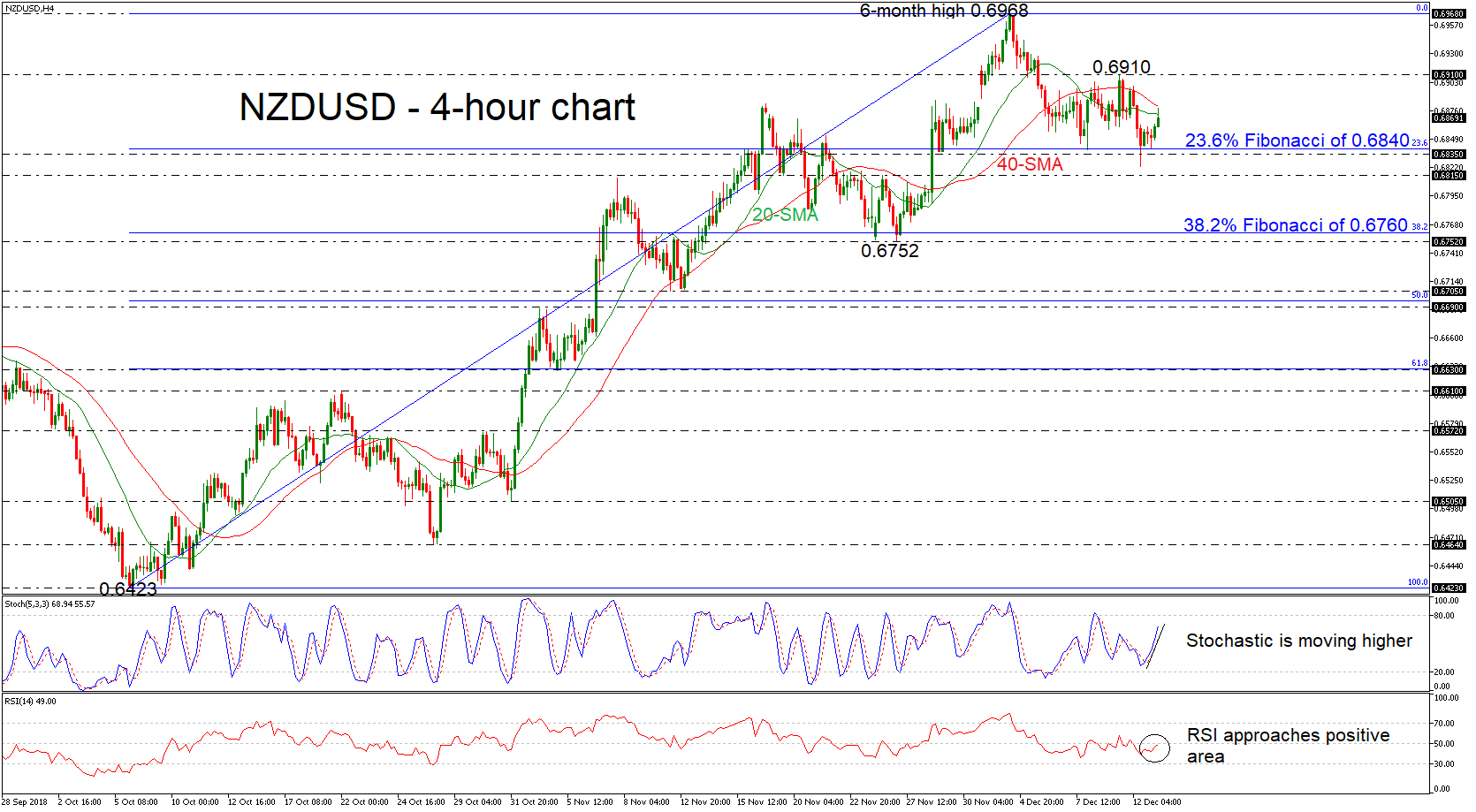

Technical Analysis – NZDUSD builds base around SMAs; positive bias in short term

Posted on December 13, 2018 at 9:20 am GMTNZDUSD has reversed back up again following the pullback on the 23.6% Fibonacci retracement level of the upleg from 0.6423 to 0.6968, around the 0.6835 support level. Currently, the price is testing the 20-day simple moving average (SMA) near 0.6873, which is acting as strong resistance level for the bulls. The stochastic oscillator is approaching the overbought level, while the RSI is trying to jump above the 50 level. If the bulls continue to have control, the price could touch [..]