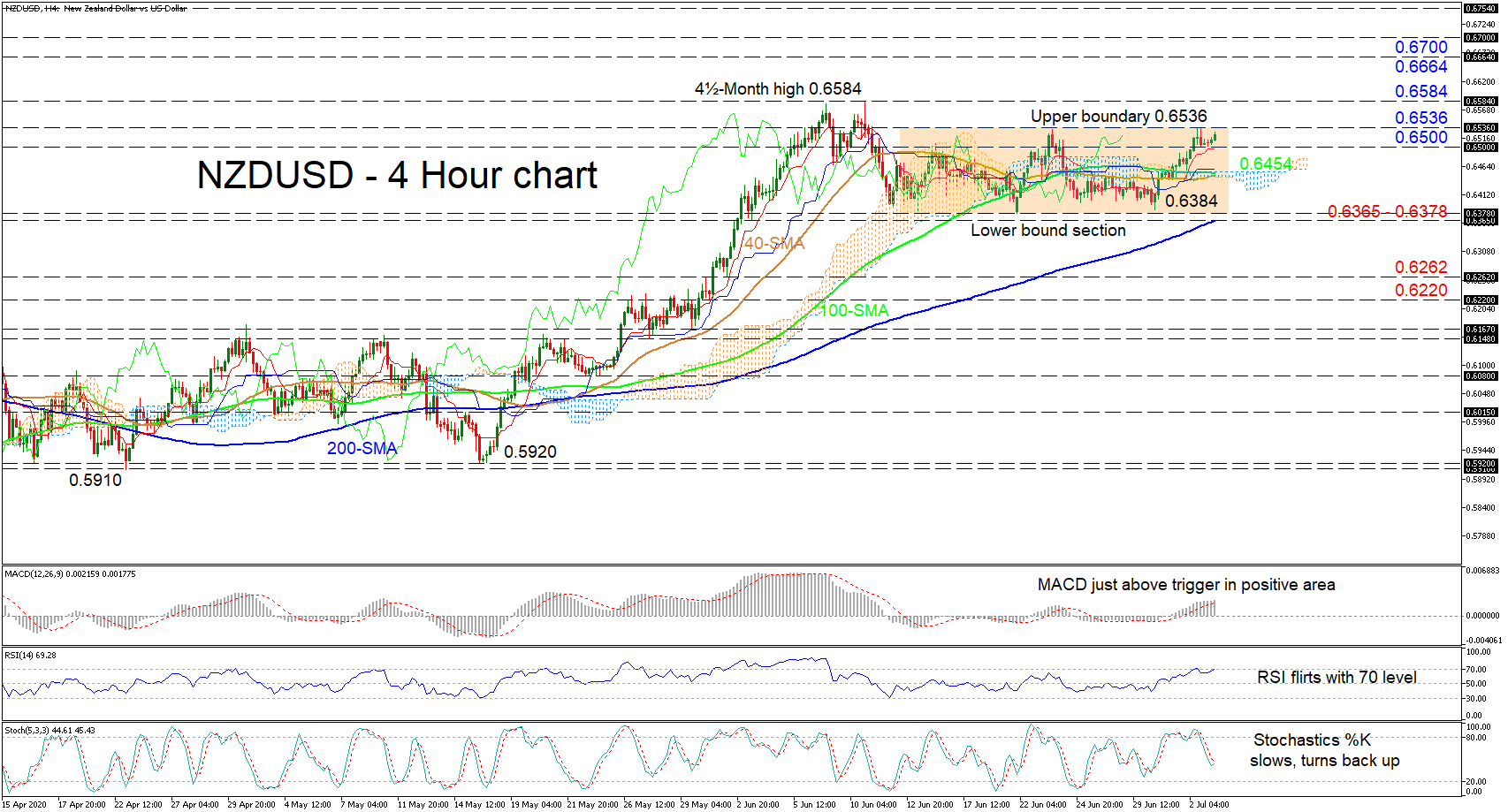

Technical Analysis – NZDUSD retests 4-month peak, creating double top

Posted on July 8, 2020 at 1:28 pm GMTNZDUSD touched the four-month peak of 0.6580 for the second time over the last month. The momentum indicators, though, are currently suggesting that the buying interest may have topped, and the pair may be regain positive momentum. The RSI and the MACD are pointing slightly down, and from the Ichimoku indicators, the red Tenkan-sen line has also paused its upside move. A closing price above 0.6580 could boost buying interest and confirm additional gains towards the 0.6665 resistance. Higher still, the 0.6750 barrier, registered on December 2019 [..]