S&P 500 at all-time highs, expected to make bigger moves ahead – Volatility report

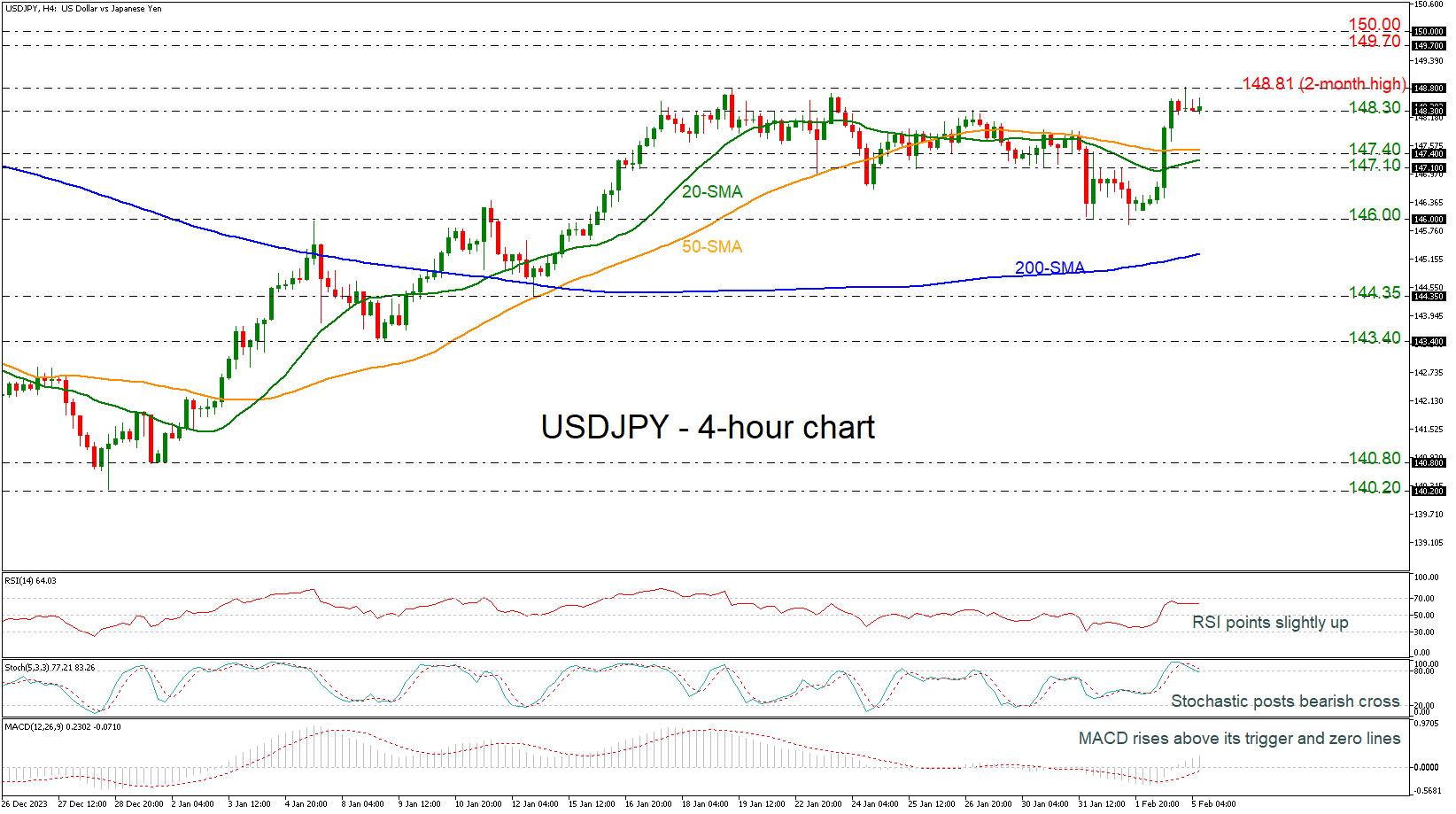

Posted on February 6, 2024 at 8:39 am GMTVolatility remains low across the FX spectrum with the exception of EUR/USD Gold volatility drops but silver remains at its midpoint; oil and Bitcoin set for small moves S&P 500 volatility rises significantly; remaining stock indices in calmer waters Volatility in EUR/USD has jumped as the pair recorded a sizeable correction last week following some key data releases. The remaining currencies covered in this report, including the yen crosses, are expected by the market to record small price movements going [..]