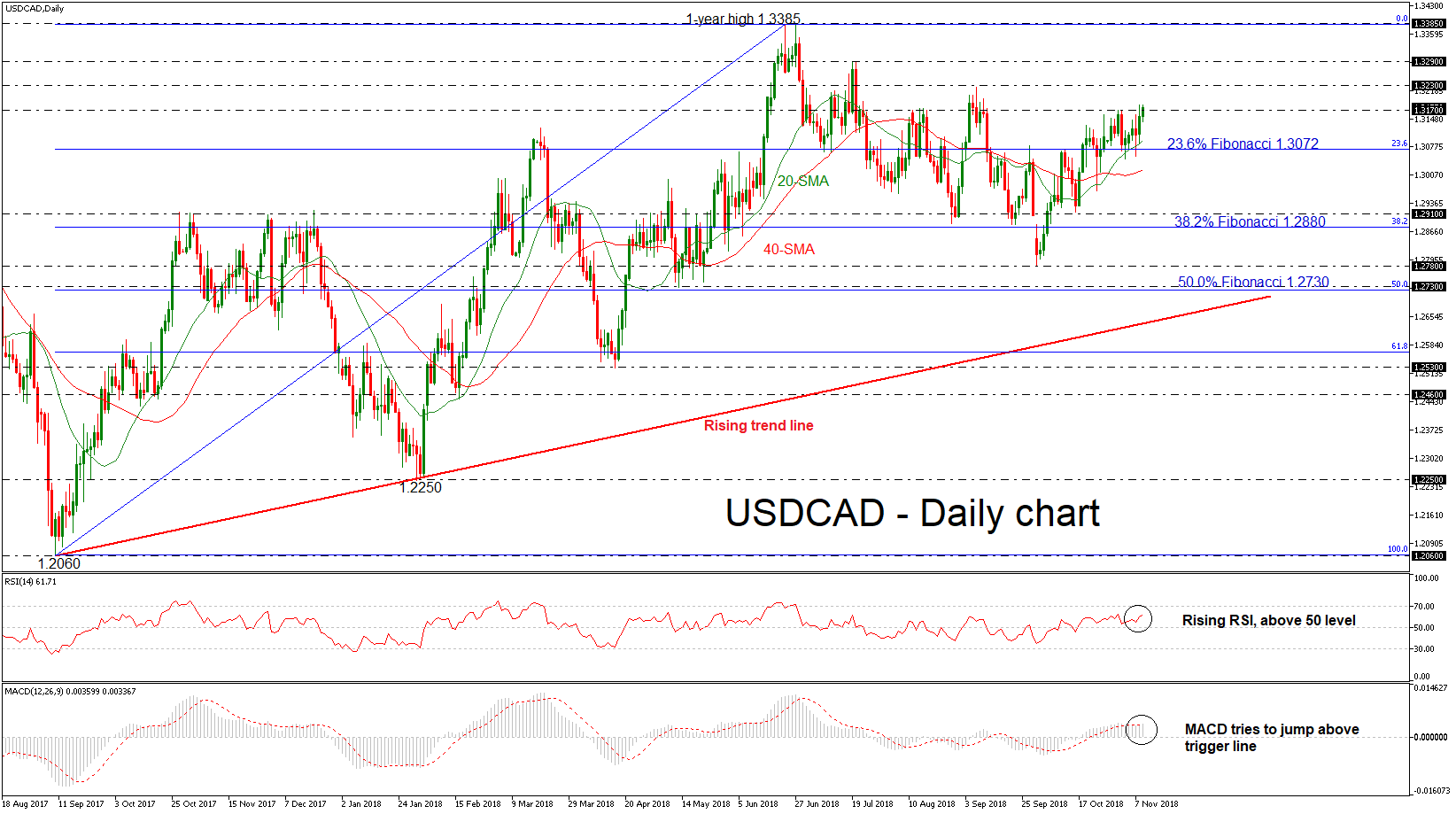

Technical Analysis – USDCAD tries to jump even higher; bullish in long-term

Posted on November 9, 2018 at 7:04 am GMTUSDCAD is challenging the 1.3170 resistance level after it failed several times to close below the 23.6% Fibonacci retracement level of the upleg from 1.2060 to 1.3385, around 1.3072. According to the RSI, the market could maintain positive momentum in the short-term as the indicator is positively sloped above its neutral threshold of 50, while the MACD oscillator is ready to post a bullish crossover with its trigger line in the daily chart. In case of a significant leg above the 1.3170 [..]