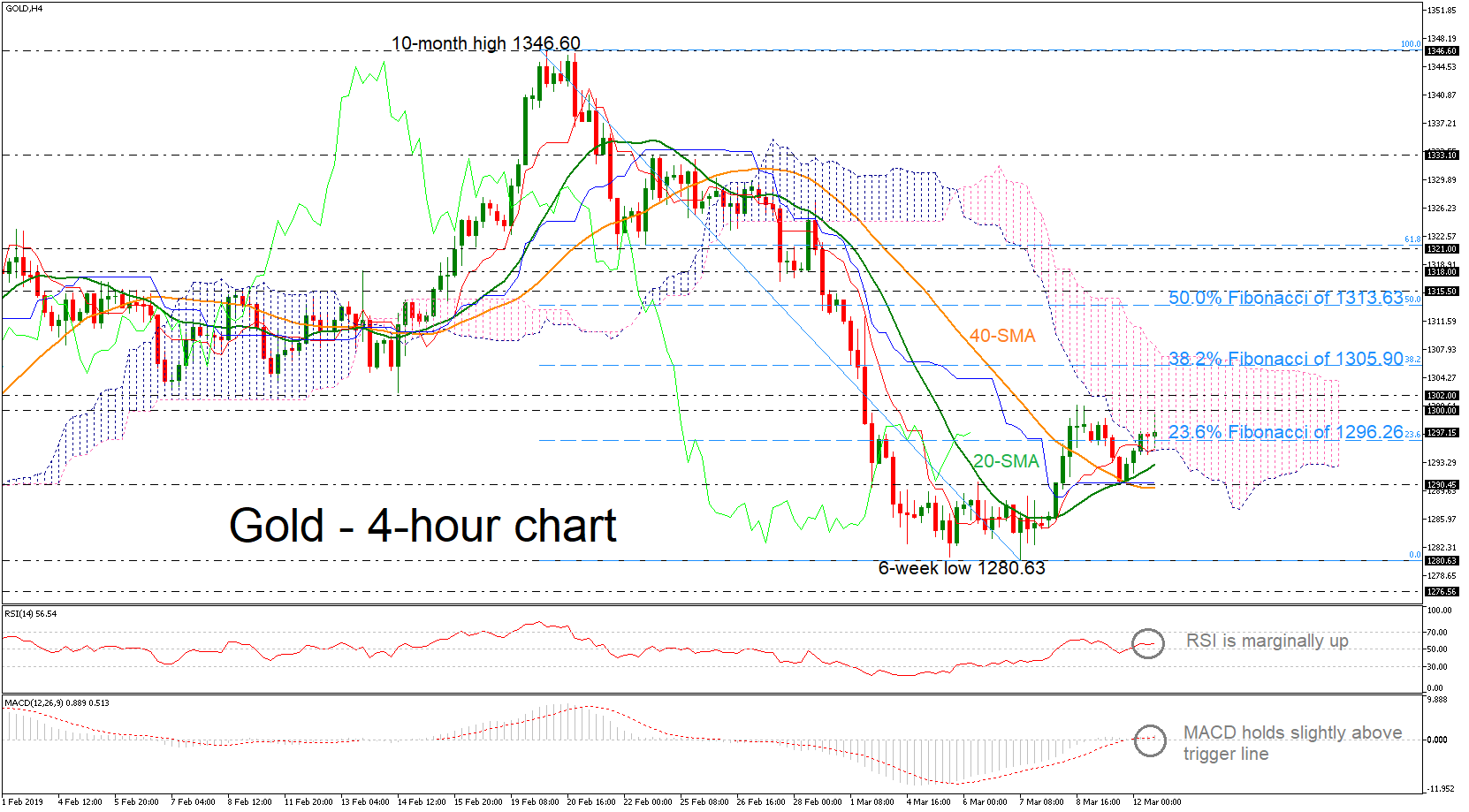

Technical Analysis – Gold to continue consolidation in short term

Posted on March 15, 2019 at 10:15 am GMTGold is trying to recover Thursday’s losses, which emerged after a failure to surpass the 20-day moving average (MA) but the technical indicators suggest that positive momentum may not pick up steam yet, at least as long as the RSI holds around its 50 neutral mark and the MACD keeps moving softly along its red signal line. The 1,1295 level could provide nearby support to downside corrections, while lower a more descent barrier may arise around 1,276 as any break below this point may confirm [..]