Banks Q1 earnings: Weak results despite stock outperformance – Stock Markets

US banks kick off Q1 earnings on Friday before opening bell

Earnings set to drop despite the robust US economy

Valuation multiples rise but remain historically cheap

Solid quarter due to Fed repricing

The banking sector started the year on the wrong foot as expectations of six rate cuts by the Fed had delivered a strong hit to their net interest margin outlook. This metric is essentially the difference between the interest income generated by long-term assets such as loans and the interest expense paid to short-term liabilities such as deposits.

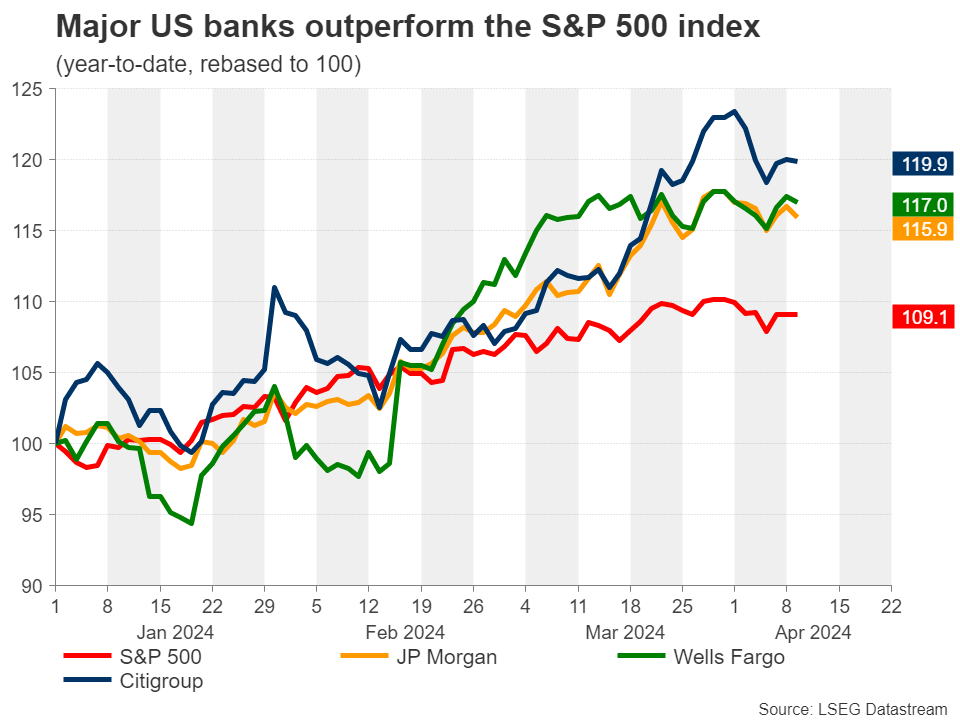

However, a barrage of upbeat macro US data prompted markets to dial back interest rate cut projections, with current market pricing implying a little less than three rate cuts in 2024. In turn, investors became more confident that the banks could preserve their wide net interest margins, which led to their stocks outperforming the S&P 500 index in 2024.

Focus on interest rates and economy

Moving forward, the interest rate trajectory as well as the health of the US economy will play a huge role on banks’ performance. For now, a strong economy has kept loan growth at considerable levels, while preventing a rise in non-performing loans.

Nevertheless, the repricing around Fed expectations has raised concerns for banks. Financial institutions are currently sitting on a pile of unrealised losses in their bond portfolios, and a forced liquidation in case of an exogenous event or a systemic crisis could result in enormous losses. Moreover, high interest rates continue to restrict dealmaking activity and put stress on risk-sensitive sectors such as real estate, in which investment banks have significant exposure.

But in any case, annual comparisons on net interest margin figures are going to be tough from now given that the Fed is on track to begin its rate cutting cycle sooner or later. Therefore, banks would like to see this weakness being offset by a rebound in M&A and dealmaking activities.

JP Morgan retains crown

JP Morgan was the best performing bank in 2023, recording the biggest annual profit in US banking history. Despite its relative outperformance against the other two examined financial institutions, JP Morgan is expected to show some signs of weakness in this earnings season.

Specifically, earnings per share (EPS) of the banking behemoth are estimated to have taken a hit for a second successive quarter, dropping 3.91% from a year ago to $4.15, according to consensus estimates by LSEG IBES. However, the bank is anticipated to record revenue of $41.83 billion, which would represent a year-on-year increase of 6.36%.

Wells Fargo set for a bad quarter

For Wells Fargo, the fundamental picture does not look that great. The bank is set to experience a deterioration in both its revenue and EPS figures, mainly driven by a narrowing net interest margin.

The bank is on track for a 2.54% annual decline in its revenue, which could reach $20.20 billion. Meanwhile, EPS is forecast to fall from $1.23 in the same quarter last year to $1.09, marking an 11.48% drop.

Citigroup’s major restructuring yet to provide results

Citigroup will face another tough earnings season despite its stock outperformance since the beginning of the year. The main reason behind this weakness is that its costly restructuring has not come to fruition yet.

The major investment bank is set to post an annual revenue drop of 4.92% to $20.39 billion. Moreover, its EPS is projected at $1.20, a whopping 35.50% decrease relative to the same quarter last year.

Discount in valuations persists

Although bank stocks have rallied hard since the beginning of the year, their valuations remain relatively subdued. Banks have not yet reached their pre-pandemic multiples even in a period of elevated interest rates, which is considered beneficial for financial institutions. At the same time, the S&P 500 is trading at 21 times forward earnings, way above its historical averages.

That said, the risks seem asymmetric at current levels as there might not be much downside even if we get a major negative surprise in upcoming earnings reports, considering how cheap valuations are.

Aloqador aktivlar

Eng oxirgi yangiliklar

Javobgarlikdan voz kechish: XM Group korxonalari har biri faqat ijro xizmatlarini koʻrsatadi va onlayn savdo platformamizdan foydalanish huquqini beradi, bu odamga veb-saytda yoki veb-sayt orqali mavjud boʻlgan kontentni koʻrish va/yoki undan foydalanishga ruxsat beradi hamda uni oʻzgartirishga moʻljallanmagan va uni oʻzgartirmaydi yoki kengaytirmaydi. Bunday kirish va foydalanish huquqi doimo quyidagilarga boʻysunadi: (i) Shartlar va qoidalar; (ii) Risklar haqida ogohlantirish; va (iii) Javobgarlikni toʻliq rad etish. Shuning uchun bunday kontent umumiy maʼlumot sifatida taqdim etiladi. Xususan, shuni esda tutingki, bizning onlayn savdo platformamiz mazmuni moliyaviy bozorlarda biror bitimni amalga oshirishga oid maslahat yoki taklif emas. Har qanday moliyaviy bozorda savdo qilish sizning kapitalingiz uchun jiddiy risk darajasini oʻz ichiga oladi.

Onlayn savdo platformamizda chop etilgan barcha materiallar faqat taʼlim/axborot maqsadlari uchun moʻljallangan va unda moliyaviy, investitsiya soligʻi yoki savdo maslahatlari va tavsiyalar; yoki bizning savdo narxlarimizning qaydlari; yoki har qanday moliyaviy vositalar bilan bitim tuzish maslahati yoki taklifi; yoki sizga kerak boʻlmagan moliyaviy reklama aksiyalari hisoblanmaydi

Har qanday uchinchi tomon kontenti, shuningdek XM tomonidan tayyorlangan kontent, masalan: fikrlar, yangiliklar, tadqiqotlar, tahlillar, narxlar va boshqa maʼlumotlar yoki bu veb-saytda joylashgan uchinchi tomon saytlariga havolalar umumiy bozor sharhi sifatida "boricha" taqdim etiladi va investitsiya maslahatini tashkil etmaydi. Har qanday kontent investitsiya tadqiqoti sifatida talqin qilinsa, siz bunday kontentni investitsiya tadqiqotlarining mustaqilligini ragʻbatlantirish uchun moʻljallangan qonun talablariga muvofiq moʻljallanmagan va tayyorlanmaganligini eʼtiborga olishingiz va qabul qilishingiz kerak, shuning uchun unga tegishli qonunlar va qoidalarga muvofiq marketing kommunikatsiyasi sifatida qaraladi. Mustaqil boʻlmagan investitsiya tadqiqoti va yuqoridagi maʼlumotlarga oid risk haqida ogohlantirishimizni oʻqib chiqqaningizga va tushunganingizga ishonch hosil qiling, unga bu yerdan kirish mumkin.