Market Comment – Stocks in the green, dollar stable as next batch of US data awaited

Stocks feeling more positive following the US PMI miss

Busy earnings calendar as focus remains on US data prints

Dollar/yen remains a tad below 155 ahead of the BoJ meeting

Aussie benefits from stronger CPI report

Market wants more of the PMI surveys medicine

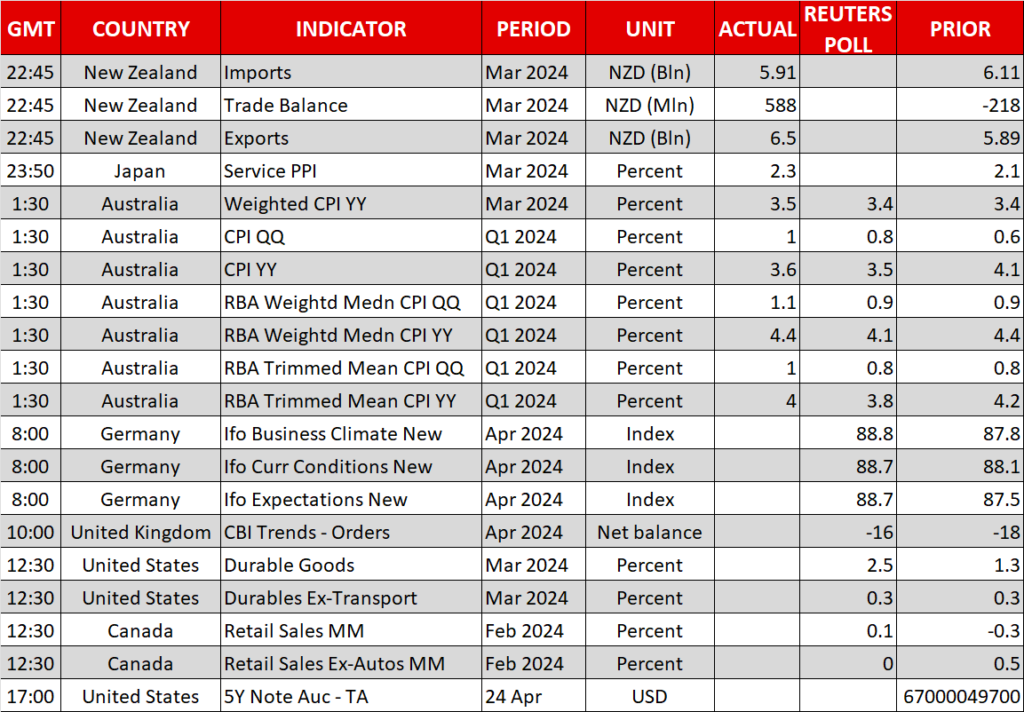

Market wants more of the PMI surveys medicineThe recent US data prints and particularly the mid-April inflation report has clearly alarmed the market of the possibility that the Fed could keep its rates unchanged in 2024. This is quite a shift considering that in January the market was confident that six rate cuts would be announced this year by the Fed.

However, after several difficult days, the US stock market really enjoyed yesterday’s session. The downside surprise by the US PMI surveys changed the market’s momentum with the S&P 500 recording its stronger daily rally since February 22.

The downside surprise by the US PMI surveys changed the market’s momentum with the S&P 500

Weak durable goods orders later today will most likely maintain the positive sentiment in stocks, but the short-term outlook is clearly dependent on Thursday’s preliminary GDP print. While the market acknowledges some upside risk to the current forecast for a 2.4% annualized growth, a stronger print might cause another correction in stocks.

Earnings proving more positive than forecastThe earnings round continues with Meta reporting after the market close today, and both Microsoft and Alphabet announcing their results tomorrow. Tesla published its details for the first quarter of 2024 yesterday and despite announcing worse figures than widely expected, equity investors were in a relatively good mood and pushed the stock higher in after-hours trading. The trigger was Tesla’s plan to launch new models, some of them more affordable than the current offering.

Also yesterday, Visa reported a jump in its revenues on the back of stable consumer spending. This is probably going to alarm the Fed doves as the higher cost of money does not appear to dent consumer appetite and thus still fueling inflation.

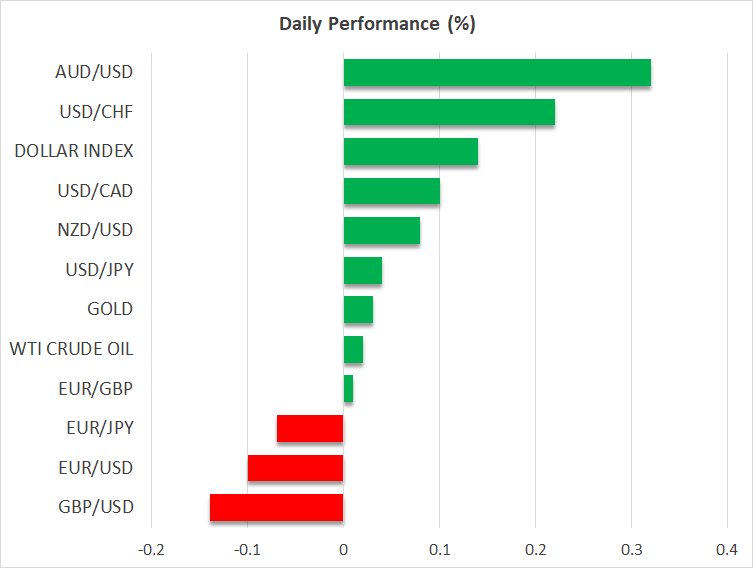

Dollar maintains its recent gainsThe dollar did not enjoy the same positive market momentum with euro/dollar hovering today around the 1.07 level. The stronger euro area preliminary PMI surveys gave a lift to both the euro and European equities, but the momentum could quickly change upon the next weak euro area data print.

In addition, there are increasing noises that the ECB much-touted June rate cut is not exactly set in stone and that the ECB is not exactly ready to embark on an easing spree with the Fed remaining on the sidelines. ECB’s Nagel and Schnabel will be on the wires later today.

Τhere are increasing noises that the ECB much-touted June rate cut is not exactly set in stone

In the meantime, dollar/yen remains a tad below the 155 threshold as the market keeps testing the Japanese authorities’ reaction function. The preliminary PMI surveys yesterday were positive but Friday’s inflation outlook report will play a key role in the BoJ meeting's outcome. The market does not expect another rate hike on Friday.

Aussie rallies on the back of stronger CPIThe Australian inflation report for the first quarter of 2024 surprised on the upside earlier today. The aussie reacted positively to the release by recording the fourth consecutive green session against the US dollar. The RBA was always seen as the least dovish central bank with the market currently assigning zero possibility of a rate cut during 2024.

Aloqador aktivlar

Eng oxirgi yangiliklar

Javobgarlikdan voz kechish: XM Group korxonalari har biri faqat ijro xizmatlarini koʻrsatadi va onlayn savdo platformamizdan foydalanish huquqini beradi, bu odamga veb-saytda yoki veb-sayt orqali mavjud boʻlgan kontentni koʻrish va/yoki undan foydalanishga ruxsat beradi hamda uni oʻzgartirishga moʻljallanmagan va uni oʻzgartirmaydi yoki kengaytirmaydi. Bunday kirish va foydalanish huquqi doimo quyidagilarga boʻysunadi: (i) Shartlar va qoidalar; (ii) Risklar haqida ogohlantirish; va (iii) Javobgarlikni toʻliq rad etish. Shuning uchun bunday kontent umumiy maʼlumot sifatida taqdim etiladi. Xususan, shuni esda tutingki, bizning onlayn savdo platformamiz mazmuni moliyaviy bozorlarda biror bitimni amalga oshirishga oid maslahat yoki taklif emas. Har qanday moliyaviy bozorda savdo qilish sizning kapitalingiz uchun jiddiy risk darajasini oʻz ichiga oladi.

Onlayn savdo platformamizda chop etilgan barcha materiallar faqat taʼlim/axborot maqsadlari uchun moʻljallangan va unda moliyaviy, investitsiya soligʻi yoki savdo maslahatlari va tavsiyalar; yoki bizning savdo narxlarimizning qaydlari; yoki har qanday moliyaviy vositalar bilan bitim tuzish maslahati yoki taklifi; yoki sizga kerak boʻlmagan moliyaviy reklama aksiyalari hisoblanmaydi

Har qanday uchinchi tomon kontenti, shuningdek XM tomonidan tayyorlangan kontent, masalan: fikrlar, yangiliklar, tadqiqotlar, tahlillar, narxlar va boshqa maʼlumotlar yoki bu veb-saytda joylashgan uchinchi tomon saytlariga havolalar umumiy bozor sharhi sifatida "boricha" taqdim etiladi va investitsiya maslahatini tashkil etmaydi. Har qanday kontent investitsiya tadqiqoti sifatida talqin qilinsa, siz bunday kontentni investitsiya tadqiqotlarining mustaqilligini ragʻbatlantirish uchun moʻljallangan qonun talablariga muvofiq moʻljallanmagan va tayyorlanmaganligini eʼtiborga olishingiz va qabul qilishingiz kerak, shuning uchun unga tegishli qonunlar va qoidalarga muvofiq marketing kommunikatsiyasi sifatida qaraladi. Mustaqil boʻlmagan investitsiya tadqiqoti va yuqoridagi maʼlumotlarga oid risk haqida ogohlantirishimizni oʻqib chiqqaningizga va tushunganingizga ishonch hosil qiling, unga bu yerdan kirish mumkin.