Technical Analysis – WTI futures signal for more bullish actions; post 9-month high

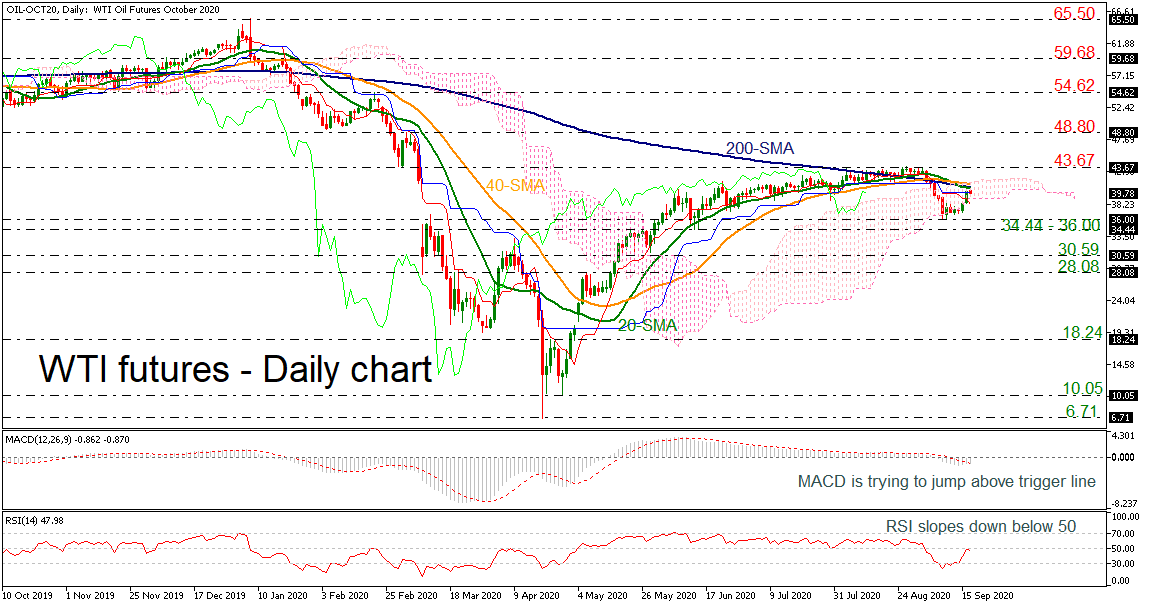

Posted on December 17, 2020 at 7:44 am GMTWTI crude oil futures stretched their seven-week rally to a nine-month high of 48.41 earlier today, remaining well above the short-term simple moving averages (SMAs). The MACD seems to be gaining momentum above its trigger line, the RSI is still hovering around its 70 overbought mark and the red Tenkan-sen is pointing up well above the blue Kijun-sen, all signaling a positive trading in the near term. Should the bullish bias extend above the nine-month high of 48.41, resistance to upside movements could be initially detected from the 48.80 barrier. [..]