With clouds gathering over the UK economy, what’s next for the pound?

BoE policymakers decided to slow their tightening efforts at the August gathering, raising interest rates by 25bps, a smaller hike than July’s half-point increment, with Governor Bailey noting that he didn’t think there was a case for another 50bps hike. This hurt market expectations regarding the BoE’s future course of action and weighed on the pound, which was already struggling against its US counterpart due to data suggesting that the US remains in better shape than other major economies.

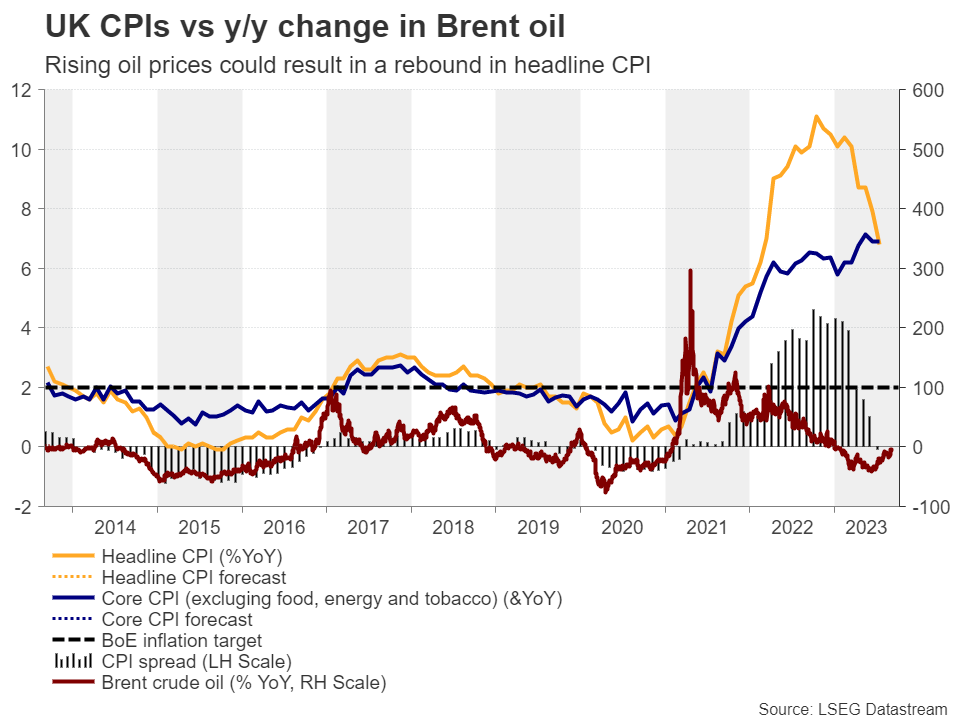

After the decision, GDP data showed that the economy grew somewhat instead of stagnating as the forecast suggested, with industrial and manufacturing production proving much stronger than expected in June. What’s more, despite the economy losing jobs and the unemployment rate rising to 4.2% in June from 4.0%, wages excluding bonuses accelerated by a full percentage point, adding to the already elevated inflation concerns. And as if all this was not enough, the CPI data revealed that the core CPI rate held steady at 6.9% y/y in July, suggesting that the decent slowdown in the headline print was due to volatile items like food and energy. With oil prices extending their recovery during August, a rebound in the headline rate in coming months cannot be ruled out.

Ugly UK PMIs leave the BoE with a dilemma

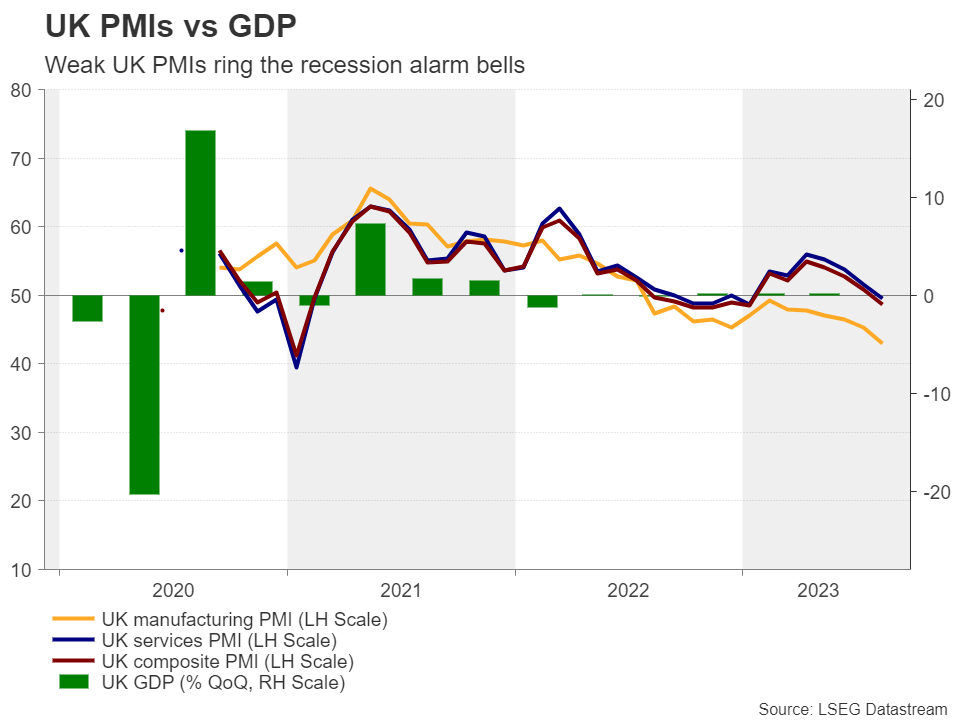

Ugly UK PMIs leave the BoE with a dilemmaAll these numbers suggest that the BoE should stay the course and continue raising rates in order to bring ultra-sticky inflation to heel. However, the PMIs for August painted an ugly picture, with the composite PMI slipping into contractionary territory for the first time since January, heightening recession fears and leaving the BoE with a dilemma: continue raising rates and risk further damaging the economy or take a breather and risk allowing inflation to get out of control?

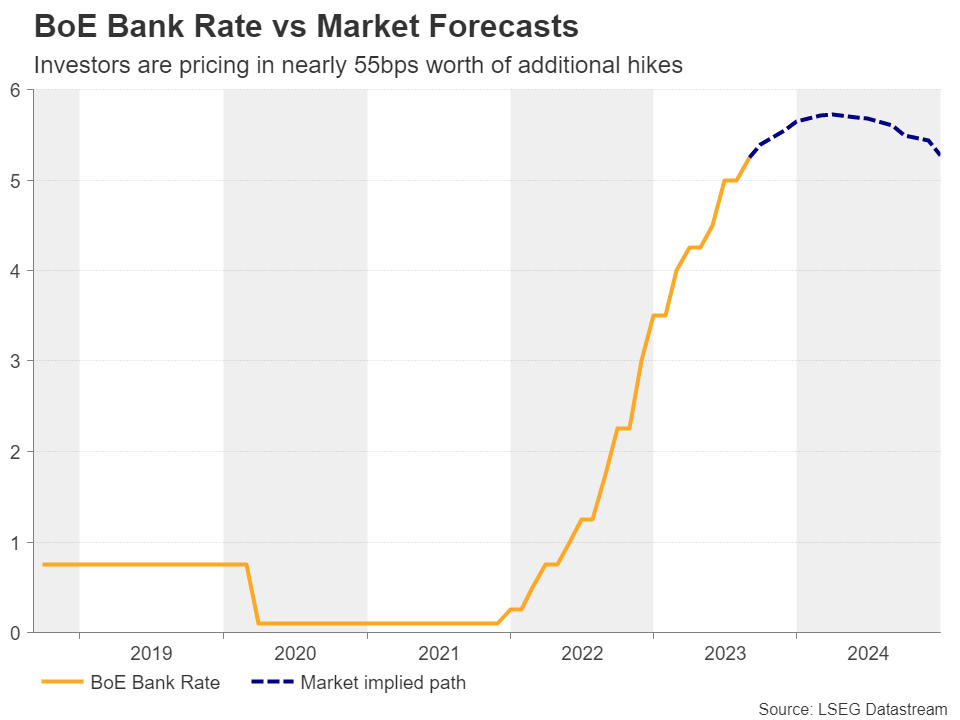

Just last week, remarks by Chief Economist Hew Pill revealed that he is in favor of keeping rates at current levels for longer rather than continuing to raise them and start cutting when they conclude the job is done. In other words, he may be willing to vote to keep interest rates on hold at the upcoming gathering on September 21. Still, the market is assigning an 83% probability for a 25bps hike that gathering, while it is fully pricing in another one by February.

This stands in a sharp contrast to the 55% probability seen for only another quarter point hike by the Fed and yet, the pound is on the back foot against the US dollar, confirming the narrative that traders are turning their gaze to growth dynamics. Despite the latest streak of data pointing to a slowdown in the US, the overall picture still suggests that the world’s largest economy is in a healthier state.

Like the September gatherings of all the major central banks, the BoE’s meeting on September 21 may prove pivotal with regards to the pound’s fate. Even if the Bank decides to press the hike button, if the decision is a close call and/or the decision has a dovish flavor, with hints that the peak of interest rates will be lower than the market currently anticipates, the pound is likely to continue to suffer. The opposite may be true if the Bank highlights the stickiness of inflation and appears ready to do whatever it takes to bring it to heel.

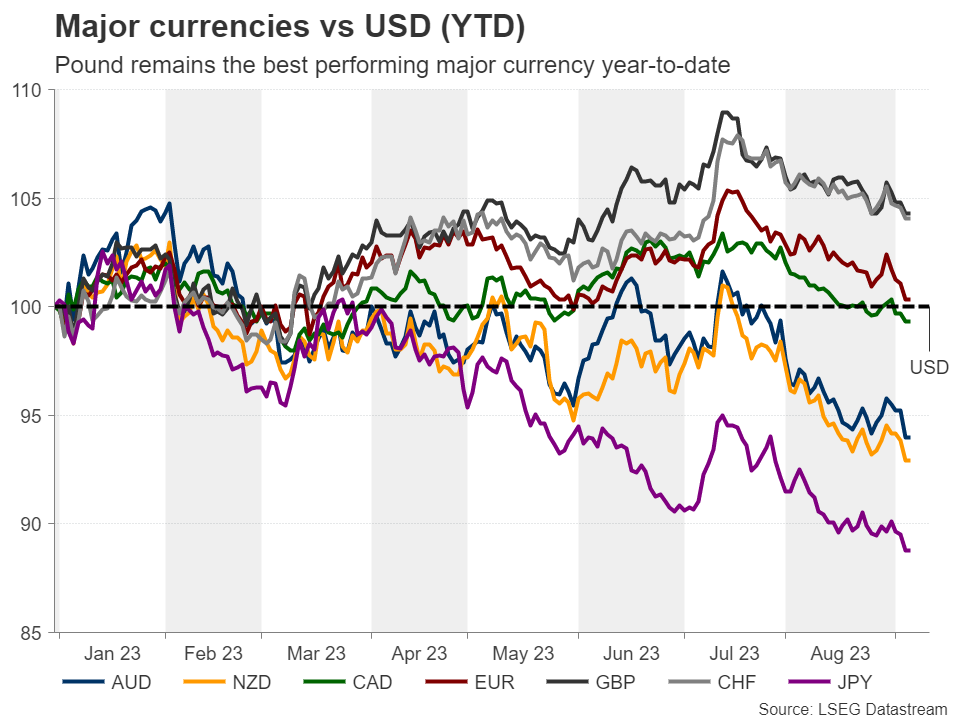

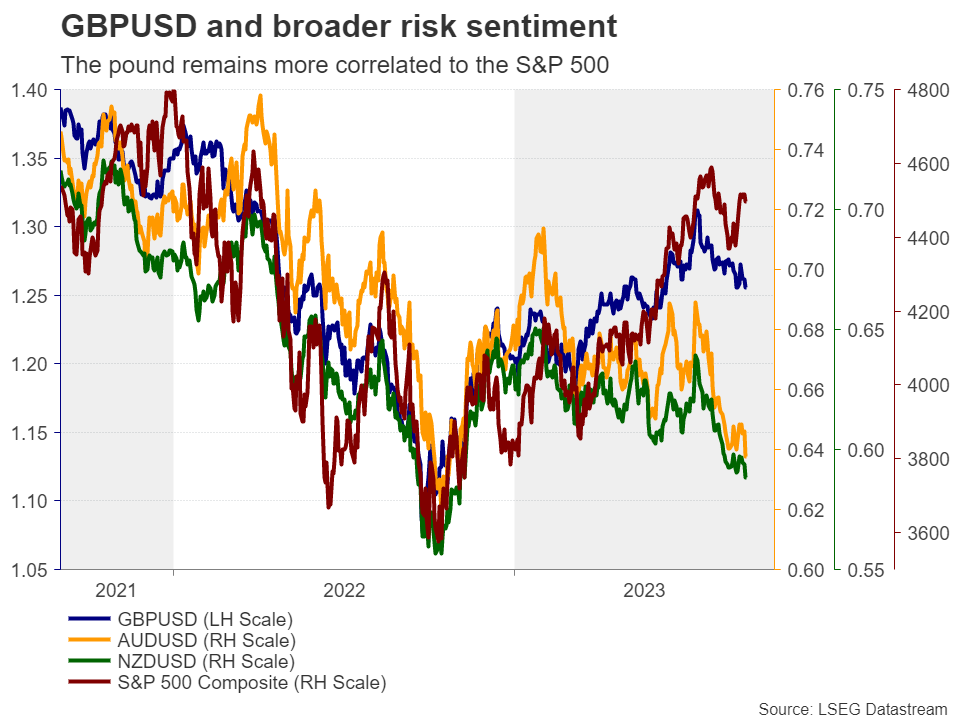

Equities have the pound’s backDespite its latest slide, the pound remains the best performing major currency – almost tied with the franc – since the turn of the year, and it is among the ones that lost the least ground since the US dollar staged a comeback. Apart from the fact that the BoE is still seen delivering more hikes than other major central banks, the pound may be also receiving support from its close correlation to the stock market.

As risk-linked currencies, the aussie and the kiwi also used to have a positive correlation with Wall Street, but due to Australia’s and New Zealand’s strong trade ties with China, these currencies are now better reflecting the concerns surrounding the performance of the world’s second largest economy. Having also in mind that both the RBA and the RBNZ seem to have concluded their tightening cycles, according to market pricing, the pound may be destined to continue outperforming those currencies. In other words, even if sterling suffers for a while longer against the US dollar, the pound/aussie and pound/kiwi pairs may be destined to continue drifting north.

Pound/kiwi pulled back after hitting the 2.1585 barrier, but it continues to trade above the uptrend line drawn from the low of February 2. This points to a positive outlook and should the bulls regain control, they could aim for another test at 2.1585, or the high of March 9, 2020, at 2.1680. A break higher could see scope for advances towards the psychological round number of 2.2000, also marked by the peak of May 26, 2016. For a bearish reversal to start being examined, the pair may need to drop below the key support zone of 2.0910.

Aloqador aktivlar

Eng oxirgi yangiliklar

Javobgarlikdan voz kechish: XM Group korxonalari har biri faqat ijro xizmatlarini koʻrsatadi va onlayn savdo platformamizdan foydalanish huquqini beradi, bu odamga veb-saytda yoki veb-sayt orqali mavjud boʻlgan kontentni koʻrish va/yoki undan foydalanishga ruxsat beradi hamda uni oʻzgartirishga moʻljallanmagan va uni oʻzgartirmaydi yoki kengaytirmaydi. Bunday kirish va foydalanish huquqi doimo quyidagilarga boʻysunadi: (i) Shartlar va qoidalar; (ii) Risklar haqida ogohlantirish; va (iii) Javobgarlikni toʻliq rad etish. Shuning uchun bunday kontent umumiy maʼlumot sifatida taqdim etiladi. Xususan, shuni esda tutingki, bizning onlayn savdo platformamiz mazmuni moliyaviy bozorlarda biror bitimni amalga oshirishga oid maslahat yoki taklif emas. Har qanday moliyaviy bozorda savdo qilish sizning kapitalingiz uchun jiddiy risk darajasini oʻz ichiga oladi.

Onlayn savdo platformamizda chop etilgan barcha materiallar faqat taʼlim/axborot maqsadlari uchun moʻljallangan va unda moliyaviy, investitsiya soligʻi yoki savdo maslahatlari va tavsiyalar; yoki bizning savdo narxlarimizning qaydlari; yoki har qanday moliyaviy vositalar bilan bitim tuzish maslahati yoki taklifi; yoki sizga kerak boʻlmagan moliyaviy reklama aksiyalari hisoblanmaydi

Har qanday uchinchi tomon kontenti, shuningdek XM tomonidan tayyorlangan kontent, masalan: fikrlar, yangiliklar, tadqiqotlar, tahlillar, narxlar va boshqa maʼlumotlar yoki bu veb-saytda joylashgan uchinchi tomon saytlariga havolalar umumiy bozor sharhi sifatida "boricha" taqdim etiladi va investitsiya maslahatini tashkil etmaydi. Har qanday kontent investitsiya tadqiqoti sifatida talqin qilinsa, siz bunday kontentni investitsiya tadqiqotlarining mustaqilligini ragʻbatlantirish uchun moʻljallangan qonun talablariga muvofiq moʻljallanmagan va tayyorlanmaganligini eʼtiborga olishingiz va qabul qilishingiz kerak, shuning uchun unga tegishli qonunlar va qoidalarga muvofiq marketing kommunikatsiyasi sifatida qaraladi. Mustaqil boʻlmagan investitsiya tadqiqoti va yuqoridagi maʼlumotlarga oid risk haqida ogohlantirishimizni oʻqib chiqqaningizga va tushunganingizga ishonch hosil qiling, unga bu yerdan kirish mumkin.