US Open Note – Stocks in the red as inflation debate continues; dollar recoups some ground

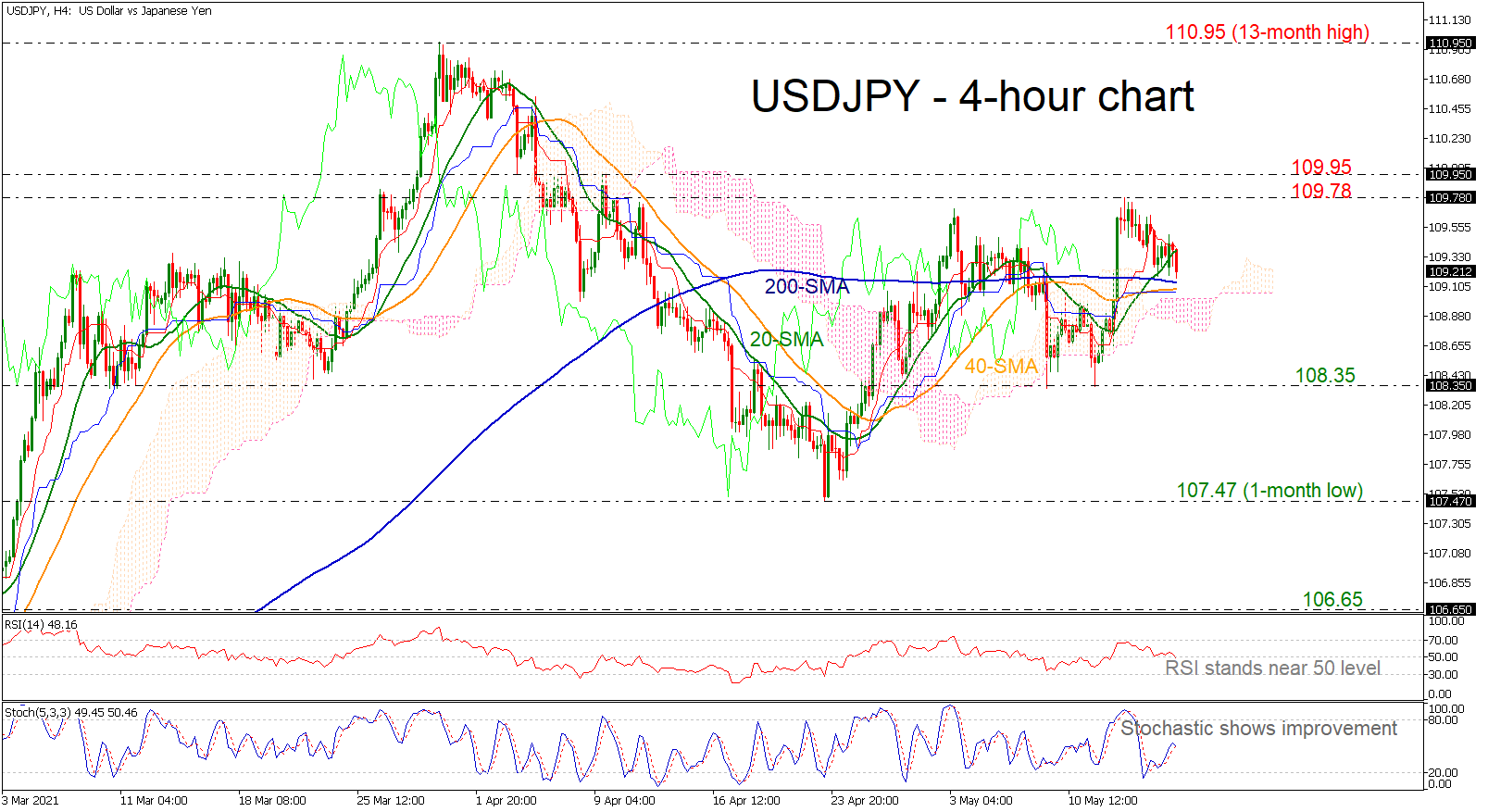

Posted on May 19, 2021 at 1:19 pm GMTFed meeting minutes eyed as inflation jitters resurface Inflation jitters and the latest infection pickups in Asia offset growth optimism in markets on Wednesday and revived fears that the Fed could start its tapering process and subsequently raise interest rates sooner than expected although the central bank has talked down the case several times, arguing that any spike in inflation will be temporary. Perhaps the Fed may once again put its assurances into words when it releases its minutes from [..]