Market Comment – US dollar recovers, stocks’ rally stalls as market tries to find its footing

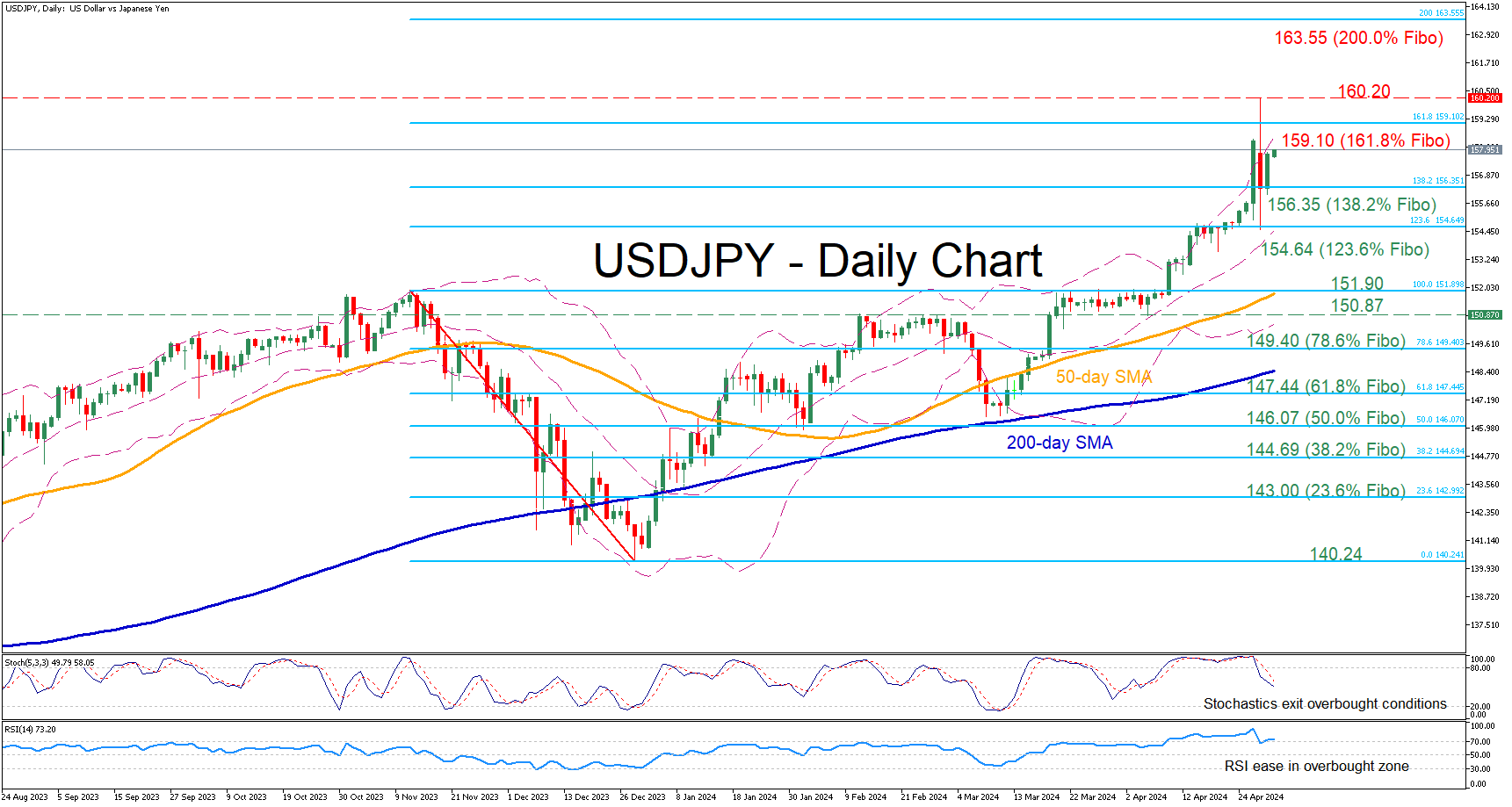

Posted on May 8, 2024 at 7:49 am GMTFed expectations drive the market; three Fed speakers on the wires today Dollar recovers but all eyes are on the US stocks and Treasury yields The pound prepares for the BoE meeting as elections gain more airtime Yen on the back foot again; gold steady amid the Israeli ground operation Dollar recovers, equity rally stalls The US dollar has almost erased its NFP losses against the euro as the US stock indices’ rally has stalled. Dovish expectations have taken centre [..]