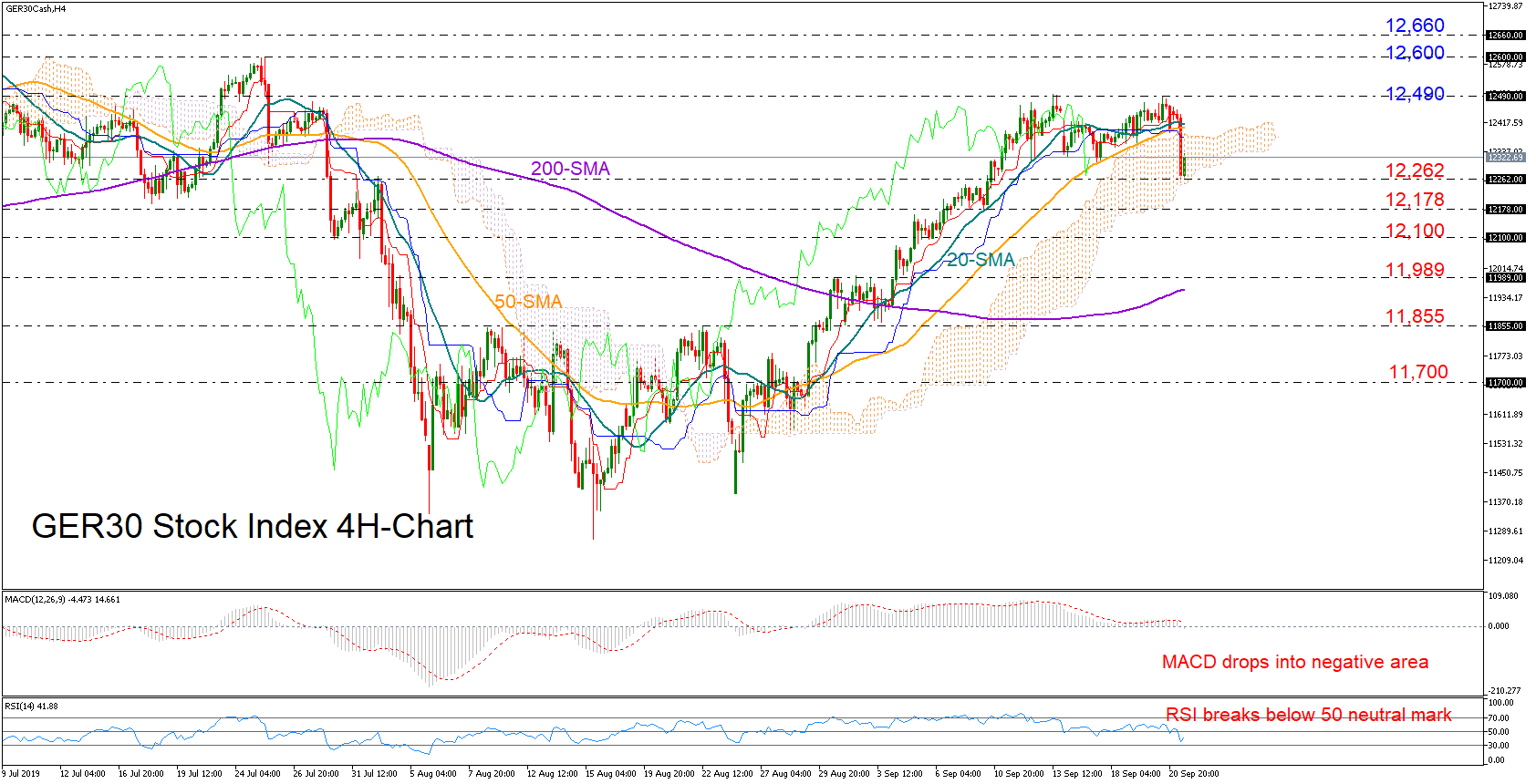

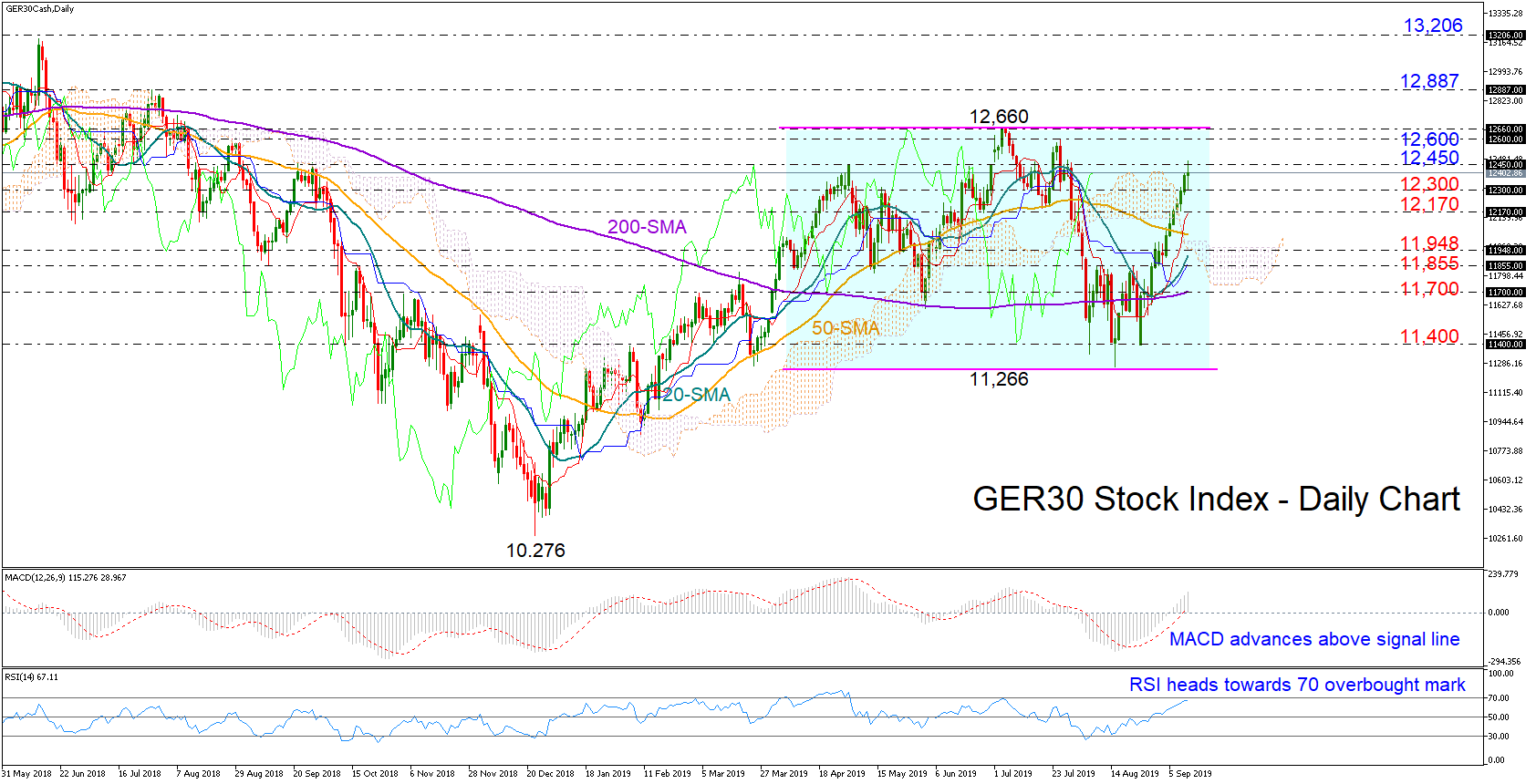

Technical Analysis – GER 30 index gives up recent highs; looks neutral in short-term

Posted on December 6, 2019 at 8:29 am GMTThe GER30 stock index gave up some ground after stubbornly and unsuccessfully testing the 13,300 region for almost a month. The short-term bias is now viewed as neutral, as the red Tenkan-sen has slowed to meet the blue Kijun-sen line, while the RSI is struggling to hold above its 50 neutral mark. A closing price below Tuesday’s trough of 12,924 and the 50-day exponential moving average (EMA) could encourage more selling, though only a significant decline below 12,660 would put [..]