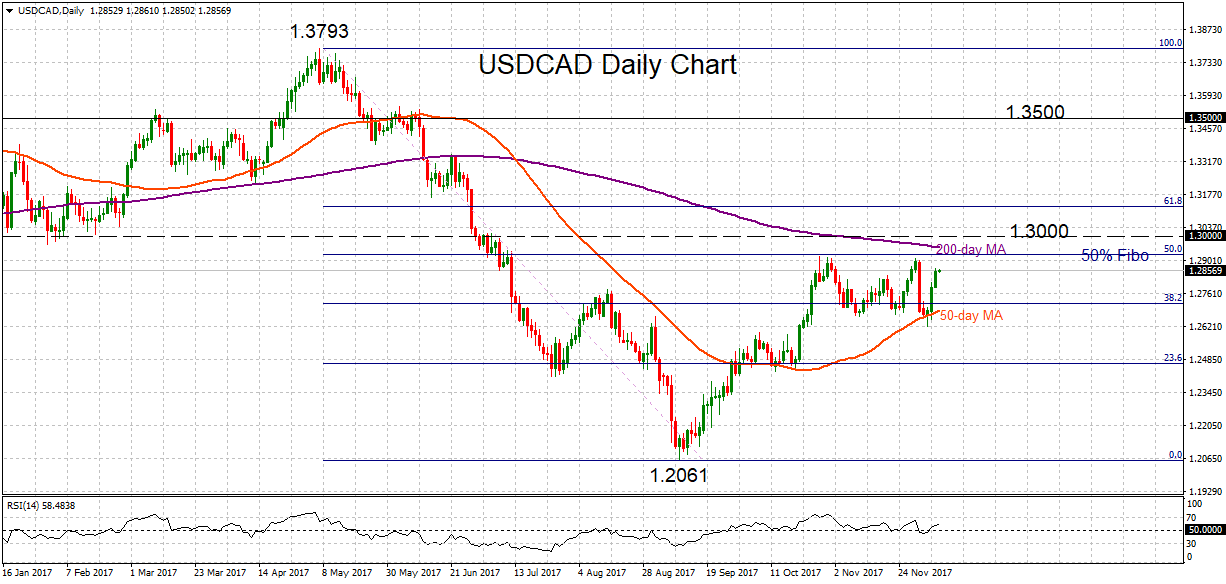

Technical Analysis – USDCAD sees increased downside risk below 50-day moving average

Posted on December 22, 2017 at 7:00 am GMTUSDCAD continues to move sideways in a range since late October. Near-term risk is tilted to the downside. The market is capped below the 200-day moving average and has dropped below the 50-day MA, sifting near-term risk to the downside. USDCAD is essentially in a consolidation phase between two key Fibonacci retracement levels of the 1.3793 to 1.2061 downleg. The 38.2% Fibonacci (1.2717) and 50% Fibonacci (1.2922) levels are providing support and resistance. The market moved into a neutral phase [..]