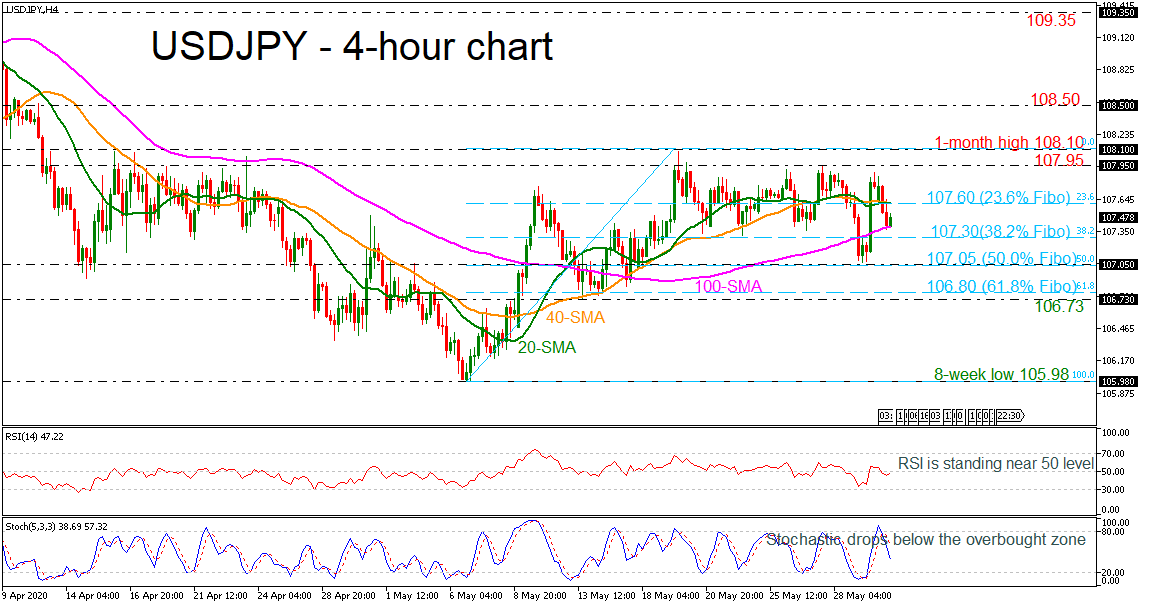

Technical Analysis – USDJPY retreats near 100-period SMA; neutral picture

Posted on June 1, 2020 at 10:00 am GMTUSDJPY has reversed back down after finding resistance at slightly below the 108.00 handle. The momentum indicators are pointing to a neutral to negative bias in the short term with the RSI just below 50 and the stochastic oscillator deep below the overbought area. Further losses below the 100-period SMA should see the 38.2% Fibonacci retracement level of the upward wave from 105.98 to 108.10 at 107.30. A drop below this area would reinforce the bearish structure in the short-term [..]