Will Australia’s labor data tempt the RBA to hike again? – Forex News Preview

At its latest gathering, the RBA raised interest rates by 25bps, stunning investors who were expecting officials to stay sidelined for the second time in a row. Policymakers decided to hike due to stubbornly high services inflation and faster-than-expected rental increases, adding that more hikes may be required depending on how the economy and the inflation outlook evolve.

In the minutes of that meeting, released today, it was revealed that board members were considering staying sidelined for another month, but the inflation risks convinced them that a hike was a more appropriate decision.

Having said all that though, despite officials saying that more hikes may be required, and despite Australia’s consumer prices increasing 6.3% year-on-year in March, market participants are currently assigning an 87% probability for no change at the upcoming meeting in June, with the remaining 13% pointing to another quarter-point hike.

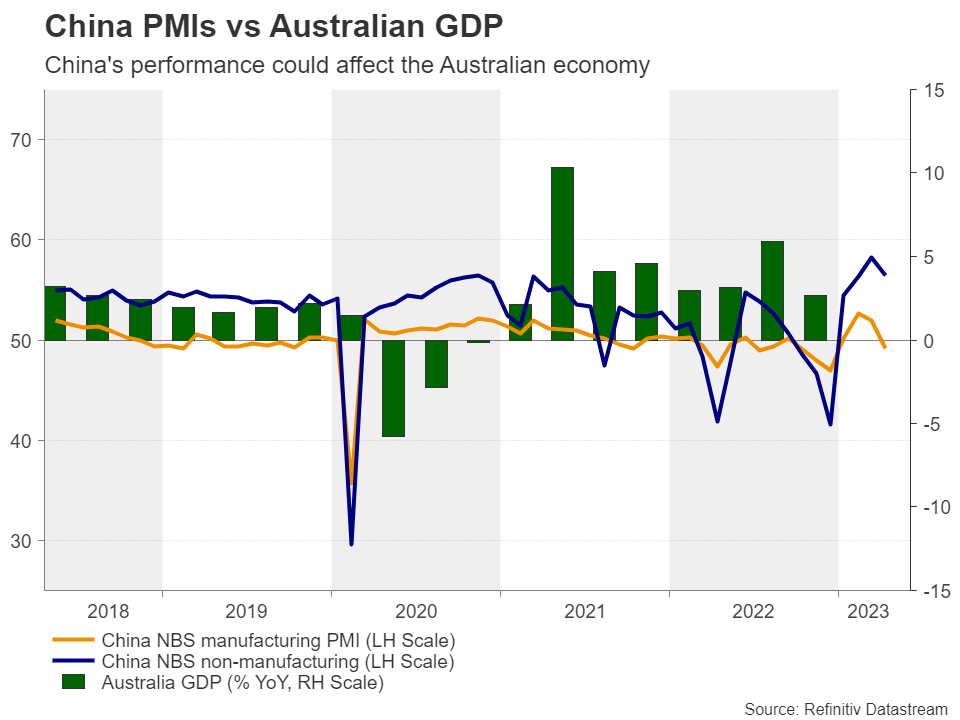

Perhaps that’s due to inflation being in a downtrend since December, when it hit 8.4% y/y, and due to Chinese data suggesting that after the post-reopening boost, the world’s second largest economy and Australia’s main trading partner is losing momentum.

Will the jobs data increase the chances of another hike?

Will the jobs data increase the chances of another hike?Beyond June, investors are pricing in around a 30% chance for a quarter-point hike in July, while they are evenly split for August and September. So, as they try to better understand how the RBA could proceed later this year, they may pay attention to the wage price index for Q1 and the employment report for April, due out during the Asian sessions Wednesday and Thursday, respectively.

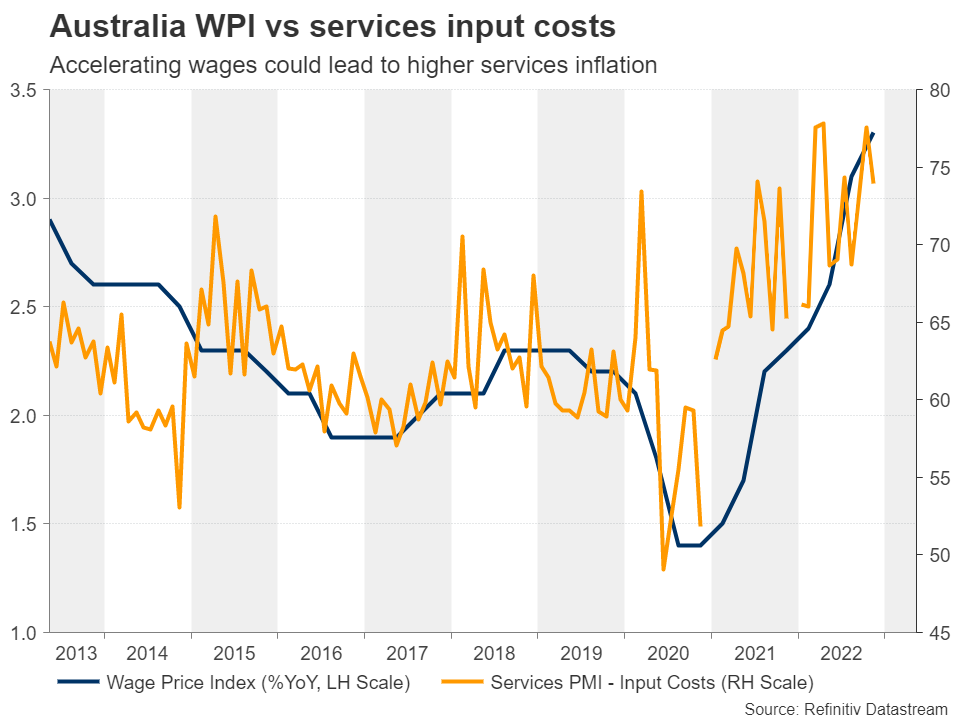

Wages are forecast to have continued to accelerate for the 9th consecutive quarter, which could add to concerns about inflation staying elevated, and although the employment change is expected to show that the economy added less than half the jobs it gained in March, the unemployment rate is seen holding steady at 3.5%, just a tick above its record low of 3.4%.

A tight labor market and rising wage growth, which according to the S&P Global services PMI, is contributing to accelerating price pressures for firms in Australia, could prompt investors to price in a higher probability for a hike during the summer months.

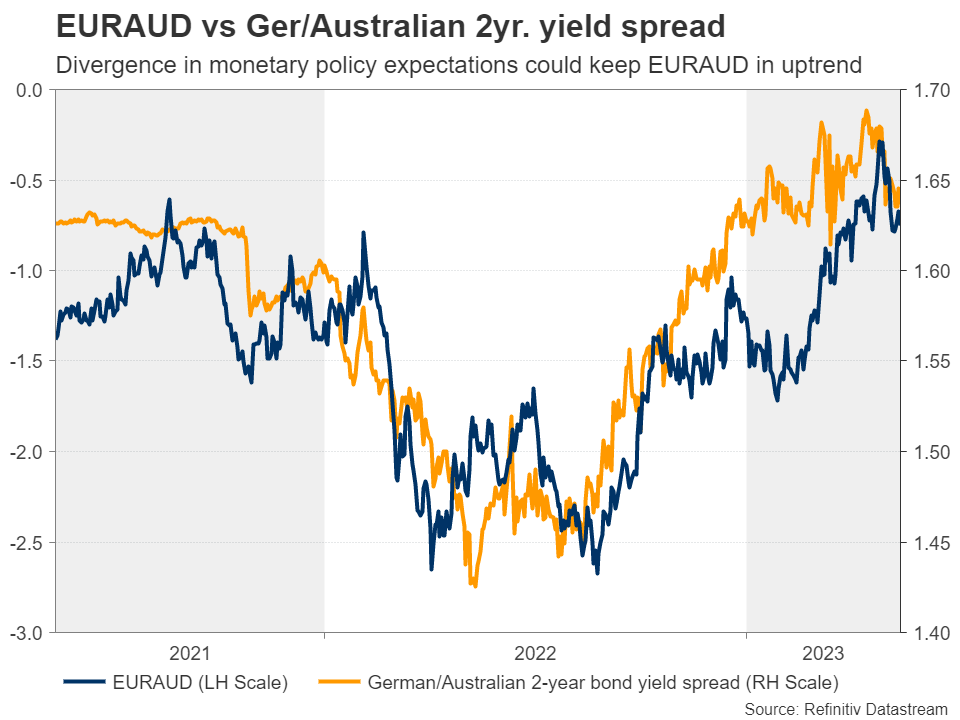

Aussie may be destined to stay weak for a while longerThis could prove positive for the Australian dollar, but its upside may be capped by market participants’ concerns over the outlook of the Chinese economy. With the Fed expected to proceed with nearly three quarter-point cuts by the end of the year, the picture in ausie/dollar may not be so clear, but with the ECB seen hiking by another 50bps, euro/aussie may be destined to continue its uptrend for a while longer, even if the Australian currency temporarily benefits by this week’s data.

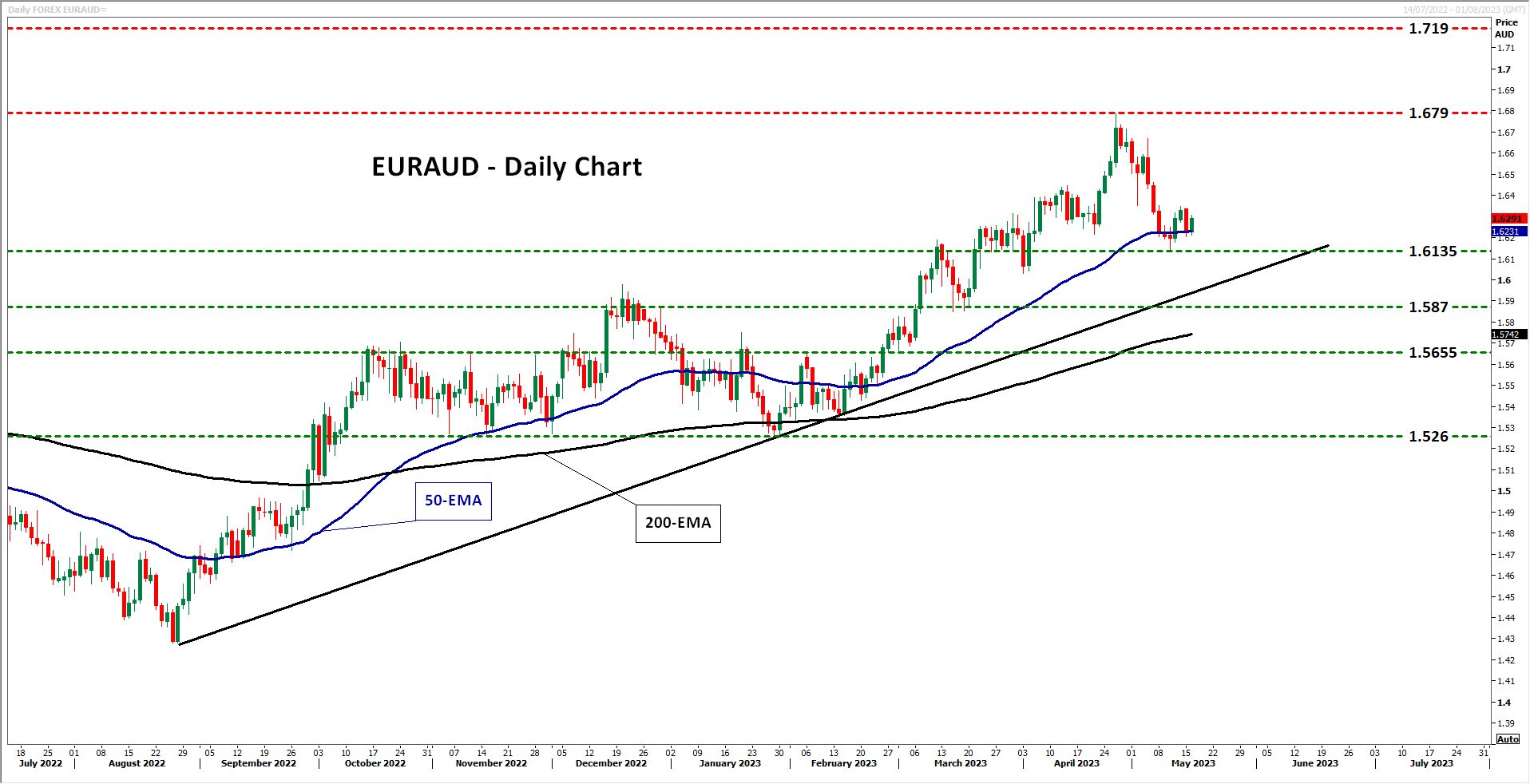

Euro/aussie has been in a sliding mode since April 26, when it hit resistance at 1.6790, a territory that threw the bulls out of the game back in October 2020 as well. Nonetheless, the pair remains above the uptrend line drawn from the low of August 26, which keeps the bigger picture positive.

Even if the slide extends beyond last week’s low of 1.6135, the buyers could still step back into the action from near the uptrend line and perhaps stage another march towards the 1.6790 zone. If they manage to break that zone, they could then put the 1.7190 area on their radar, which offered resistance back in early May 2020.

The outlook could start darkening if the bears are able to break the aforementioned uptrend line, but also the 1.5870 support. Should this happen, they may get encouraged to dive towards the 1.5655 territory, marked by the inside swing high of February 6, the break of which could see scope for extensions towards the 1.5260 area, which acted as a floor between November 4 and January 30.免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。