Does the Santa Claus rally really exist? – Special Report

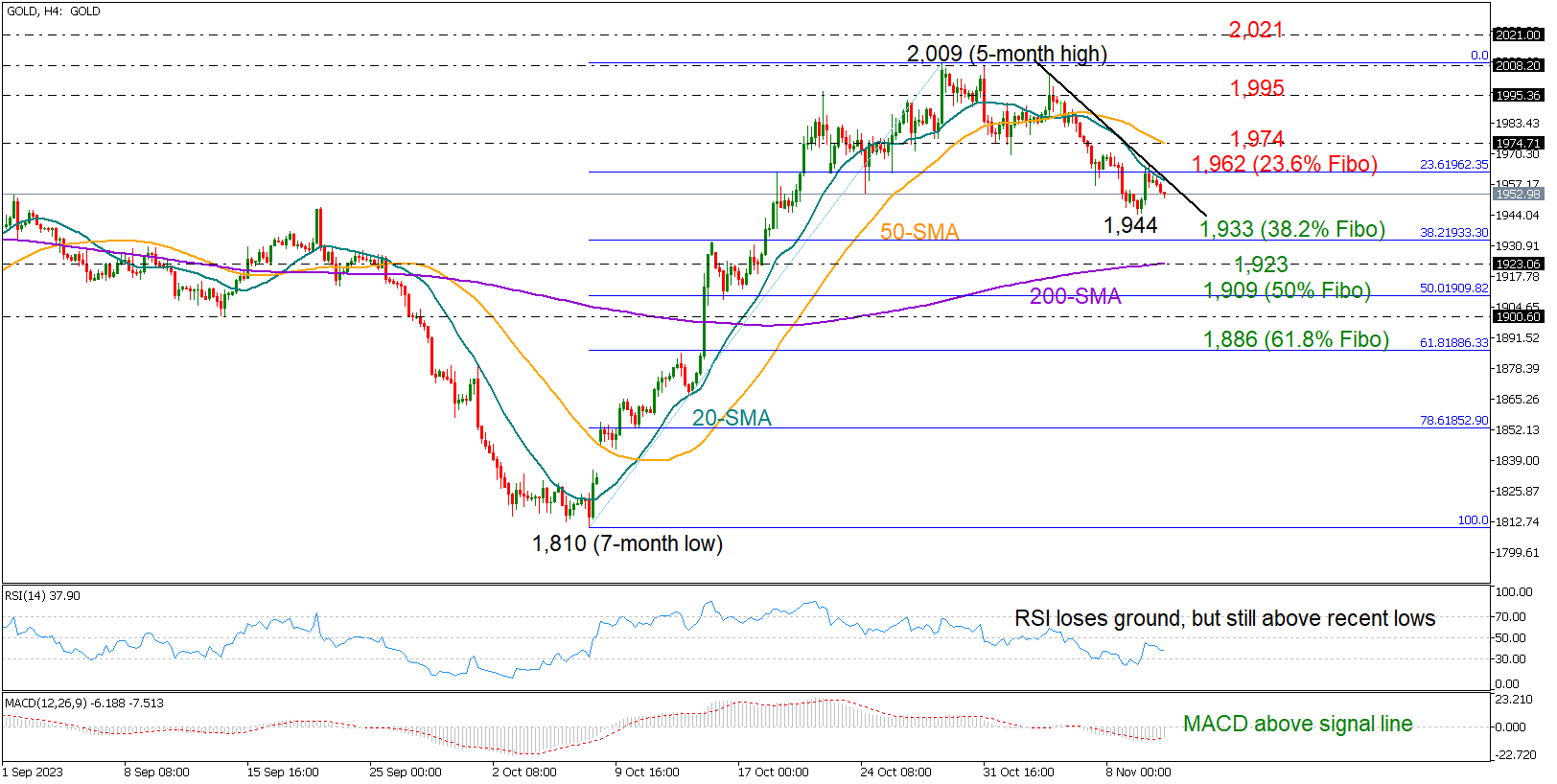

Posted on November 22, 2023 at 1:54 pm GMTUS equities exhibit a strongly positive year-end performance post-Thanksgiving FX pairs do not follow a specific pattern in the examined period Gold and USDJPY rally every time the Thanksgiving holiday falls on November 23 We are nearing the end of another trading year and the newswires are crammed with stories about the famous Santa Claus rally. In a nutshell, the market believes that risky assets tend to rally towards the end of the year. Most analysts calculate the assets’ performance [..]