Market Comment – Core PCE inflation takes center stage

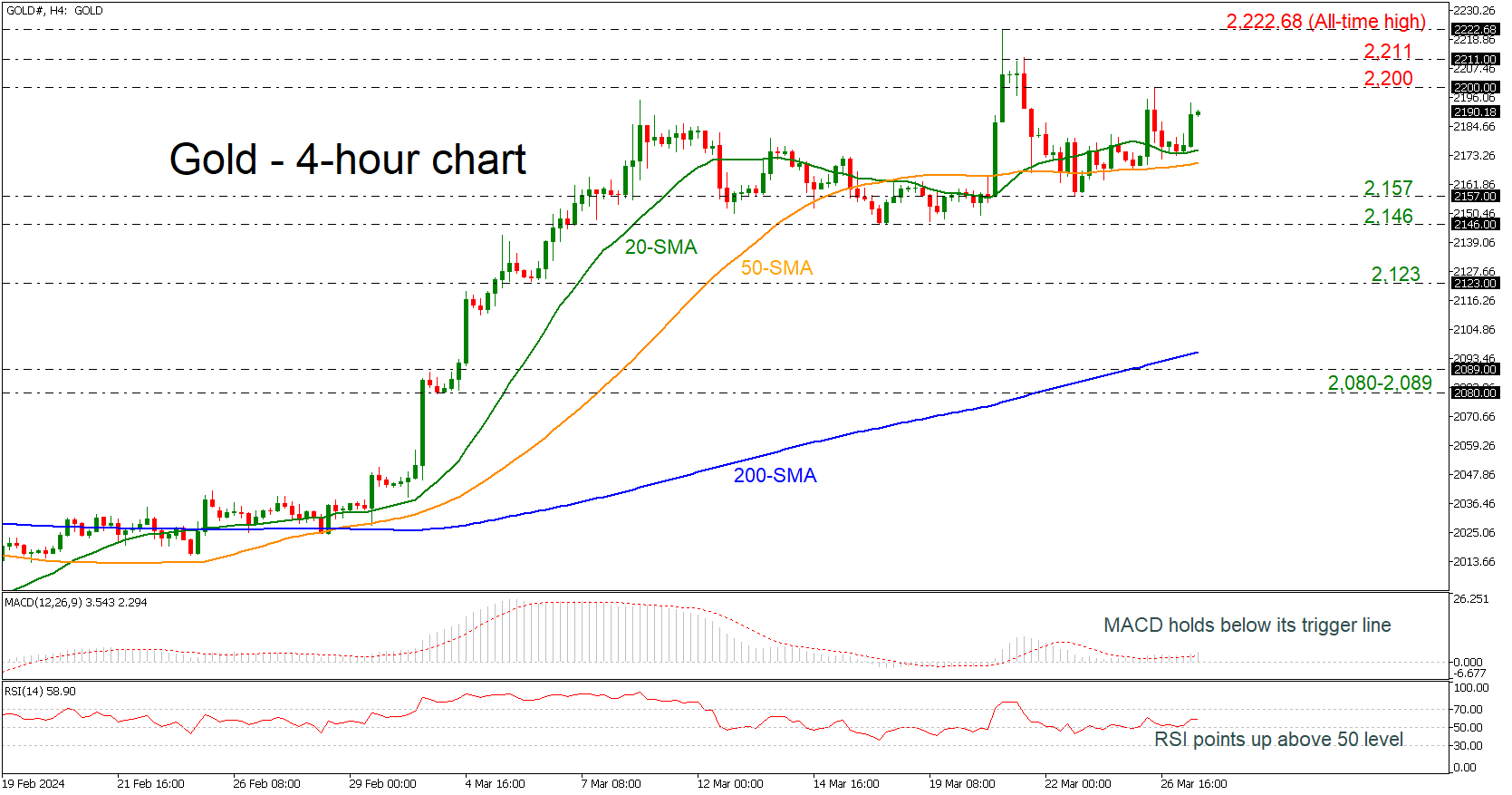

Posted on March 29, 2024 at 9:10 am GMTDollar extends advance ahead of core PCE data Dollar/yen stays on intervention watch S&P 500 secures strongest Q1 in five years Gold stretches to new record high Will PCE data point to sticky inflation? The US dollar continued outperforming most of its major peers on Thursday as the upside revision of the US GDP data for Q4 added more credence to Fed Governor Waller’s view that the Fed should not rush into lowering interest rates. Today, dollar traders have turned [..]