Alphabet Q1 earnings: Ad revenue and AI frenzy take center stage – Stock Market News

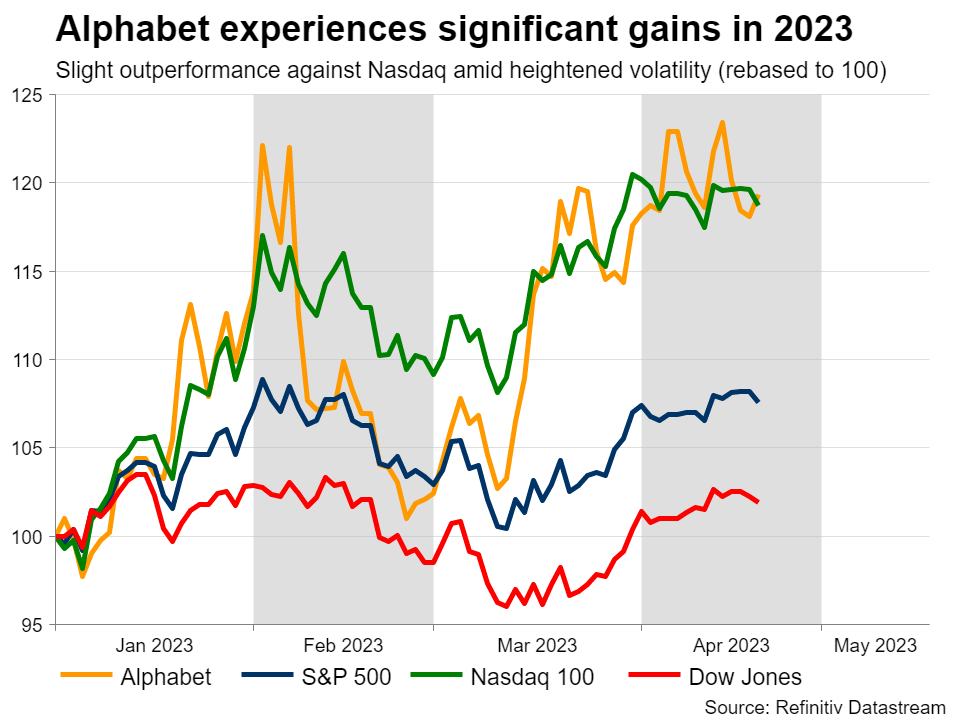

Alphabet had a very strong start to the year, but there are no idiosyncratic drivers behind this move. The tech giant has gained on the back of the recent banking turmoil as investors surprisingly found shelter in tech companies, with the anticipation of rate cuts in 2023 acting as a tailwind for growth-oriented companies.

During these turbulent times, Alphabet’s main issue is that compared to its tech peers, who have more diversified revenue streams, its income is massively relying on its advertising segment. Looking forward, as market participants continue to share the view that a global recession is still the base case scenario for 2023, advertising conditions could become even more challenging. Therefore, it remains to be seen whether the firm can endure both the increasing competition and the worsening conditions in the ad market, while at the same time expand its operations to the constantly evolving and trending AI sector.

Competition intensifiesIt is common knowledge that Alphabet’s search engine has been one of its main cash generating machines, but things could change drastically on that front. Last November, the start-up Open AI launched an AI chatbot, called ChatGPT, which gained instant popularity.

To make matters worse for Alphabet, Microsoft invested $10 billion into Open AI to secure exclusive cloud computing access to its Azure infrastructure services, with the partnership also aiming to create an updated AI version of Microsoft's Bing search engine. These developments ignited concerns that Bing, which is already the number-two player in the search market, could start stealing market share from Google’s traditional search engine.

In February, Alphabet launched its own AI-powered searching tool, Bard, but it made a factual error in its first demo, which led to an $100 billion loss of market cap for Alphabet in the same day. Apart from that, reports came out last week, citing that Samsung is seriously considering replacing Google with Bing as the default search engine on all its computing devices. Overall, it seems that Alphabet’s dominance in the industry is seriously questioned, but the tech giant is unlikely to go down without a fight.

Profitability shrinksMixed financial figures are expected for Alphabet. The tech giant is expected to post revenue of $68.88 billion for the first quarter, according to consensus estimates by Refinitiv IBES, which would represent a marginal year-on-year growth of 1.3%. Although total revenue is on track for a minor increase, advertisement revenue is set to fall by 1.70% percent during the same time horizon. Aligned with the latter, earnings per share (EPS) are estimated to decrease 13.38% on an annual basis to $1.07.

Meanwhile, investors will be closely eyeing the firm’s profit margins, which are projected to decline due to higher capital expenditure for the research and development of new products in the AI field. Alphabet’s operating margin is anticipated at 23.50%, marking a significant drop from the 29.55% figure recorded in the same quarter last year. All in all, slower revenue growth coupled with squeezed margins and a gloomy macroeconomic outlook are likely to hurt both the company’s financial and growth estimates.

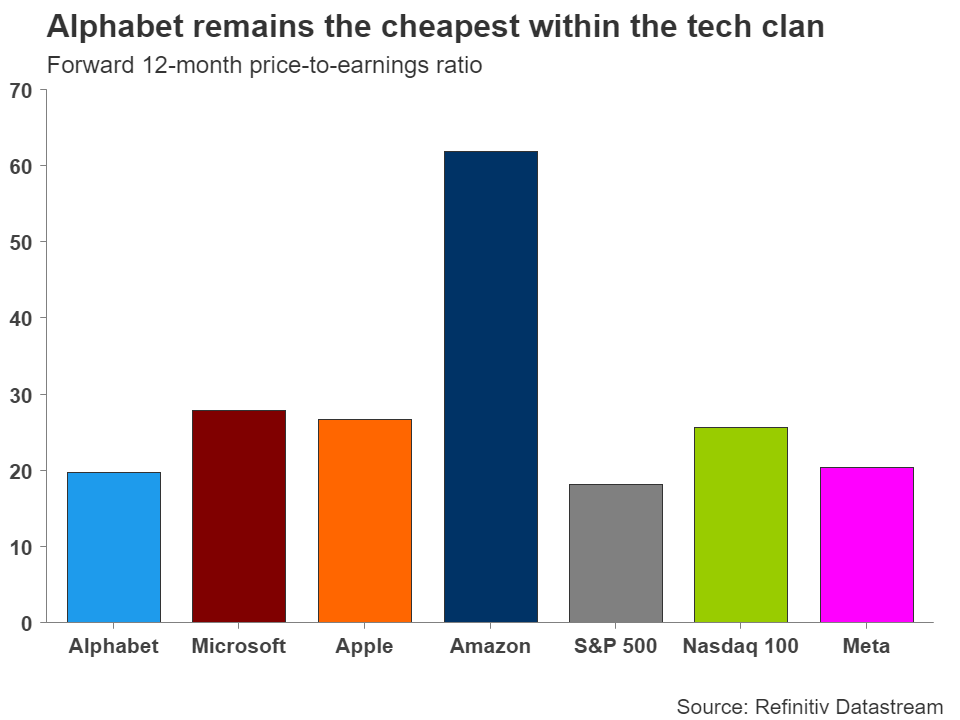

Valuation reflects a bargain or a bust?At current levels, Alphabet’s valuation suggests that market participants are extremely bearish on the firm’s prospects. Especially if you compare its multiples with those of the other major tech companies, which are equally vulnerable both to high interest rates and a recession, Alphabet seems to be trading at a huge discount.

Specifically, the 12-month forward price-to-earnings ratio, which denotes the dollar amount someone would need to invest to receive back one dollar in annual earnings, currently stands at 19.7x, appearing relatively deflated compared to the heavy-tech Nasdaq’s and the technology sector’s figures of 25.6x and 22.0x, respectively. Despite some short-term challenges, it’s difficult to argue that the leading tech firm will lose its crown within the advertising sector, thus even if earnings surprise to the downside, a potential sell-off could offer an attractive entry point for investors.

Can the stock extend its rebound?Taking a technical look, Alphabet’s stock had a devastating 2022, plummeting to a 2½ -year low of 83.34 in November. Although the share price has gained some ground since the beginning of 2023, there is a long way till it revisits its all-time highs.

If earnings come out better than expected, the price could initially challenge $109.40, which is the 38.2% Fibonacci retracement of the $151.55-$83.34 downtrend. Conquering this barricade, the bulls could then aim for the 50.0% Fibo of $117.45.

On the flipside, should earnings disappoint, the 23.6% Fibo of $99.44 could act as the first line of defense. Failing to halt there, the price could descend towards the February low of $88.80.免責聲明: XM Group提供線上交易平台的登入和執行服務,允許個人查看和/或使用網站所提供的內容,但不進行任何更改或擴展其服務和訪問權限,並受以下條款與條例約束:(i)條款與條例;(ii)風險提示;(iii)完全免責聲明。網站內部所提供的所有資訊,僅限於一般資訊用途。請注意,我們所有的線上交易平台內容並不構成,也不被視為進入金融市場交易的邀約或邀請 。金融市場交易會對您的投資帶來重大風險。

所有缐上交易平台所發佈的資料,僅適用於教育/資訊類用途,不包含也不應被視爲適用於金融、投資稅或交易相關諮詢和建議,或是交易價格紀錄,或是任何金融商品或非應邀途徑的金融相關優惠的交易邀約或邀請。

本網站的所有XM和第三方所提供的内容,包括意見、新聞、研究、分析、價格其他資訊和第三方網站鏈接,皆爲‘按原狀’,並作爲一般市場評論所提供,而非投資建議。請理解和接受,所有被歸類為投資研究範圍的相關内容,並非爲了促進投資研究獨立性,而根據法律要求所編寫,而是被視爲符合營銷傳播相關法律與法規所編寫的内容。請確保您已詳讀並完全理解我們的非獨立投資研究提示和風險提示資訊,相關詳情請點擊 這裡查看。