Market Comment – Fed’s Waller fuels the dollar, yen intervention warnings intensify

Fed Gov. Waller says no rush to lower rates

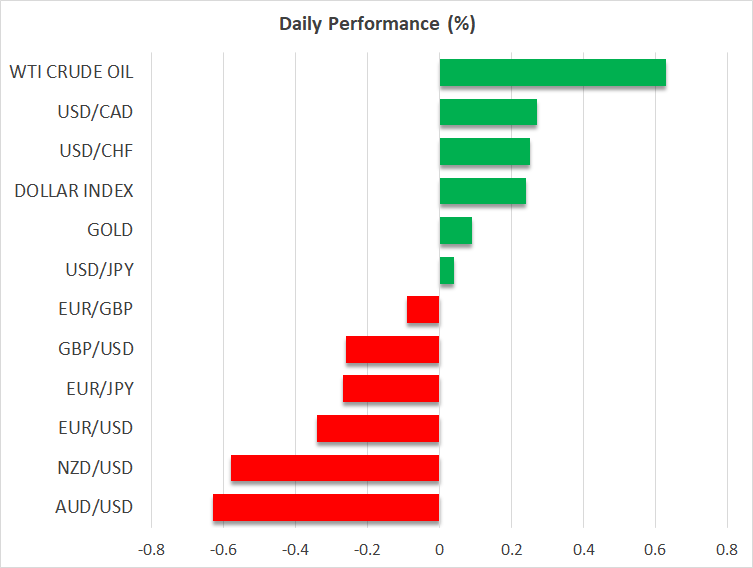

June rate cut probability declines, dollar gains

Yen recovers on stronger intervention warnings

Wall Street and gold trade north

Dollar gains as Waller signals patience

Dollar gains as Waller signals patienceThe US dollar finished Wednesday slightly higher against all but one of its major peers and continues to trade on the front foot on Thursday as well. The only currency versus which it lost ground yesterday was the Japanese yen.

The greenback started the day on a relatively quiet note but comments by Fed Governor Christopher Waller after Wall Street’s closing bell added some fuel to the currency’s engines. Waller said that the recent disappointment in inflation numbers confirms the case for the Fed to wait for a while before pressing the rate cut button.

Waller’s remarks seem contradictive to Powell’s view at the press conference following last week’s decision, where he said that recent high inflation readings had not changed the narrative of slowly easing price pressures, and thereby are not a reason to alter the Committee’s plans.

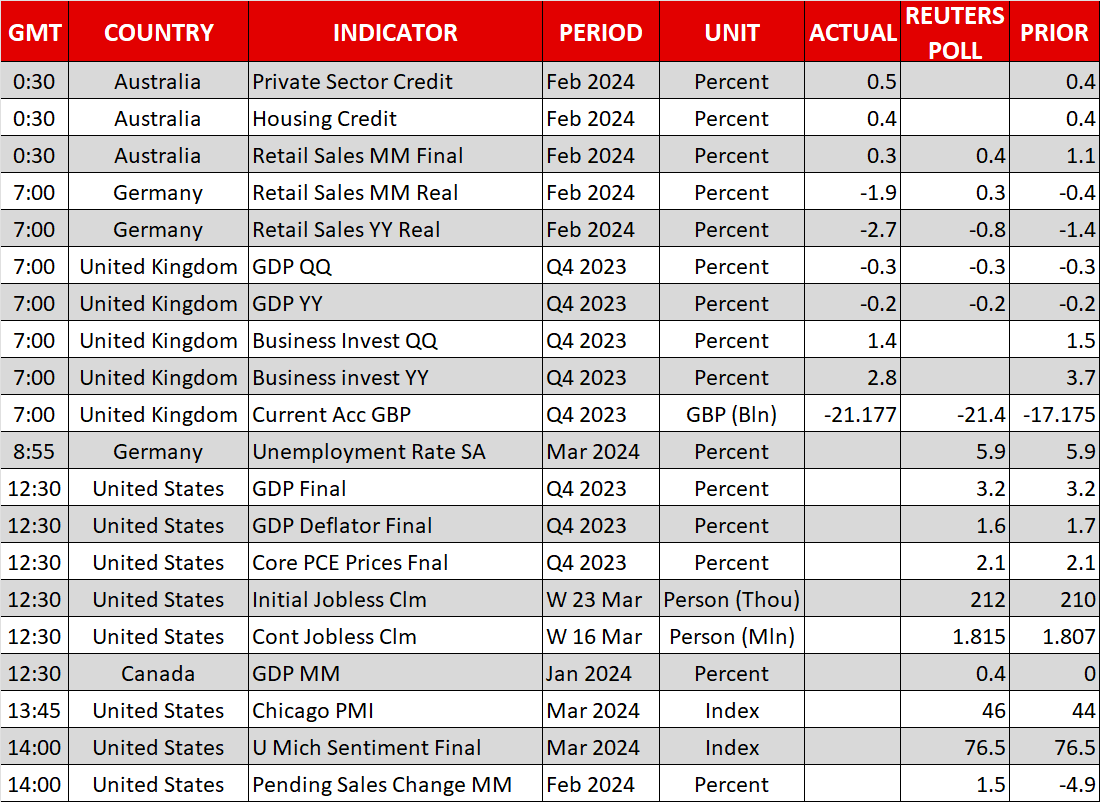

Given that Waller was the first among Fed policymakers to talk about rate cuts, investors took his words seriously and lifted their implied path somewhat. According to Fed fund futures, the probability of a June cut slid to around 68%, while the total number of basis points worth of rate reductions by the end of the year came down to 75, matching once again the Fed’s own projections.

The next big test for Fed expectations and the US dollar may be tomorrow’s core PCE index, which is the Fed’s favorite gauge. Although Powell has already mentioned that the stickiness in recent inflation data is not a reason for the Fed to hold its fire, Waller’s opinion adds extra importance to tomorrow’s data.

Another round of data pointing to stickier-than-previously-expected inflation could further weigh on the probability of a June rate cut and thereby further support the dollar.

Japanese authorities ready to interveneThe yen was the only major currency against which the dollar lost ground yesterday, with the once safe haven gaining after Japan’s three main monetary authorities – the Bank of Japan, the Finance Ministry and Japan’s Finance Services Agency – held a meeting late in Tokyo trading hours to discuss the slide in the yen and suggested that they were ready to intervene in the market to stop speculative moves.

Dollar/yen was trading in a consolidative manner slightly below 152.00 ahead of the meeting with the announcement pushing the price down to 151.00. Although the pair rebounded slightly later, it remained unaffected today by the BoJ’s summary of opinions, which confirmed that at last week’s gathering, policymakers highlighted the need to proceed slowly and gradually in phasing out ultra-loose monetary policy.

That said, although yen sellers may be reluctant to push dollar/yen beyond 152.00, this could still happen if the dollar receives fuel by tomorrow’s PCE data. Such a break could ring the intervention alarm bells louder.

Wall Street trades in the green, gold shinesOn Wall Street, all three of its main indices closed in the green, with the Dow Jones gaining the most and the S&P 500 securing a new closing record. The Nasdaq gained the least, perhaps dragged down by Nvidia, which closed in the red for a second straight session.

More data suggesting that inflation in the US is proving stickier than expected could weigh on Wall Street, but any PCE-related retreat is unlikely to lead to a long-lasting decline. Even if delayed, the next move on US interest rates is likely to be lower, which is positive for firms that are valued by discounting free cash flows for the quarters and years ahead, while recent activity has shown that investors are willing to price more future growth opportunities related to artificial intelligence.

Gold also traded higher yesterday, despite the recovery in the US dollar. Perhaps this is because central banks continue with increased buying activity in an attempt to diversify their currency reserves. This suggests that even if the precious metal is dragged down by a higher-than-expected core PCE rate tomorrow, the slide may prove to be limited and short-lived.

免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。