Week Ahead – Tracking the recovery: is Europe lagging the US?

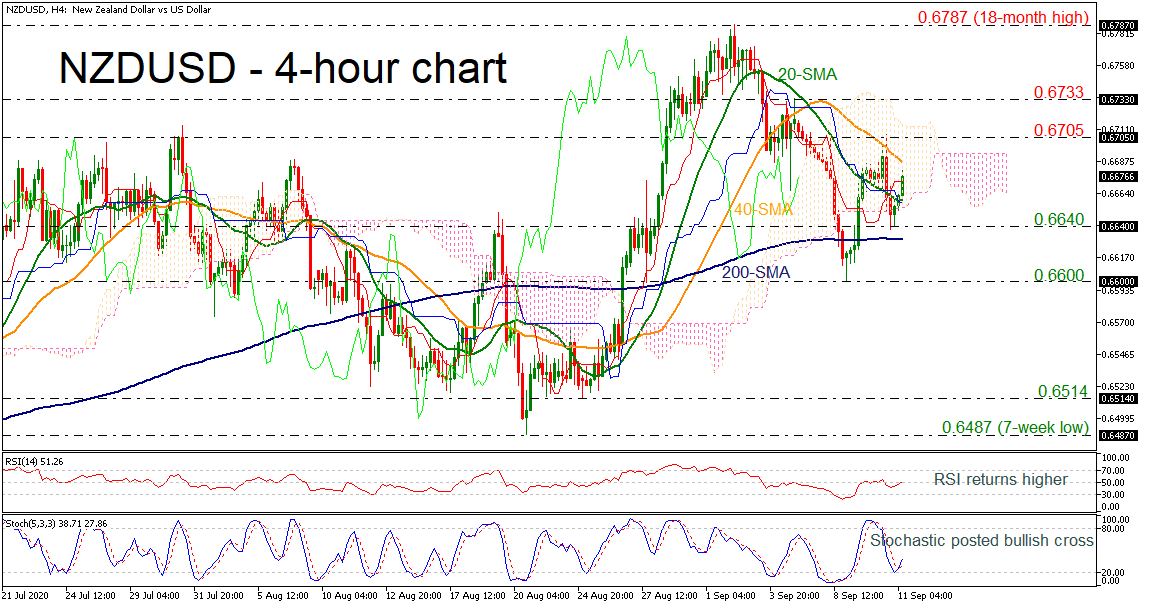

Posted on September 18, 2020 at 12:53 pm GMTThe latest flash PMI releases will dominate the economic agenda next week as the recovery in the United States appears to be picking up a gear, while the European rebound may have hit a snag. The tables have been turning lately in the US vs Eurozone recovery story, threatening to unravel the euro rally. Trying to predict the economic comeback from the pandemic will also be preoccupying policymakers at the Reserve Bank of New Zealand at their September meeting amid [..]