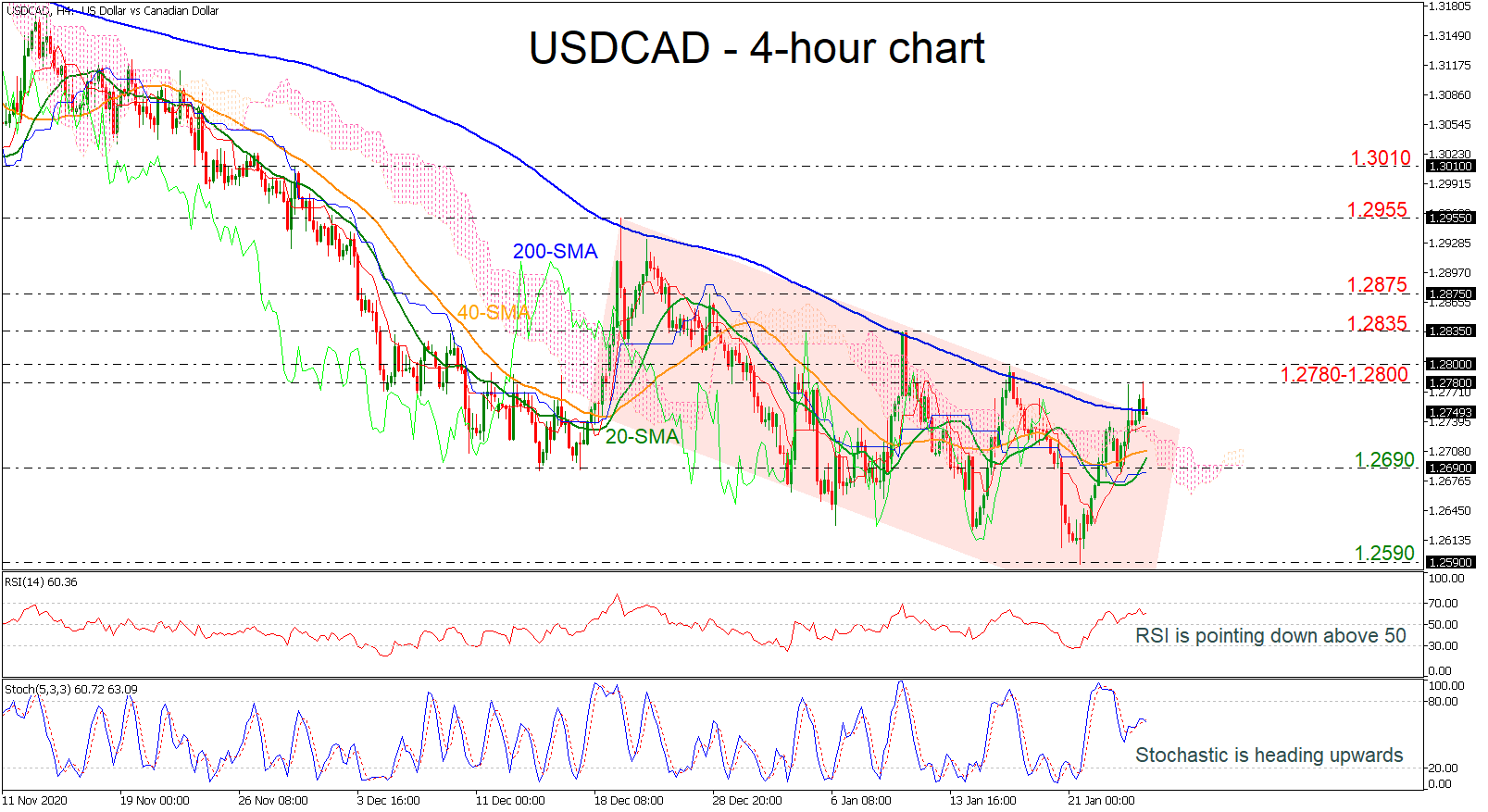

Technical Analysis – USDCAD retreats towards descending channel

Posted on January 26, 2021 at 10:16 am GMTUSDCAD climbed above the short-term descending channel earlier today in the four-hour chart but failed to jump above the 1.2780 resistance, returning lower. The directionless Ichimoku lines and the steadied cloud further reflect the weakness in the price momentum. Meanwhile, the RSI is heading south but is still holding comfortably above its neutral threshold of 50, whereas the Stochastic is moving higher after the bullish cross within its %K and %D lines, endorsing the rebound off 1.2590. Initial support to downside movements could commence within the zone of the cloud, where the 40- [..]