Daily Comment – Dollar rebounds, loonie tumbles on Trump tariff threats

- Trump vows tariffs on Canada, Mexico and China

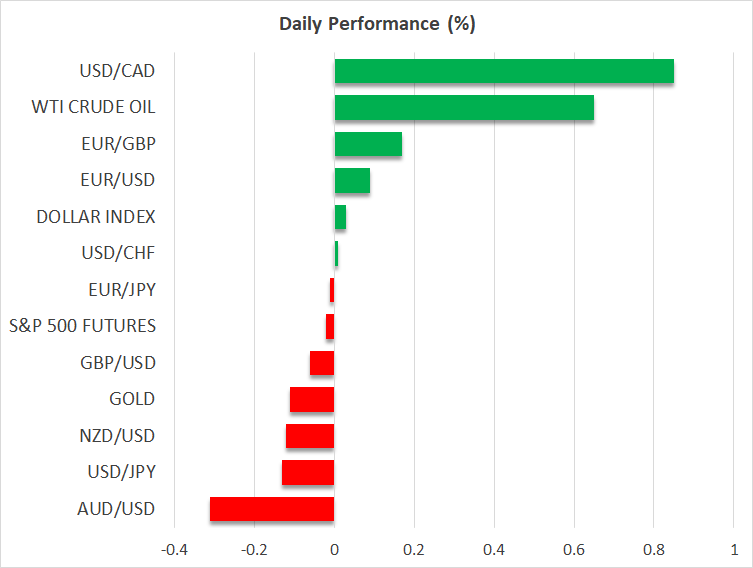

- Dollar gains, loonie tumbles the most among majors

- RBNZ expected to deliver another bold rate cut

- Gold and oil fall on Israel-Hezbollah ceasefire headlines

Trump threatens Canada, Mexico and China with tariffs

The US dollar recharged today after US President-elect Donald Trump said that he will impose a 25% tariff on all imports from Canada and Mexico and that he will charge an additional 10% on Chinese goods.

Among the major currencies, the Canadian dollar took the biggest hit, with the Aussie following suit due to Australia’s close trade ties with China. That said, the Mexican Peso was hurt more than the loonie, which likely suggests that the markets are anticipating more trouble for Mexico.

What’s more, although the extra 10% tariff on Chinese goods does not sound all that scary, Trump has previously threatened to hit the world’s second largest economy with tariffs of more than 60%, which means that investors are likely to stay on the edge of their seats in anticipation of what will actually come through in the end.

Trump’s remarks come just after he nominated fund manager Scott Bessent as Treasury Secretary, whose stance on tariffs was seen as less aggressive than Trump’s, thereby resulting in a pullback in the US dollar and Treasury yields. Perhaps Trump wanted to remind everyone who is in charge and that he is not deviating from what he promised during his pre-election campaign.

Fed pause bets remain elevated ahead of Fed minutes

An aggressive tariff policy could well refuel inflation and that’s why investors continued assigning a strong 45% chance for a rate-cut pause by the Fed at the upcoming gathering on December 18, despite Minneapolis Fed President Neel Kashkari saying that he is open to cutting rates again next month.

The last few years, Kashkari has been on the hawkish end of the Fed’s policy spectrum, and thus, the fact that his remarks did not impact market expectations reveals how focused investors are on what Trump has to say. Therefore, more tariff threats could add more fuel to the dollar’s engines and increase the likelihood of the Fed taking the sidelines at the turn of the year.

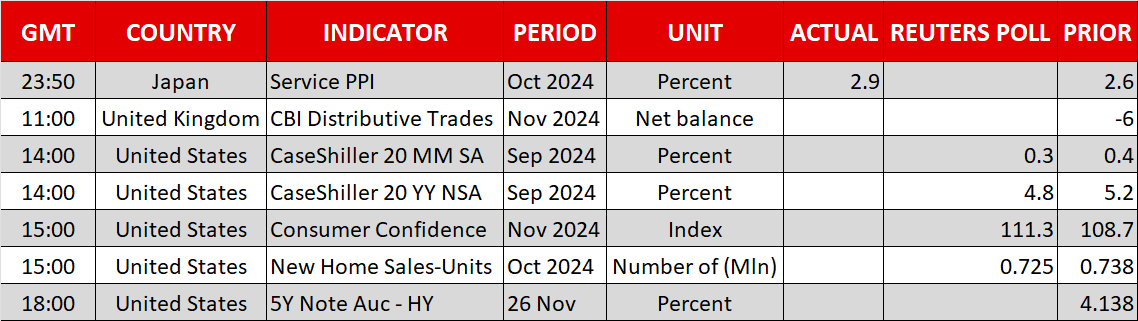

The minutes of the latest FOMC decision are scheduled to be released later today but given that several policymakers have already expressed their opinion more recently, with Chair Powell saying that they are in no rush to lower borrowing costs, the release may be treated as outdated, especially with Trump upping the ante on his tariff rhetoric.

Will the RBNZ deliver a triple rate cut this time?

The kiwi was also hurt by Trump’s remarks, but it quickly recovered its tariff-related losses. Perhaps traders of this currency prefer not to engage in aggressive positioning ahead of the RBNZ decision tonight.

Another bold move is a done deal according to market pricing, with a back-to-back 50bps cut receiving a 60% chance, and a bigger 75bps reduction seen at 40%. This means that another double rate cut could even prove positive for the kiwi as such a decision will disappoint those expecting a bigger one.

Ceasefire headlines hurt gold and oil

Gold and oil prices took a nosedive yesterday on headlines that a ceasefire between Israel and Lebanon’s Hezbollah is expected to be announced within 36 hours. Gold has been the safe haven of choice during periods of escalating geopolitical tensions, while oil has been benefiting from fears of supply shortages. Thus, the ceasefire news resulted in strong counter moves.

That said, it is too early to start examining whether this is the beginning of bigger declines. With regard to gold, there are still tensions between Ukraine and Russia that could allow for some safe-haven demand, while Trump’s tariff policy may prompt China to restart its gold purchases. As for oil, the ceasefire news amid weak global demand is another reason for OPEC and its allies to postpone removing the agreed restrictions on output.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.