times already over the past year, whereby markets are not too fussed about rate cut expectations being scaled back as long as the American economy is humming along quite nicely.

Valuation concerns

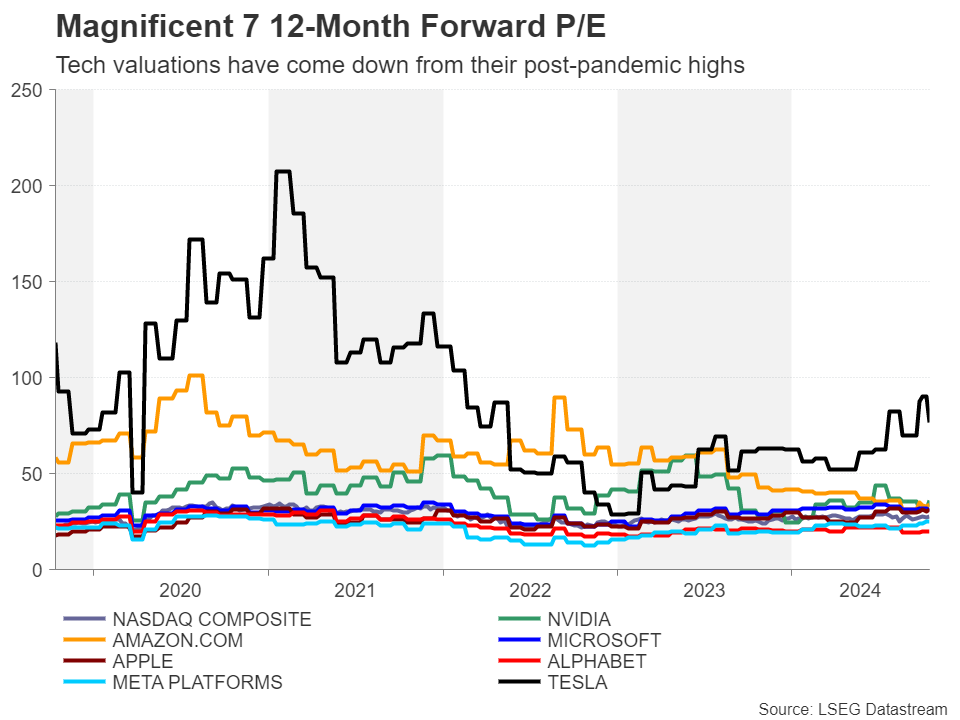

However, the mini selloff on Tuesday was a reminder that the increased volatility since the summer hasn’t completely abated. Whilst there are several risks that could upset the outlook as mentioned above, the bigger danger is that a lot of the valuations seem to be based on the most optimistic scenario rather than the base case.

This may have been the case with chipmakers, whose shares slumped on Tuesday after the Dutch semiconductor giant, ASML Holding, lowered its earnings outlook for 2025, sending the stock crashing by over 15%. There’s a risk that tech firms investing heavily in artificial intelligence (AI) could suffer the same fate if their earnings don’t live up to the high market expectations.

Netflix earnings eyed

Nvidia, which has surged by about 165% in the year-to-date, is the most immune to earnings disappointment as demand for its AI chips is very high and is likely to stay strong for the foreseeable future. Yet, its stock got caught up in this week’s turbulence due to overbought trading conditions.

Netflix also looks set to pass its earnings test when it becomes the first of the Big Tech to report on Thursday. Tesla and Amazon will follow next week.

Banks impress, mostly

Wall Street’s biggest banks have already announced their results, exceeding expectations on most counts. Citigroup, whose results were the least impressive, saw its share price dive by about 5%.

Energy stocks have also not had a good week as investors price out the possibility of an imminent Israeli attack on Iranian oil facilities, weighing on oil futures.

Don’t ignore the elections

Over the next couple of weeks, the US election is likely to become a more prominent theme as the two candidates – Donald Trump and Kamala Harris – remain almost neck and neck in most polls. But contract betting, which has just resumed after a US court ban was lifted, put the odds in favour of Trump.

Earnings will probably become the dominant driver, however, especially as rate cut expectations are unlikely to shift much before the Fed’s November meeting.

Asset collegati

Ultime news

Disclaimer: le entità di XM Group forniscono servizi di sola esecuzione e accesso al nostro servizio di trading online, che permette all'individuo di visualizzare e/o utilizzare i contenuti disponibili sul sito o attraverso di esso; non ha il proposito di modificare o espandere le proprie funzioni, né le modifica o espande. L'accesso e l'utilizzo sono sempre soggetti a: (i) Termini e condizioni; (ii) Avvertenza sui rischi e (iii) Disclaimer completo. Tali contenuti sono perciò forniti a scopo puramente informativo. Nello specifico, ti preghiamo di considerare che i contenuti del nostro servizio di trading online non rappresentano un sollecito né un'offerta ad operare sui mercati finanziari. Il trading su qualsiasi mercato finanziario comporta un notevole livello di rischio per il tuo capitale.

Tutto il materiale pubblicato sul nostro servizio di trading online è unicamente a scopo educativo e informativo, e non contiene (e non dovrebbe essere considerato come contenente) consigli e raccomandazioni di carattere finanziario, di trading o fiscale, né informazioni riguardanti i nostri prezzi di trading, offerte o solleciti riguardanti transazioni che possano coinvolgere strumenti finanziari, oppure promozioni finanziarie da te non richieste.

Tutti i contenuti di terze parti, oltre ai contenuti offerti da XM, siano essi opinioni, news, ricerca, analisi, prezzi, altre informazioni o link a siti di terzi presenti su questo sito, sono forniti "così com'è", e vanno considerati come commenti generali sui mercati; per questo motivo, non possono essere visti come consigli di investimento. Dato che tutti i contenuti sono intesi come ricerche di investimento, devi considerare e accettare che non sono stati preparati né creati seguendo i requisiti normativi pensati per promuovere l'indipendenza delle ricerche di investimento; per questo motivo, questi contenuti devono essere considerati come comunicazioni di marketing in base alle leggi e normative vigenti. Assicurati di avere letto e compreso pienamente la nostra Notifica sulla ricerca di investimento non indipendente e la nostra Informativa sul rischio riguardante le informazioni sopra citate; tali documenti sono consultabili qui.