New Zealand to post Q3 GDP as recovery gathers steam, kiwi soars – Forex News Preview

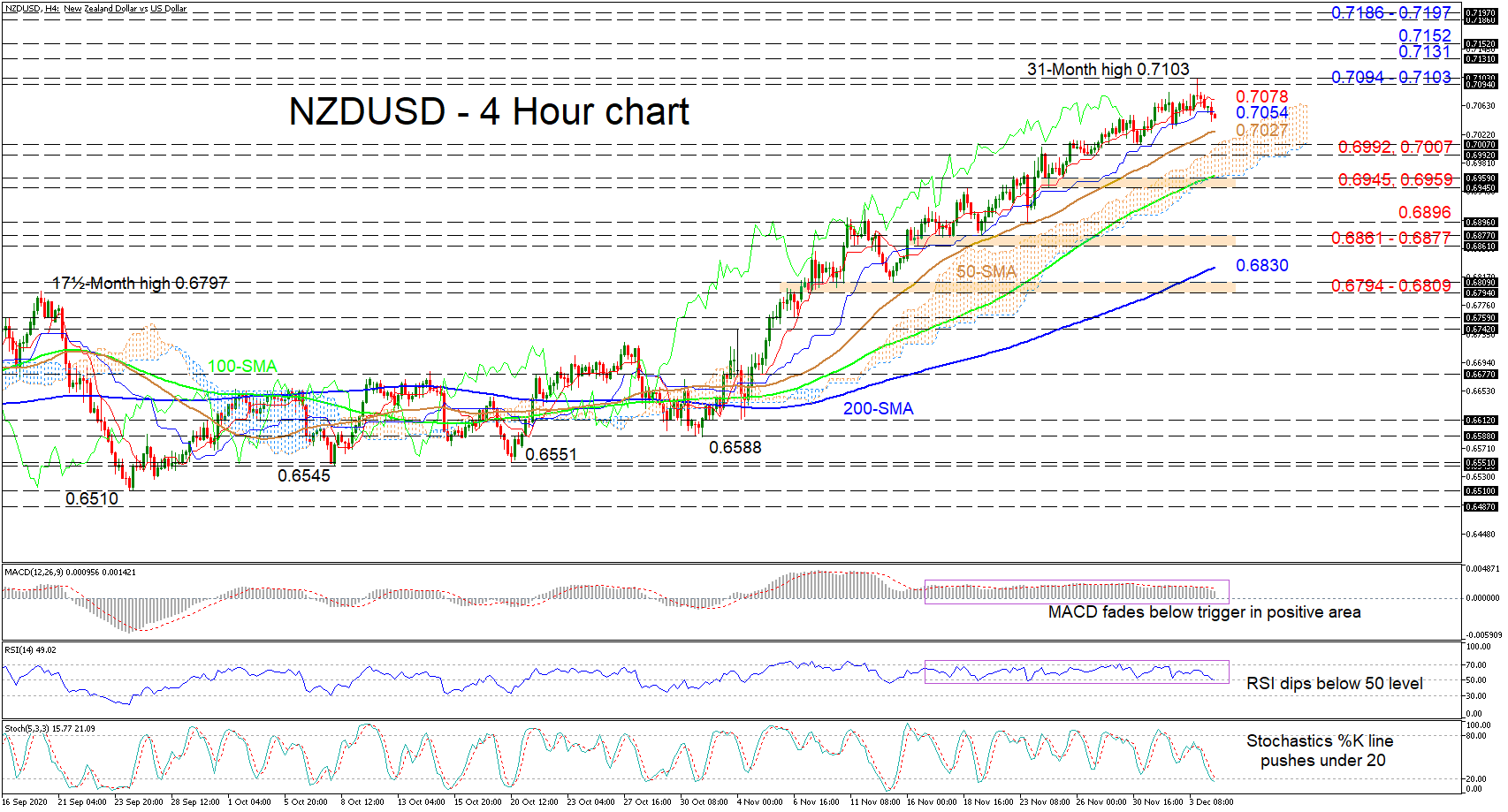

Posted on December 16, 2020 at 3:29 pm GMTThird quarter GDP figures are scheduled for release in New Zealand on Thursday (Wednesday, 21:45 GMT), following hot on the heels of the government’s upwardly revised economic projections earlier today. The Pacific nation’s economy is forecast to have bounced back strongly in Q3 despite its biggest city – Auckland – spending much of August and September under lockdown. Although the now ‘outdated’ data won’t change anything as far as the outlook is concerned, it could reinforce the kiwi’s uptrend if [..]