Besides yen pairs, neutral volatility across the board ahead of Fed and NFP – Volatility Watch

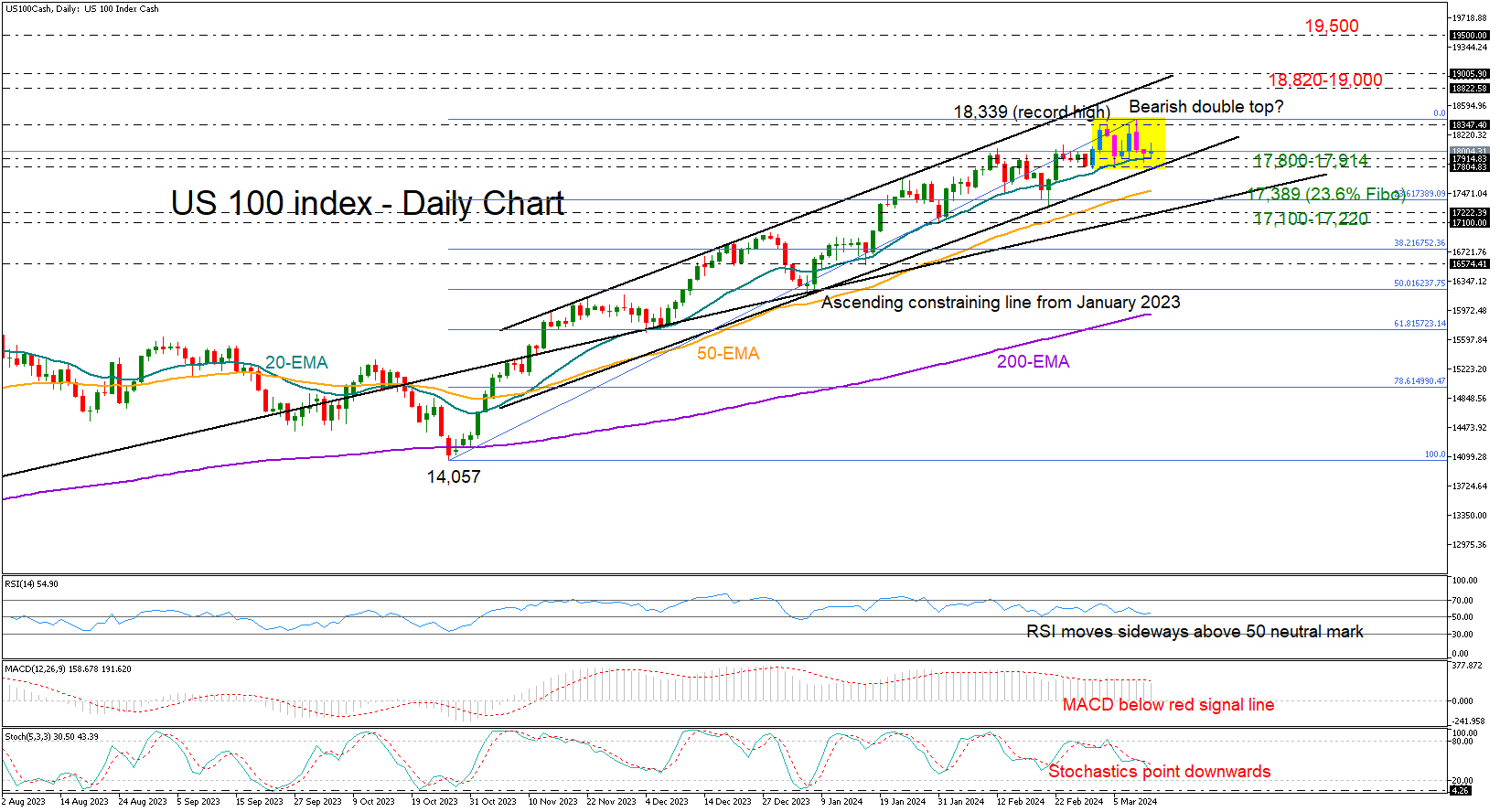

Posted on April 30, 2024 at 9:55 am GMTJapan’s intervention spurs volatility in yen pairs, usual action elsewhere in FX market Commodities enjoy lower volatility as geopolitical tensions subside Equities at neutral volatility levels during earnings season, Bitcoin volatility picks up Volatility in yen crosses has exploded on the back of a suspected Japanese intervention. Moreover, apart from dollar/yen, other dollar pairs are trading in the middle of their volatility range ahead of the Fed decision on Wednesday and NFP report on Friday. Volatility in the commodity space has also dropped, particularly [..]