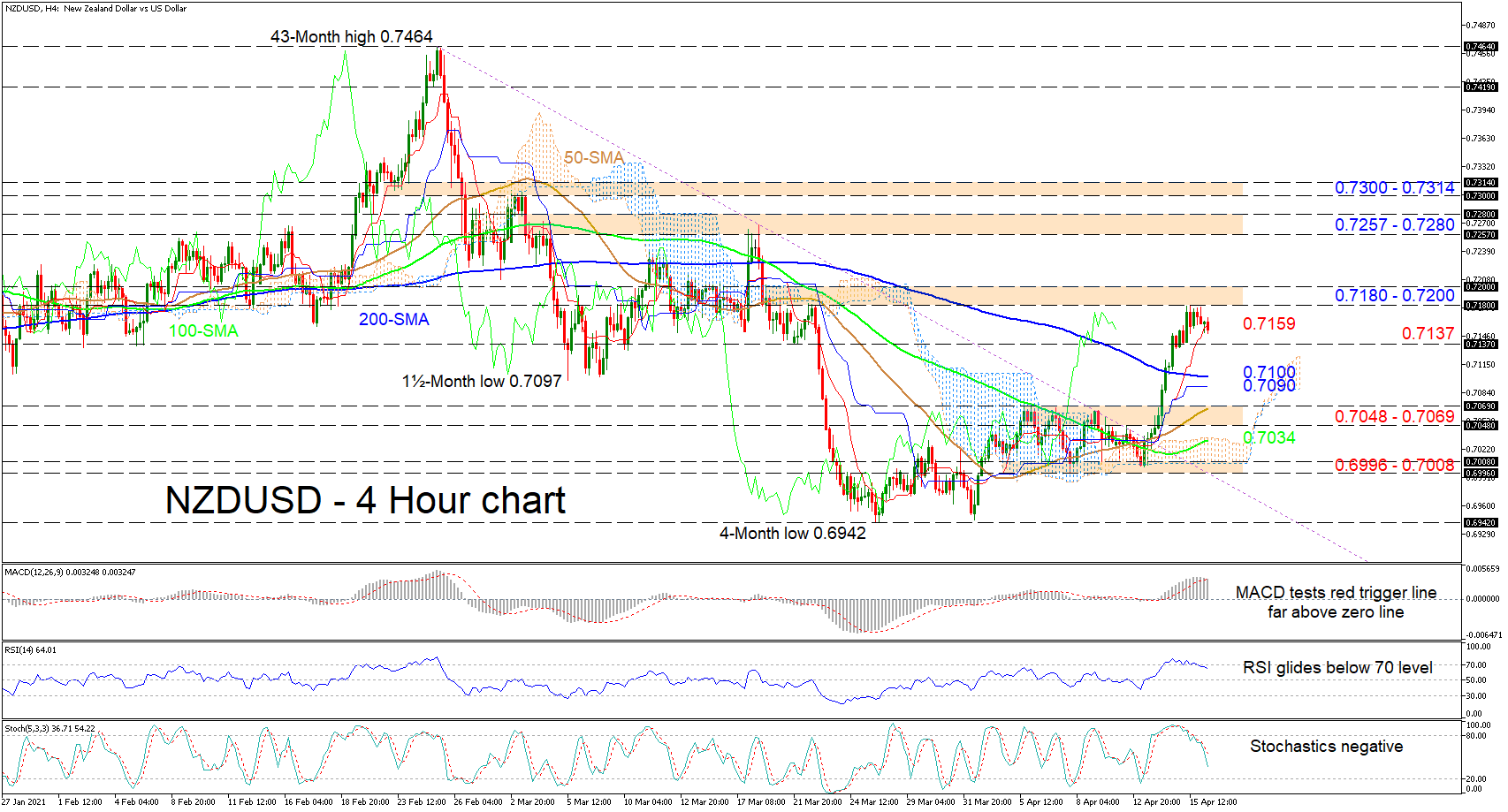

Technical Analysis – NZDUSD recoups losses but resistance zone silences ascent

Posted on April 16, 2021 at 8:54 am GMTNZDUSD has recoiled to the red Tenkan-sen line at 0.7159 after its recent aggressive positive impetus hit a minor snag at the resistance section of 0.7180-0.7200. The former level happens to be where a plunge in the pair started back on March 22, which sent the pair to the four-month low of 0.6942. The rising 50- and 100-period simple moving averages (SMAs) are backing the latest bullish form in the pair. The stalling in the hike is being mirrored in [..]