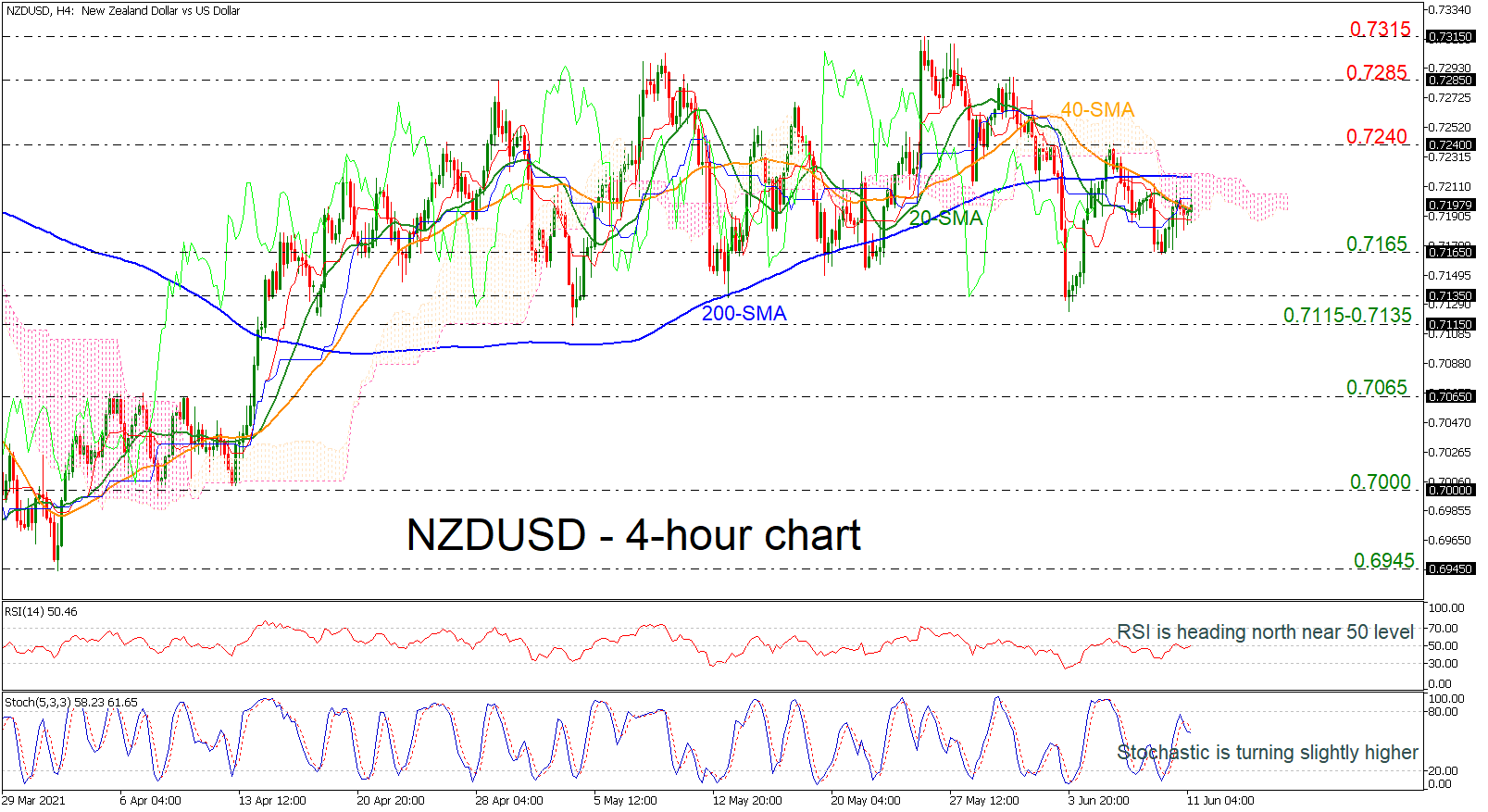

Technical Analysis – NZDUSD bulls take charge; 0.71 level under fire

Posted on June 25, 2021 at 1:34 pm GMTNZDUSD is extending its minor uptrend, which began from the near 7-month low of 0.6922, climbing to challenge the 0.7100 handle. While the bearish simple moving averages (SMAs) continue to sponsor a negative picture, the rising Ichimoku lines are signalling bullish impetus, suggesting strength in the ascent. The short-term oscillators are also reflecting growing positive momentum. The MACD is powering above its red trigger line in the bullish region, while the rising RSI is approaching the 70 overbought level. The [..]