Will the BoC hit the hike button again? – Forex News Preview

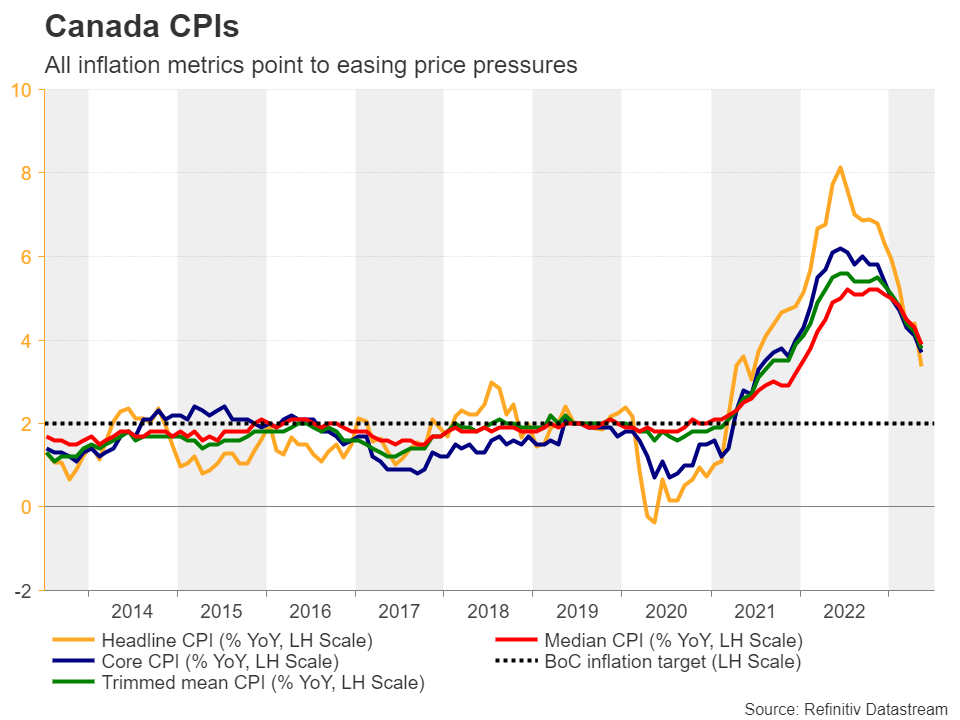

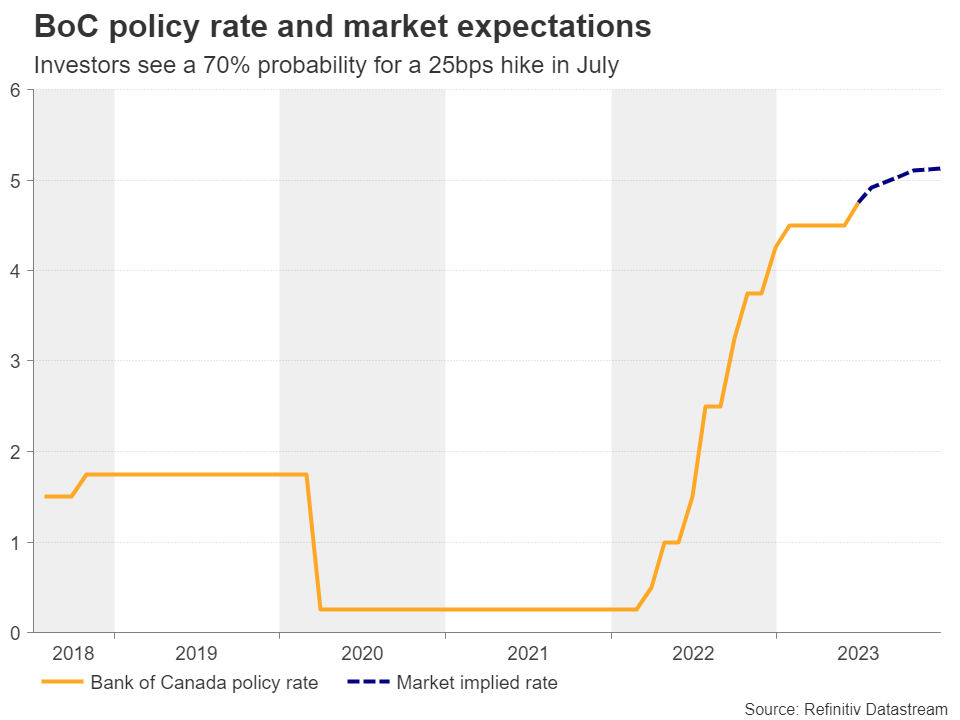

At its June meeting, the BoC decided to raise its target for the overnight rate to 4.75%, ending a pause period that began in January. In the accompanying statement, officials noted that although headline inflation is globally coming down due to lower energy prices, underlying inflation remains stubbornly high, adding that they will continue to evaluate whether the inflation dynamics are consistent with achieving their objective.

Since then, the employment report for May revealed that the economy lost jobs, driving the unemployment rate up to 5.2% from 5.0%, while the CPIs for the same period revealed a larger-than-expected slowdown in both headline and core terms. Specifically, the headline CPI rate fell a full percentage point, to 3.4% year-on-year from 4.4%, and the core one dropped to 3.7% y/y from 4.1%. On the other hand, though, retail sales for April grew much more than expected, pointing towards upside risks to consumer prices in the months ahead.

These releases led to confusion among investors, who ahead of Friday’s employment report for June, were split on whether Canadian policymakers should hit the hike button for a second time in a row this week.

Friday’s jobs data tilt the scale towards a hikeThat said, Friday’s jobs data revealed that the economy gained triple the expected jobs in June and that although the unemployment rate rose further to 5.4%, the participation rate increased as well. In other words, the rise in the unemployment rate may have been because more economically inactive people were willing to register and start actively looking for a job.

This shifted the scale towards another hike on Wednesday, with the market now assigning a 70% probability for a rate increase and 30% for no action at all. As for the rest of the year, investors are nearly split on whether another quarter-point hike is needed by December.

Statement and new projections to enter the spotlight

Statement and new projections to enter the spotlightHaving all that in mind, a 25bps hike on Wednesday could help the loonie gain initially but not much as this is a largely expected decision. If policymakers do push the hike button, the attention is likely to quickly turn to the accompanying statement and the quarterly monetary policy report, which includes updated macroeconomic projections.

The April report revealed that inflation is likely to return to the Bank’s 2% objective at the end of 2024, but that was before the larger-than-expected slowdown in May. Therefore, if there are downside revisions to the inflation outlook and the Bank does not clearly signal the need for additional hikes, investors are likely to scale back their bets about another hike by year end.

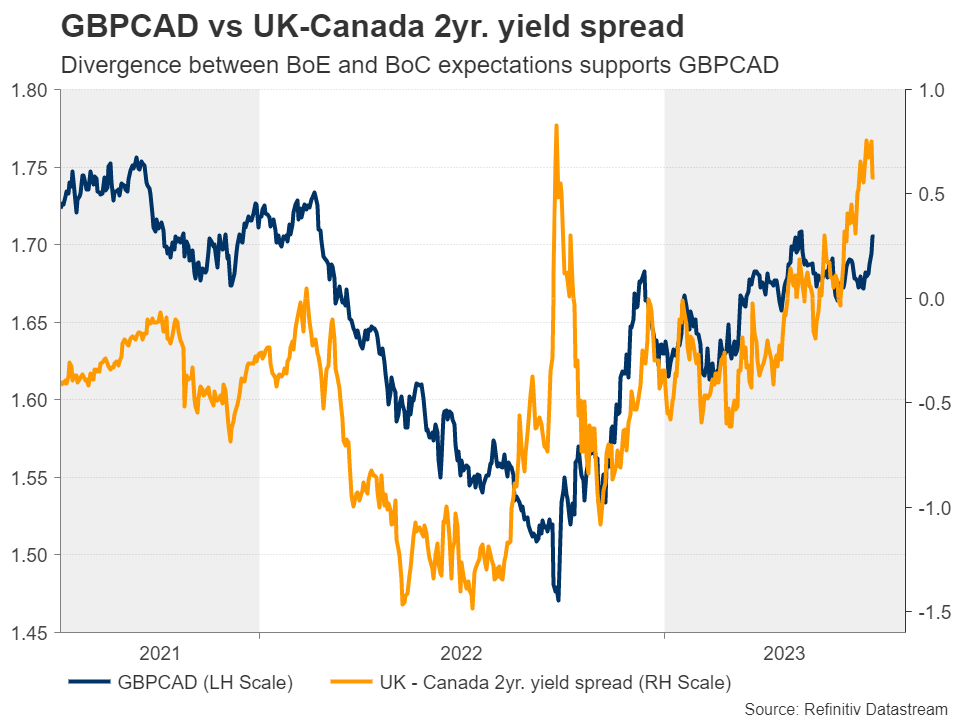

A dovish hike could hurt the loonieThis would add a dovish flavor to a potential hike and may work against the Canadian dollar. Specifically, the loonie may weaken the most against the pound, which has been benefiting from expectations that the BoE will deliver another 140bps worth of hikes before it signals the end of its own tightening crusade. For the loonie to enjoy sustained gains, the BoC may need to raise rates now and clearly telegraph that more hikes are looming.

Pound/loonie trades in uptrend mode

Pound/loonie trades in uptrend modeThe pound/loonie pair moved higher last week, overcoming the 1.6970 barrier, but staying below the peak of May 4 at 1.7150, which is also the highest point since February 25. Overall, the price structure suggests that the pair has been trading in an uptrend since September, but one that has been losing momentum recently.

A trend continuation could be signaled upon a break above 1.7150, a move that would confirm a higher high on the daily chart and perhaps pave the way towards the high of February 21, 2022, at around 1.7370, the break of which could extend the pair’s gains towards the 1.7600 territory, which acted as a ceiling between April 20 and September 20, 2021.

For the outlook to turn bearish, pound/loonie may need to fall below the 1.6525 zone, which currently coincides with the 200-day exponential moving average. Such a dip may allow declines towards the 1.6230 zone, marked by the low of March 2, or the 1.6075 territory, which offered support between February 7 and 16.免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。