Will Alphabet’s earnings tempt investors to buy more of its stock? – Stock Markets

Alphabet is expected to report a nearly 10% increase in revenue

Despite latest rally, it remains relatively cheap compared to its peers

Results are scheduled to be released on October 24, after closing bell

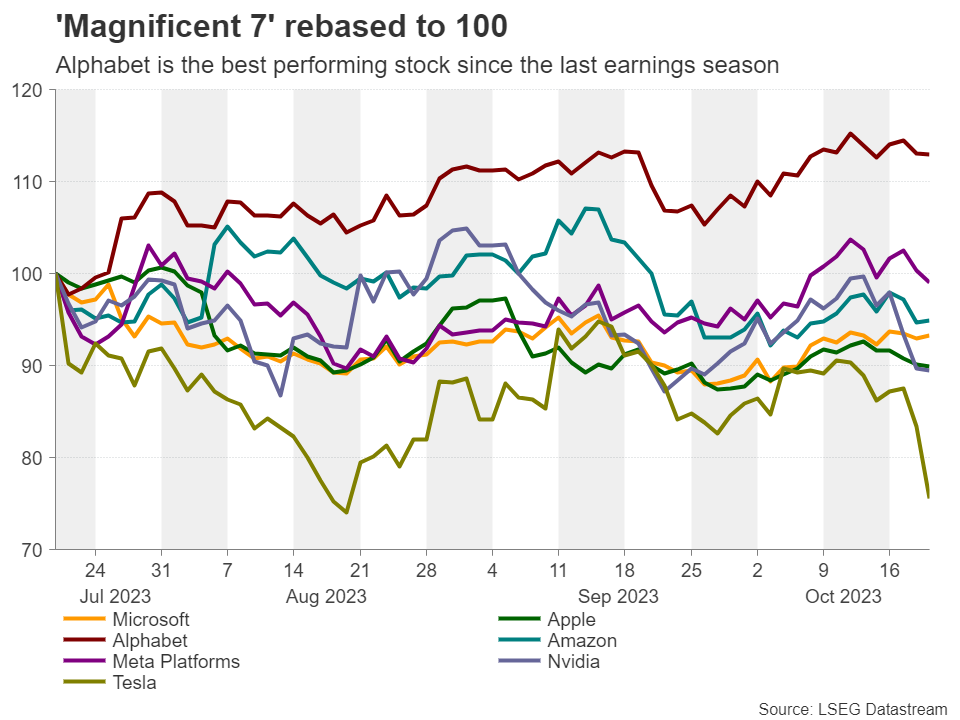

Since the prior earnings season, when Alphabet reported better-than-expected results for Q2, the firm’s shares rose more than 10%, outperforming all the other US mega-cap tech companies of the ‘Magnificent 7’ group.

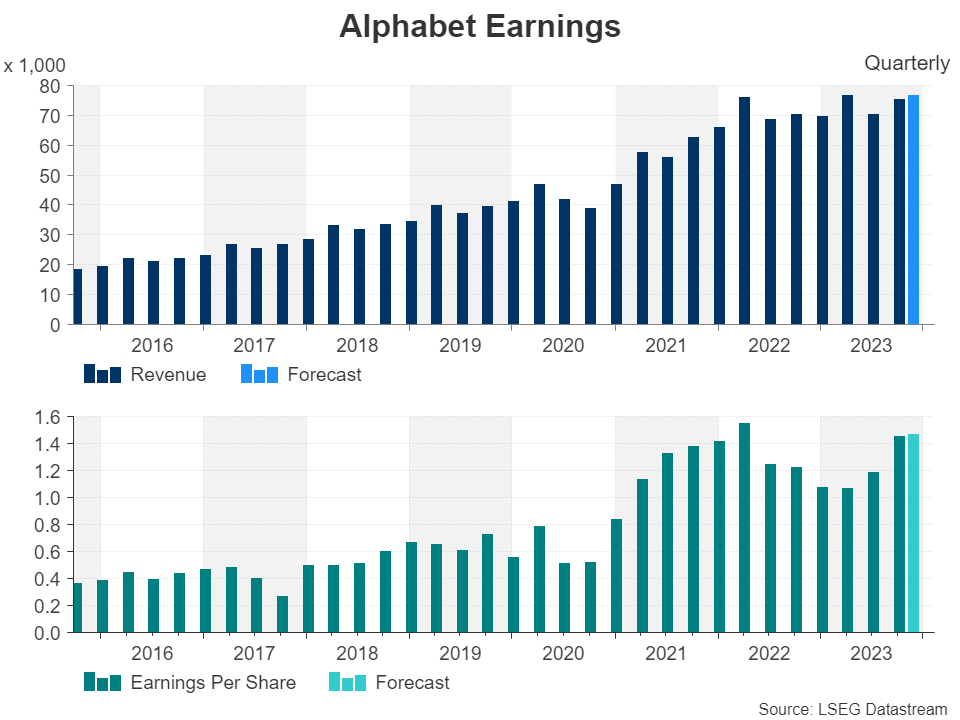

On Tuesday, Google’s parent is forecast to announce earnings per share (EPS) of $1.45 during Q3, which would mark an impressive jump of 36.61% from the same period last year, while revenue is seen growing 9.91% to $75.94bn, which will mark the biggest y/y increase since Q2 2022. It is also worth mentioning that EPS returned to growth only in Q2 this year after six quarters of deterioration.

Back then, the highlights were Google Cloud and YouTube ads, which were the two biggest contributors to the overall revenue growth. Therefore, it would be interesting to see whether momentum continued in Q3.

Advertisement to take center stageWith the Google advertising segment accounting for around 78% of the firm’s revenue, YouTube ads as well as ads on Google’s search engine may play a determinant role on where the stock may be headed next, even if the initial reaction is triggered by any deviations from the EPS and overall revenue projections.

Google search is estimated to have around a 90% share of the search-engine market, and it is not a surprise that the antitrust case against its monopoly has attracted special attention. That said, even with the trials going on, investors expect the advertising sector’s revenue to grow by 6.44% y/y, nearly double the growth rate it posted in Q2.

On top of that, YouTube ads revenue received a boost in Q2 thanks to the offering of Shorts, a streaming service, and Primetime Channels, with the future looking more promising than the past. Yes, advertising may have been more cautious this year due to very high interest rates, and investors may have concerns that an economic slowdown could hinder a potential rebound even if interest rates begin to fall at some point, but the US Presidential elections and the Olympic games could very well offset this uncertainty, as these events have been historically proven to be major drivers in ad spend.

Cloud and AI business also in focusGoogle’s Cloud business grew around 28% in each of the prior quarters of the year, but it is now expected to have slowed to around 26%. Maybe the slowdown was due to higher interest rates weighing on consumption growth. With that in mind, it will be interesting to see whether expectations of rate cuts by the Fed next year will positively impact the firm’s projections of revenue from this service.

Regarding the artificial intelligence (AI) business, Microsoft’s ChatGPT initially appeared to be a major threat to Google’s Search, but Alphabet introduced its own chatbot, named Bard, which appears to be a more personalized service than ChatGPT that is more of a writing content-generating machine. As Bard is able to make personal suggestions, like creating vacation plans or recommending a diet, it could very well help the firm grow its advertising revenue even more.

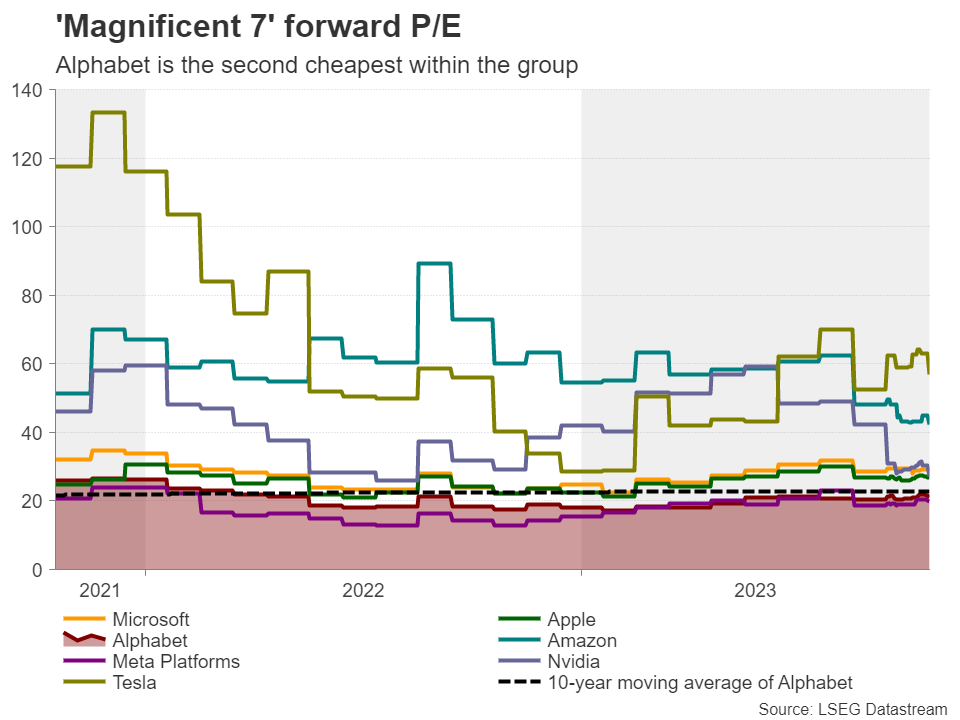

Valuation adds to attractivenessAlthough Alphabet is the best performing stock within the ‘Magnificent 7’ group since the last earnings season, it holds only the fourth place year-to-date, while from a multiples’ perspective, it appears to be the second cheapest, with a forward price-to-earnings ratio (P/E) of 21.4x. This multiple is slightly above the forward P/E ratio of the S&P 500 of 18.3x, but below its own 10-year moving average.

All this adds to the stock’s attractiveness, and even if the EPS or revenue results disappoint, a slide in the share price may be seen by investors as an opportunity to enter the market at more favorable levels.

Will the uptrend continue?From a technical standpoint, Alphabet’s stock entered a consolidation phase after hitting a one-and-a-half year high near the 141.00 zone on October 12. However, it remains in a broader uptrend, as the price structure remains of higher highs and higher lows above the uptrend line drawn from the low of April 26. Thus, even if it corrects lower in the near future, as long as it remains above that line, investors could well jump back into the action and drive the price up for another test near the 141.00 zone, or near 144.00, which is marked by the peak of March 29, 2022.

For the outlook to turn bearish, the stock may need to dive all the way below the 127.50 territory, which provided strong support in August and September, and acted as key resistance in June.

For the outlook to turn bearish, the stock may need to dive all the way below the 127.50 territory, which provided strong support in August and September, and acted as key resistance in June.Aloqador aktivlar

Eng oxirgi yangiliklar

Javobgarlikdan voz kechish: XM Group korxonalari har biri faqat ijro xizmatlarini koʻrsatadi va onlayn savdo platformamizdan foydalanish huquqini beradi, bu odamga veb-saytda yoki veb-sayt orqali mavjud boʻlgan kontentni koʻrish va/yoki undan foydalanishga ruxsat beradi hamda uni oʻzgartirishga moʻljallanmagan va uni oʻzgartirmaydi yoki kengaytirmaydi. Bunday kirish va foydalanish huquqi doimo quyidagilarga boʻysunadi: (i) Shartlar va qoidalar; (ii) Risklar haqida ogohlantirish; va (iii) Javobgarlikni toʻliq rad etish. Shuning uchun bunday kontent umumiy maʼlumot sifatida taqdim etiladi. Xususan, shuni esda tutingki, bizning onlayn savdo platformamiz mazmuni moliyaviy bozorlarda biror bitimni amalga oshirishga oid maslahat yoki taklif emas. Har qanday moliyaviy bozorda savdo qilish sizning kapitalingiz uchun jiddiy risk darajasini oʻz ichiga oladi.

Onlayn savdo platformamizda chop etilgan barcha materiallar faqat taʼlim/axborot maqsadlari uchun moʻljallangan va unda moliyaviy, investitsiya soligʻi yoki savdo maslahatlari va tavsiyalar; yoki bizning savdo narxlarimizning qaydlari; yoki har qanday moliyaviy vositalar bilan bitim tuzish maslahati yoki taklifi; yoki sizga kerak boʻlmagan moliyaviy reklama aksiyalari hisoblanmaydi

Har qanday uchinchi tomon kontenti, shuningdek XM tomonidan tayyorlangan kontent, masalan: fikrlar, yangiliklar, tadqiqotlar, tahlillar, narxlar va boshqa maʼlumotlar yoki bu veb-saytda joylashgan uchinchi tomon saytlariga havolalar umumiy bozor sharhi sifatida "boricha" taqdim etiladi va investitsiya maslahatini tashkil etmaydi. Har qanday kontent investitsiya tadqiqoti sifatida talqin qilinsa, siz bunday kontentni investitsiya tadqiqotlarining mustaqilligini ragʻbatlantirish uchun moʻljallangan qonun talablariga muvofiq moʻljallanmagan va tayyorlanmaganligini eʼtiborga olishingiz va qabul qilishingiz kerak, shuning uchun unga tegishli qonunlar va qoidalarga muvofiq marketing kommunikatsiyasi sifatida qaraladi. Mustaqil boʻlmagan investitsiya tadqiqoti va yuqoridagi maʼlumotlarga oid risk haqida ogohlantirishimizni oʻqib chiqqaningizga va tushunganingizga ishonch hosil qiling, unga bu yerdan kirish mumkin.