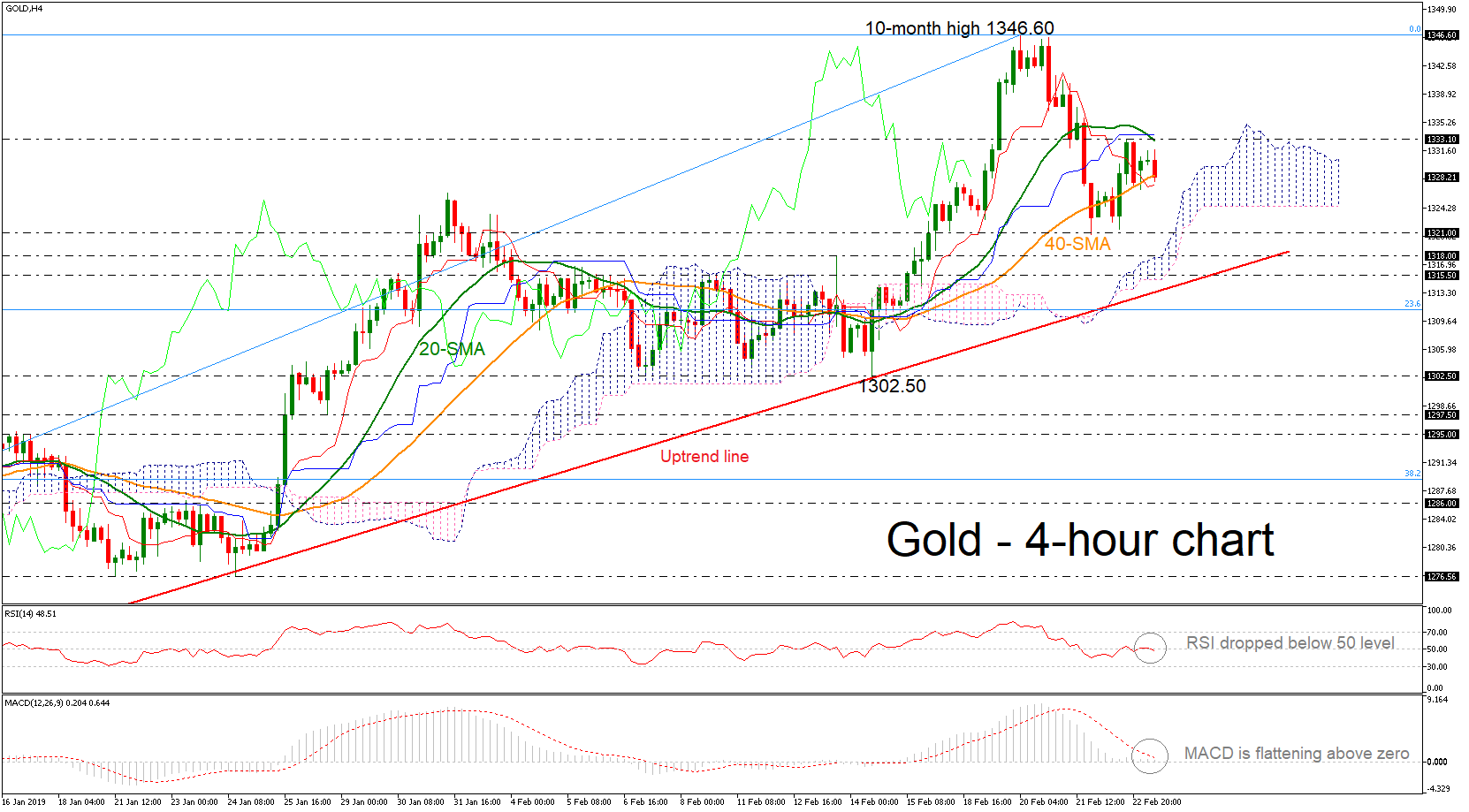

Technical Analysis – Gold bulls take a break but still keep control

Posted on February 27, 2019 at 9:29 am GMTGold retreated to meet its previous peak of 1,326 after hitting a 10-month high at 1,346 last week as the RSI pierced into overbought zone. With the indicator now pointing to the downside and towards its 50 neutral mark and the MACD weakening below its red signal line but above zero, the bias is seen as neutral in the short term. Moving southwards, a key support is expected to be challenged at the bottom of the ascending channel near 1,317. A clear negative breakout of the [..]