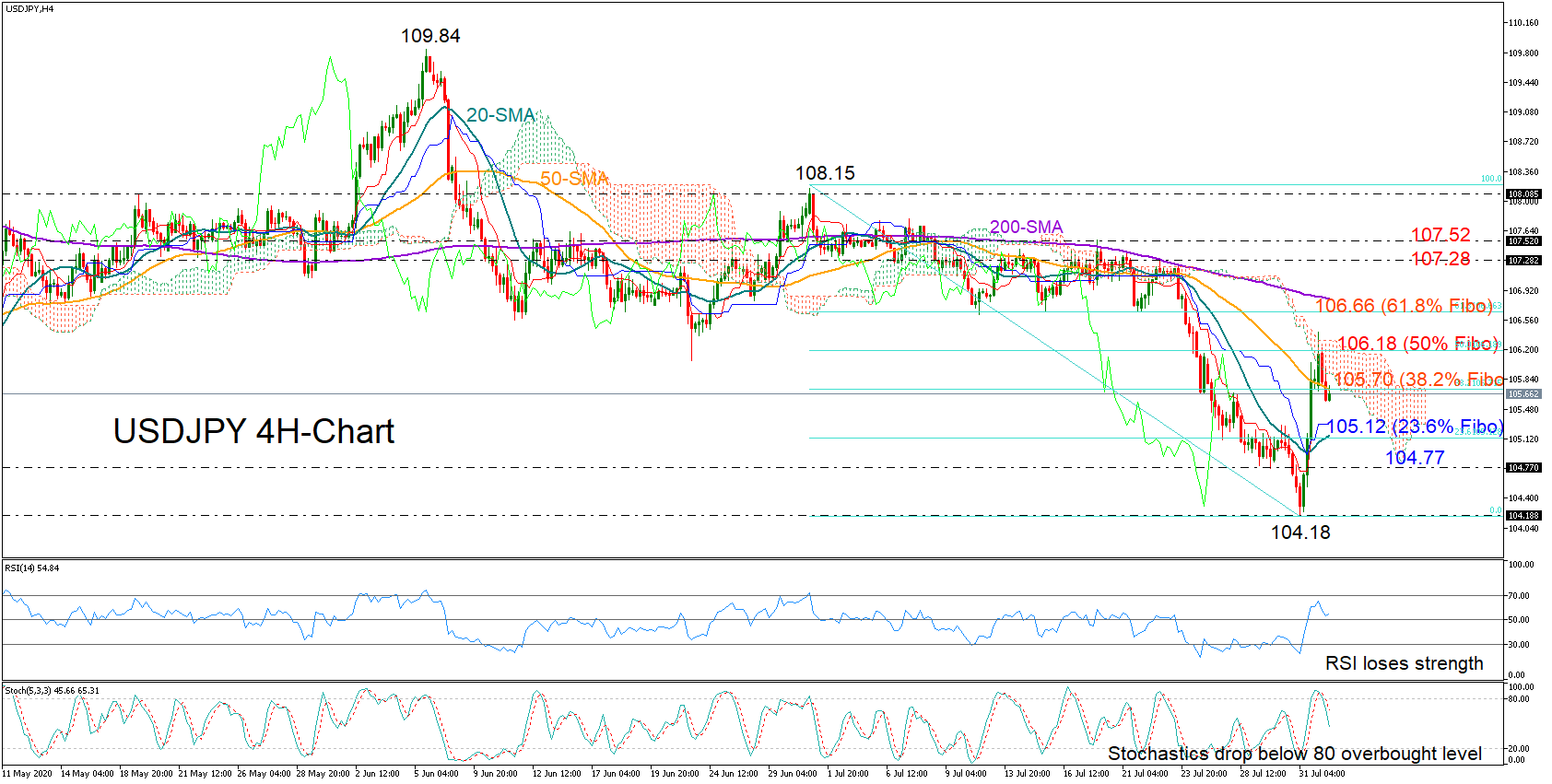

Technical Analysis – USDJPY downside risks endure under SMAs and diagonal line

Posted on August 5, 2020 at 7:50 am GMTUSDJPY is following a downward trajectory despite efforts to recoup recent losses, mirrored in the stalled blue Kijun-sen line and the improvement in the MACD oscillator. The negative direction appears to persist backed by the gradual declining simple moving averages (SMAs) and the unbroken bearish tone of the Ichimoku lines, with a falling red Tenkan-sen line. The MACD, in the negative region, has pushed above its red trigger line while the RSI slowly glides lower in bearish territory. To the [..]