European Open Preview – Yen crumbles as risk sentiment improves, dollar rebounds

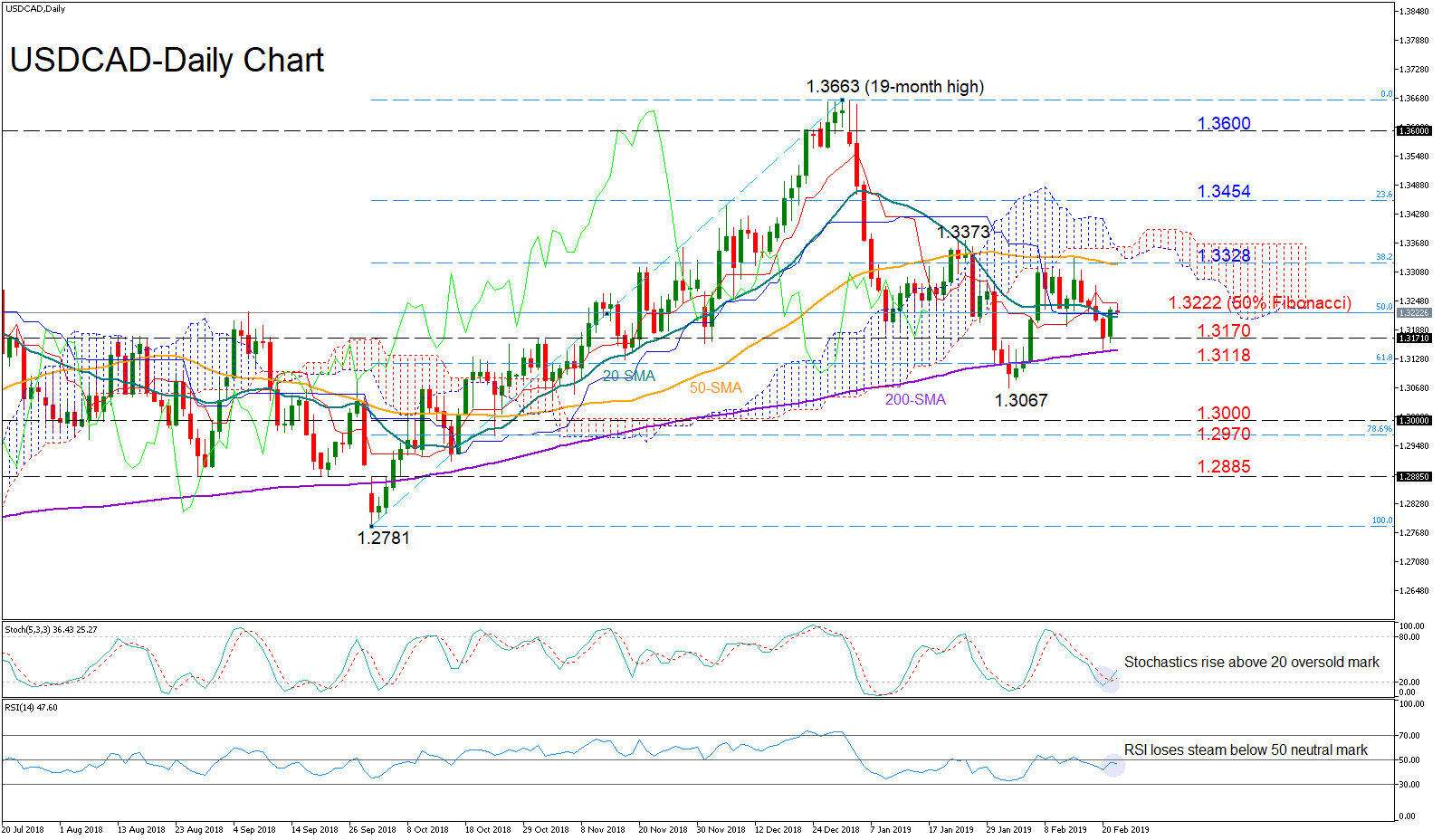

Posted on March 1, 2019 at 8:53 am GMTDollar rebounds after US GDP beats expectations, looks to ISM manufacturing index Yen falls to two-month lows as solid Chinese PMIs reinvigorate risk appetite Busy schedule today: Eurozone inflation data, UK manufacturing PMI, Canadian GDP Dollar inches up as US GDP tops forecasts, but stocks struggle The dollar was the main winner in Thursday’s session, drawing support from stronger-than-anticipated US GDP data for Q4 to outperform all its G10 peers outside of the Swiss franc. Economic growth clocked in at [..]