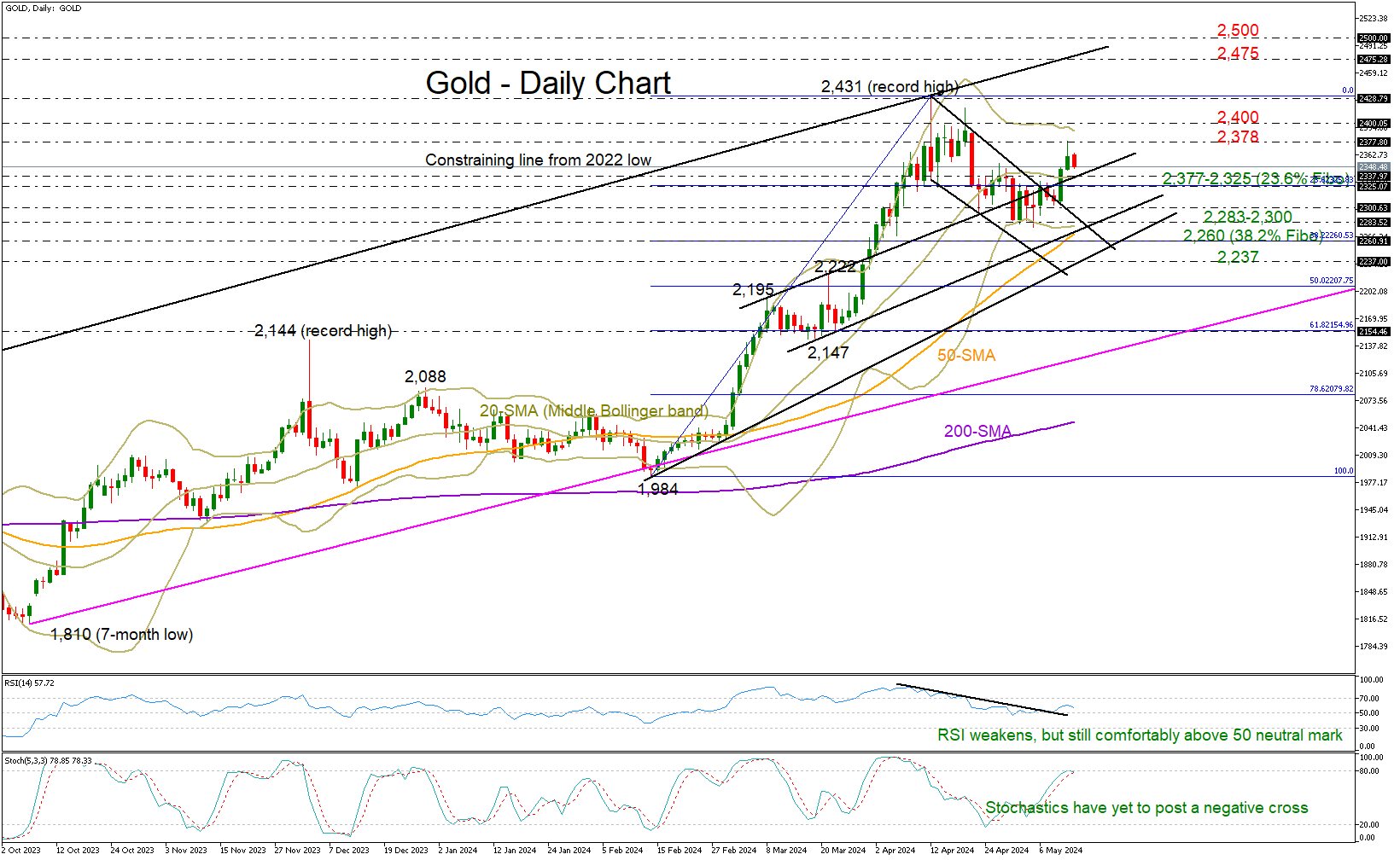

Can gold climb to a new record high? – Special Report

Posted on May 14, 2024 at 2:52 pm GMTGold pulls back after hitting record high near $2430 Retreat remains short-lived as geopolitical risks escalate But demand from China seems to be slowing Yet, the chances for fresh advances remain elevated Geopolitics among the main drivers After hitting a record high at around $2,430 on April 12, gold entered a corrective phase due to the easing of geopolitical tensions at the time allowing investors to continue offloading safe-haven positions. However, the retreat remained short-lived, with the precious metal [..]