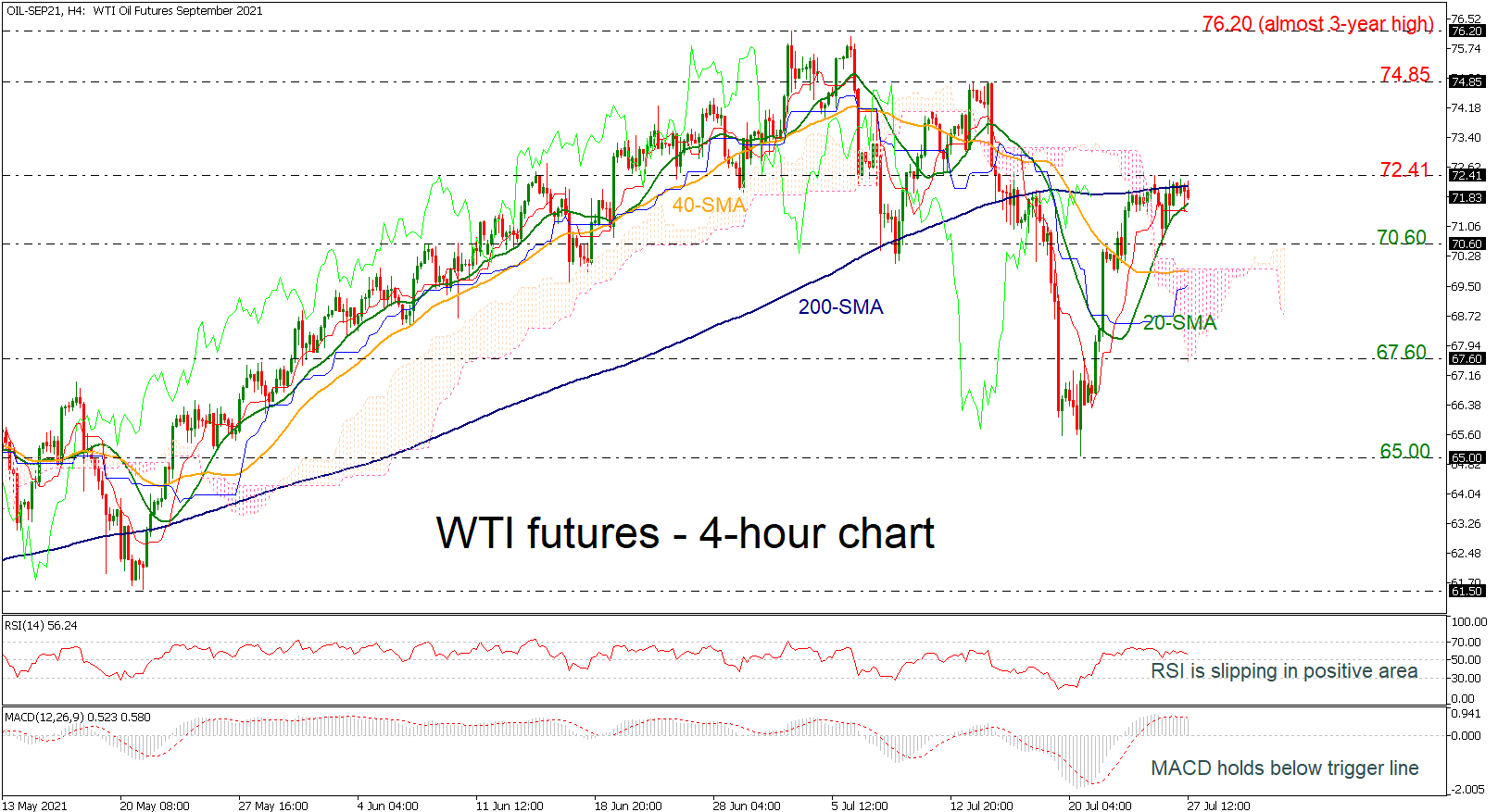

Technical Analysis – WTI futures struggle to surpass 200-period SMA

Posted on July 27, 2021 at 12:50 pm GMTWTI crude oil futures are moving sideways, finding strong resistance at the 200-period simple moving average (SMA) and support at the 20-period SMA. The RSI indicator is falling in the positive region, while the MACD is losing momentum in the bullish region. Both are suggesting that a potential downside pullback may be on the cards in the next sessions. A successful attempt below the short-term SMA could send the price towards the 70.60 support and the upper surface of the [..]